Region:Middle East

Author(s):Dev

Product Code:KRAE0013

Pages:108

Published On:December 2025

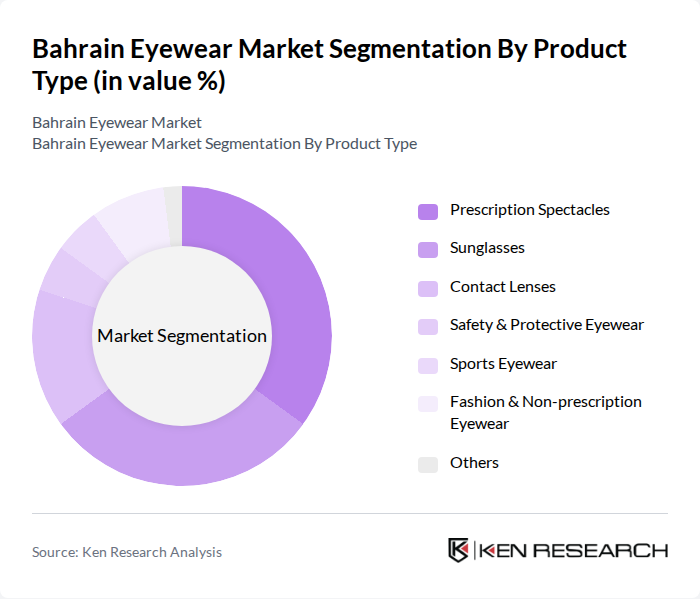

By Product Type:The product type segmentation includes various categories such as Prescription Spectacles, Sunglasses, Contact Lenses, Safety & Protective Eyewear, Sports Eyewear, Fashion & Non-prescription Eyewear, and Others. Among these, Prescription Spectacles and Sunglasses are the leading segments, driven by the increasing prevalence of vision problems and the growing trend of eyewear as a fashion statement. Consumers are increasingly opting for stylish frames that complement their personal style, while also addressing their vision needs.

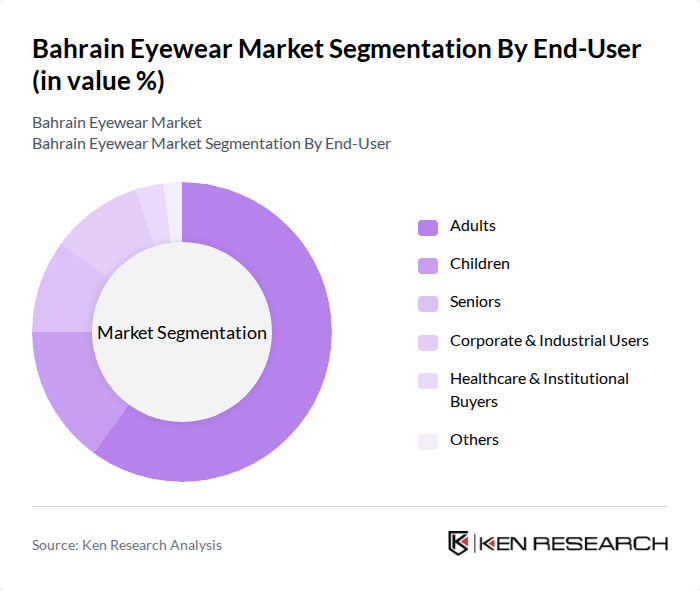

By End-User:The end-user segmentation encompasses Adults, Children, Seniors, Corporate & Industrial Users, Healthcare & Institutional Buyers, and Others. The adult segment dominates the market, driven by the increasing need for vision correction and the growing trend of eyewear as a fashion accessory. Additionally, the corporate sector is witnessing a rise in demand for protective eyewear, further contributing to the overall market growth.

The Bahrain Eyewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optica Bahrain, Yateem Eye Center & Yateem Optician, Al Jishi H.A. Optical, Al Jaber Optical (Bahrain operations), Al Jazeera Optical, Hassan’s Optician Co. (Bahrain), Rivoli EyeZone (Rivoli Group), Vision Express (Bahrain), Aster Opticals (Bahrain), Al Shams Optical, Al Manama Optical, Al Bustan Optical, Al Razi Optics, Al Hurra Optical, Bahrain Opticians contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain eyewear market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of augmented reality in retail is expected to enhance the shopping experience, allowing customers to virtually try on eyewear. Additionally, the increasing focus on sustainability will likely lead to a rise in demand for eco-friendly eyewear options, aligning with global trends. These factors will create a dynamic market landscape, fostering innovation and growth opportunities for local and international brands alike.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Spectacles Sunglasses Contact Lenses Safety & Protective Eyewear Sports Eyewear Fashion & Non?prescription Eyewear Others |

| By End-User | Adults Children Seniors Corporate & Industrial Users Healthcare & Institutional Buyers Others |

| By Distribution Channel | Optical Retail Chains Independent Optical Stores E?commerce Platforms Supermarkets/Hypermarkets Pharmacies & Drugstores Others |

| By Price Range | Mass / Budget Mid-Range Premium Luxury Others |

| By Frame Material | Plastic Metal Mixed & Composite Materials Wood & Niche Materials Others |

| By Brand Origin | Local Retail & House Brands International Designer Brands International Value Brands Private Labels |

| By Usage Occasion | Everyday Vision Correction Occasional & Fashion Use Occupational & Safety Use Sports & Outdoor Activities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Eyewear Retailers | 50 | Store Owners, Retail Managers |

| Consumers of Prescription Glasses | 120 | Individuals aged 18-65, Eyewear Users |

| Sunglasses Market | 60 | Fashion Enthusiasts, Seasonal Buyers |

| Contact Lens Users | 50 | Optometry Patients, Regular Users |

| Online Eyewear Shoppers | 70 | eCommerce Users, Tech-Savvy Consumers |

The Bahrain Eyewear Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increased consumer awareness of eye health and fashion consciousness among the population.