Region:Global

Author(s):Geetanshi

Product Code:KRAE1062

Pages:88

Published On:February 2026

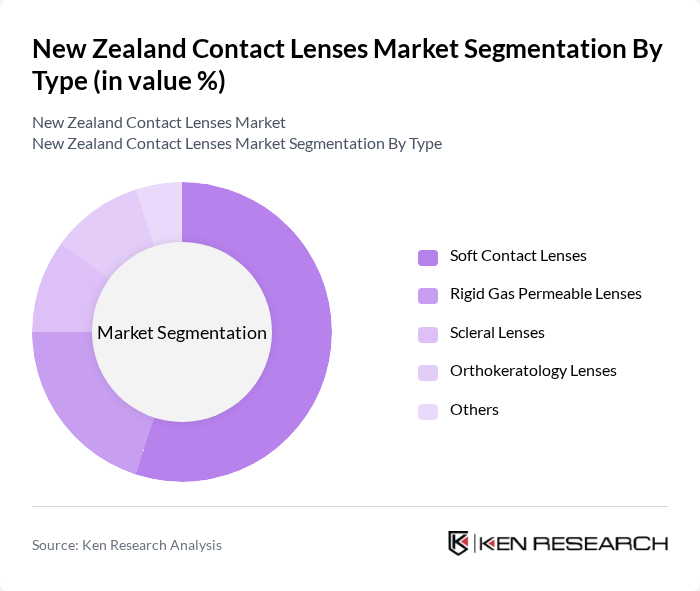

By Type:The market is segmented into various types of contact lenses, including Soft Contact Lenses, Rigid Gas Permeable Lenses, Scleral Lenses, Orthokeratology Lenses, and Others. Among these, Soft Contact Lenses dominate the market due to their comfort, ease of use, and availability in various designs and prescriptions. The increasing preference for daily disposable lenses has further boosted the demand for this segment. Rigid Gas Permeable Lenses are also gaining traction, particularly among users with specific vision correction needs.

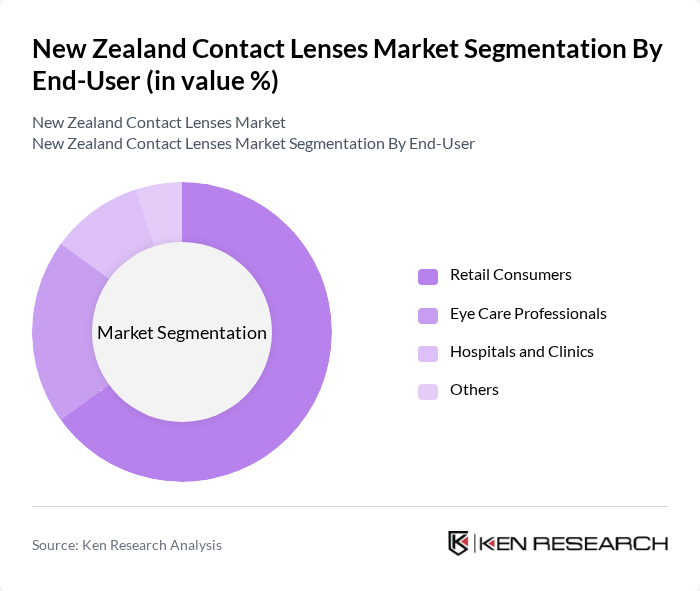

By End-User:The market is segmented by end-users into Retail Consumers, Eye Care Professionals, Hospitals and Clinics, and Others. Retail Consumers represent the largest segment, driven by the increasing number of individuals opting for contact lenses over traditional eyewear. Eye Care Professionals also play a significant role in the market, as they are essential for prescribing and fitting contact lenses. Hospitals and Clinics contribute to the market by providing specialized services and products to patients with specific eye conditions.

The New Zealand Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, CooperVision, Bausch + Lomb, Alcon, Menicon, Hoya Corporation, EssilorLuxottica, CIBA Vision, SynergEyes, Vision Direct, Optometry Australia, Specsavers, The Contact Lens Company, Contact Lens Warehouse, Eye Health New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand contact lenses market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As the population ages, the demand for multifocal and specialized lenses is expected to rise. Additionally, the increasing popularity of online retail channels will facilitate greater access to a wider range of products. Companies that focus on sustainable practices and innovative designs will likely capture a larger market share, aligning with consumer trends towards eco-friendly products and personalized solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Contact Lenses Rigid Gas Permeable Lenses Scleral Lenses Orthokeratology Lenses Others |

| By End-User | Retail Consumers Eye Care Professionals Hospitals and Clinics Others |

| By Distribution Channel | Online Retail Optical Stores Supermarkets/Hypermarkets Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Others |

| By Age Group | Children Adults Seniors Others |

| By Usage Frequency | Daily Wear Extended Wear Others |

| By Region | North Island South Island Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Optometrist Insights | 100 | Optometrists, Eye Care Specialists |

| Consumer Preferences | 120 | Contact Lens Users, Potential Users |

| Retailer Feedback | 80 | Retail Managers, Sales Representatives |

| Market Trends Analysis | 60 | Industry Analysts, Market Researchers |

| Patient Experience Surveys | 90 | Current Contact Lens Wearers, Recent Switchers |

The New Zealand Contact Lenses Market is valued at approximately USD 11 million, reflecting a steady growth driven by increasing vision disorders, awareness of eye health, and demand for both corrective and cosmetic lenses.