Region:Middle East

Author(s):Shubham

Product Code:KRAB7464

Pages:81

Published On:October 2025

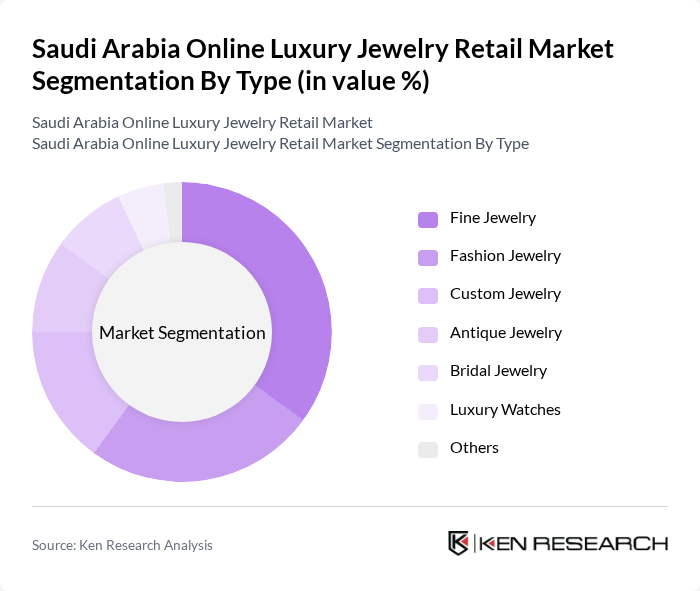

By Type:The market is segmented into various types of jewelry, including Fine Jewelry, Fashion Jewelry, Custom Jewelry, Antique Jewelry, Bridal Jewelry, Luxury Watches, and Others. Fine Jewelry is particularly popular due to its high-quality materials and craftsmanship, appealing to affluent consumers seeking investment pieces. Fashion Jewelry, on the other hand, attracts a younger demographic looking for trendy and affordable options. Custom Jewelry is gaining traction as consumers seek personalized pieces that reflect their individual style.

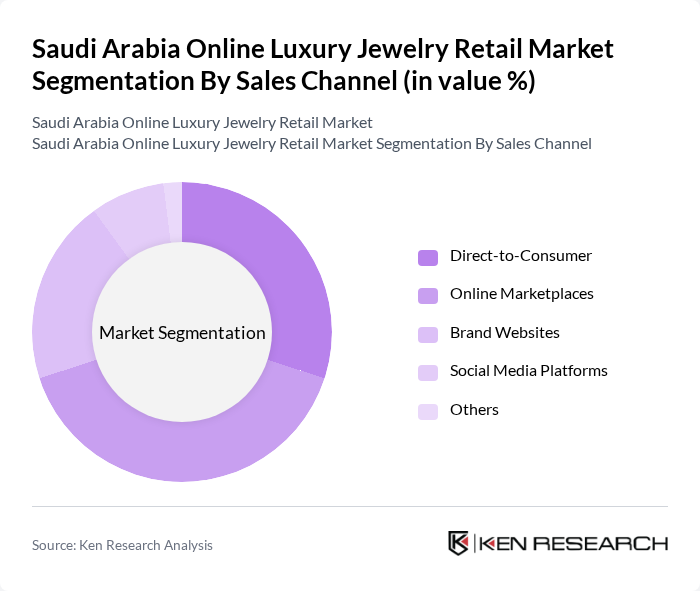

By Sales Channel:The market is also segmented by sales channels, including Direct-to-Consumer, Online Marketplaces, Brand Websites, Social Media Platforms, and Others. Direct-to-Consumer sales are gaining popularity as brands establish their online presence, allowing for better customer engagement and brand loyalty. Online Marketplaces provide a platform for various brands to reach a broader audience, while Social Media Platforms are increasingly being used for marketing and direct sales, especially among younger consumers.

The Saudi Arabia Online Luxury Jewelry Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Jewelry, L'azurde Company for Jewelry, Damas Jewelry, Mouawad Jewelry, Tanishq, Cartier, Tiffany & Co., Bvlgari, Chopard, Van Cleef & Arpels, Graff, Piaget, Harry Winston, David Yurman, Swarovski contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online luxury jewelry market in Saudi Arabia appears promising, driven by technological advancements and changing consumer preferences. As e-commerce continues to expand, brands are likely to invest in personalized shopping experiences and enhanced customer service. Additionally, the growing trend of ethical sourcing and sustainability will shape product offerings, appealing to environmentally conscious consumers. The integration of augmented reality in online shopping may also enhance customer engagement, making the purchasing process more interactive and enjoyable.

| Segment | Sub-Segments |

|---|---|

| By Type | Fine Jewelry Fashion Jewelry Custom Jewelry Antique Jewelry Bridal Jewelry Luxury Watches Others |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Brand Websites Social Media Platforms Others |

| By Price Range | Below SAR 1,000 SAR 1,000 - SAR 5,000 SAR 5,000 - SAR 10,000 Above SAR 10,000 |

| By Material | Gold Silver Platinum Gemstones Others |

| By Occasion | Weddings Anniversaries Birthdays Festivals Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Lifestyle Preferences |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers | 100 | Retail Managers, E-commerce Directors |

| Affluent Consumer Insights | 150 | High Net-Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 50 | Designers, Craftsmanship Experts |

| E-commerce Platform Executives | 80 | Product Managers, Marketing Heads |

| Market Analysts and Experts | 30 | Industry Analysts, Economic Advisors |

The Saudi Arabia Online Luxury Jewelry Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing disposable incomes and a shift towards online shopping among consumers.