Region:Middle East

Author(s):Dev

Product Code:KRAC4895

Pages:84

Published On:October 2025

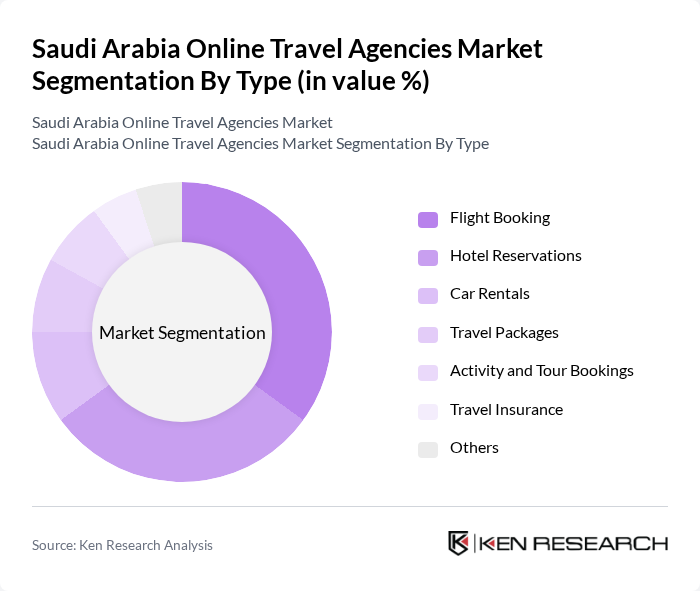

By Type:The market is segmented into various types, including Flight Booking, Hotel Reservations, Car Rentals, Travel Packages, Activity and Tour Bookings, Travel Insurance, and Others. Among these,Flight BookingandHotel Reservationsare the most prominent segments, driven by the increasing number of travelers and the growing trend of online bookings. The dominance of these segments is further supported by the rising demand for flexible travel options, bundled packages, and the convenience of digital booking platforms .

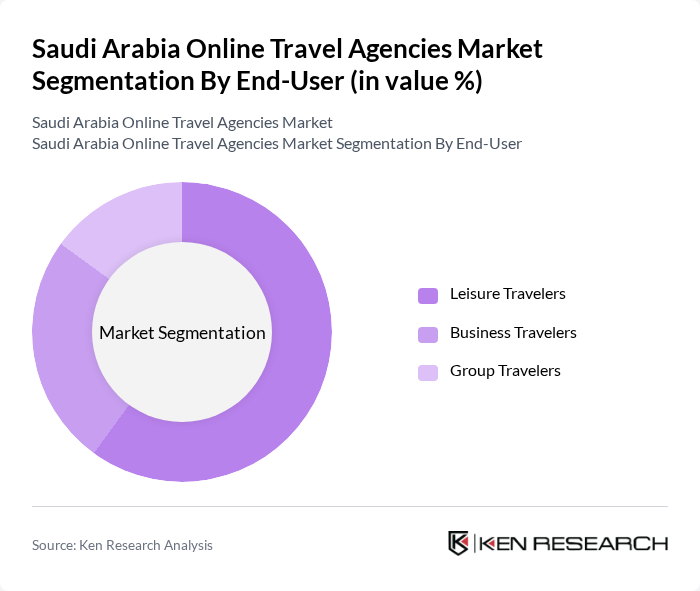

By End-User:The market is further segmented by end-user categories, including Leisure Travelers, Business Travelers, and Group Travelers.Leisure Travelersdominate the market, driven by the increasing trend of vacationing and exploring new destinations, whileBusiness Travelerscontribute significantly due to the growing corporate sector in Saudi Arabia. The rise in group travel is also notable, particularly for religious and cultural tourism .

The Saudi Arabia Online Travel Agencies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Booking.com, Expedia Group, Agoda, Airbnb, Cleartrip, Wego, Flyin, Almosafer, TripAdvisor, Traveloka, Skyscanner, OYO Rooms, Trivago, Lastminute.com, and Kayak contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabian online travel agency market appears promising, driven by technological advancements and evolving consumer preferences. As personalization becomes a key focus, agencies are expected to leverage data analytics to enhance customer experiences. Additionally, the integration of artificial intelligence in customer service will streamline operations and improve engagement. The growing emphasis on sustainable travel will also shape offerings, encouraging OTAs to develop eco-friendly travel packages that cater to environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Flight Booking Hotel Reservations Car Rentals Travel Packages Activity and Tour Bookings Travel Insurance Others |

| By End-User | Leisure Travelers Business Travelers Group Travelers |

| By Sales Channel | Direct Online Sales Mobile Applications Third-Party Aggregators |

| By Customer Segment | Individual Travelers Families Corporate Clients |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers |

| By Region | Central Region Western Region Eastern Region Southern Region |

| By Customer Loyalty Programs | Membership Discounts Reward Points Referral Bonuses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frequent Travelers | 100 | Business Travelers, Leisure Travelers |

| Travel Agency Executives | 50 | General Managers, Marketing Directors |

| Online Booking Users | 90 | Millennials, Gen Z Travelers |

| Tourism Industry Experts | 40 | Consultants, Analysts |

| Hotel and Accommodation Providers | 60 | Hotel Managers, Revenue Managers |

The Saudi Arabia Online Travel Agencies Market is valued at approximately USD 5 billion, driven by increased digital platform adoption, rising disposable income, and a growing preference for convenience among consumers.