Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4449

Pages:82

Published On:October 2025

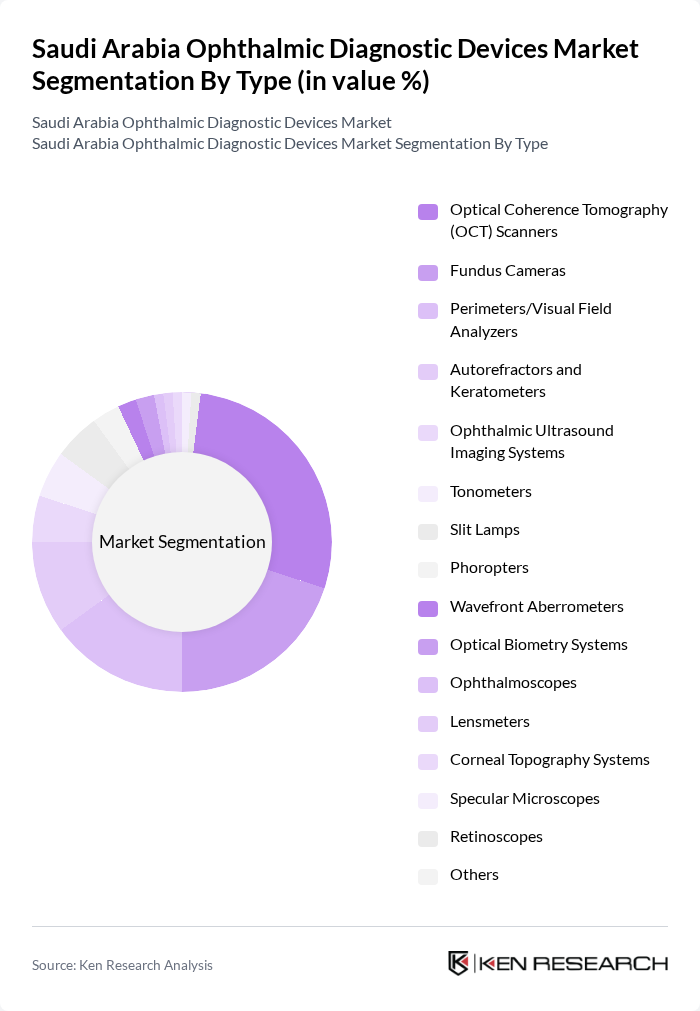

By Type:The market is segmented into various types of ophthalmic diagnostic devices, including Optical Coherence Tomography (OCT) Scanners, Fundus Cameras, Perimeters/Visual Field Analyzers, Autorefractors and Keratometers, Ophthalmic Ultrasound Imaging Systems, Tonometers, Slit Lamps, Phoropters, Wavefront Aberrometers, Optical Biometry Systems, Ophthalmoscopes, Lensmeters, Corneal Topography Systems, Specular Microscopes, Retinoscopes, and Others. Among these, Optical Coherence Tomography (OCT) Scanners are leading the market as the largest revenue-generating segment due to their ability to provide high-resolution cross-sectional images of the retina and anterior segment structures, which is crucial for diagnosing conditions such as glaucoma, macular degeneration, and diabetic retinopathy. The increasing adoption of OCT technology in hospitals and clinics is driven by its non-invasive nature, rapid imaging capabilities, and the growing awareness of early detection and monitoring of progressive eye diseases.

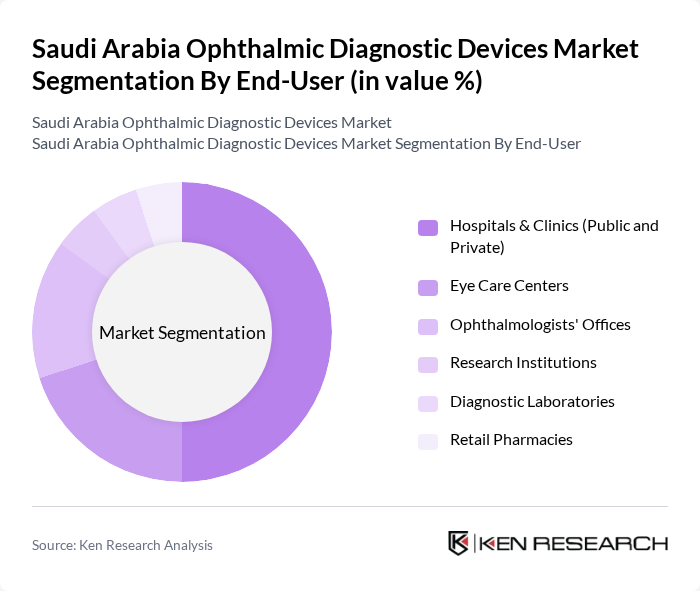

By End-User:The end-user segmentation includes Hospitals & Clinics (Public and Private), Eye Care Centers, Ophthalmologists' Offices, Research Institutions, Diagnostic Laboratories, and Retail Pharmacies. Hospitals and clinics are the dominant end-users, accounting for a significant share of the market. This is attributed to the increasing number of eye surgeries including cataract procedures and refractive surgeries, the growing demand for comprehensive eye care services encompassing screening, diagnosis, and treatment planning, and the substantial investment in healthcare infrastructure by both public and private sectors. The integration of advanced diagnostic devices in these facilities enhances the quality of care and improves patient outcomes, making them the primary consumers of ophthalmic diagnostic devices.

The Saudi Arabia Ophthalmic Diagnostic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Johnson & Johnson Vision, Carl Zeiss Meditec AG, Bausch + Lomb, Topcon Corporation, Heidelberg Engineering GmbH, Nidek Co., Ltd., Canon Inc., Optovue, Inc., Optos plc, Reichert Technologies (part of AMETEK, Inc.), Huvitz Co., Ltd., Visionix (Luneau Technology Group), Medmont International Pty Ltd, Sonomed Escalon, Haag-Streit Group, Ziemer Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ophthalmic diagnostic devices market in Saudi Arabia appears promising, driven by increasing healthcare investments and technological advancements. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the shift towards portable devices will facilitate broader access to eye care. Additionally, the growing trend of telemedicine will likely reshape service delivery, allowing for remote consultations and monitoring, thus expanding the market's reach and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Coherence Tomography (OCT) Scanners Fundus Cameras Perimeters/Visual Field Analyzers Autorefractors and Keratometers Ophthalmic Ultrasound Imaging Systems Tonometers Slit Lamps Phoropters Wavefront Aberrometers Optical Biometry Systems Ophthalmoscopes Lensmeters Corneal Topography Systems Specular Microscopes Retinoscopes Others |

| By End-User | Hospitals & Clinics (Public and Private) Eye Care Centers Ophthalmologists’ Offices Research Institutions Diagnostic Laboratories Retail Pharmacies |

| By Application | Disease Diagnosis Routine Eye Check-ups Surgical Assistance Research and Development |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Makkah) Southern Region Other Regions |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Digital Imaging Non-Contact Devices Contact Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Clinics | 80 | Ophthalmologists, Clinic Managers |

| Hospitals with Eye Care Departments | 70 | Healthcare Administrators, Medical Directors |

| Medical Device Distributors | 50 | Sales Managers, Product Specialists |

| Patient Focus Groups | 40 | Patients with Eye Conditions, Caregivers |

| Regulatory Bodies | 40 | Regulatory Affairs Officers, Policy Makers |

The Saudi Arabia Ophthalmic Diagnostic Devices Market is valued at approximately USD 115 million, reflecting a significant growth driven by the rising prevalence of eye disorders and advancements in diagnostic technology.