Region:Middle East

Author(s):Shubham

Product Code:KRAD5514

Pages:98

Published On:December 2025

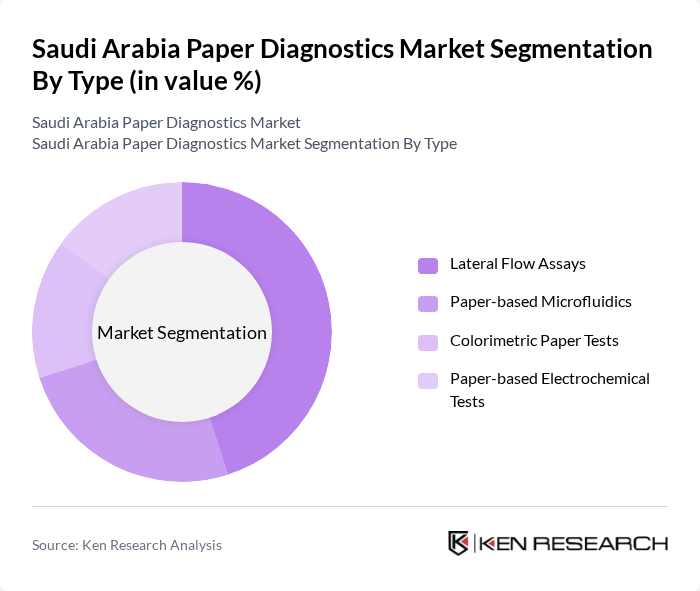

By Type:The market is segmented into various types of paper diagnostics, including Lateral Flow Assays, Paper-based Microfluidics, Colorimetric Paper Tests, and Paper-based Electrochemical Tests. Lateral Flow Assays remain the most dominant category, aligned with their extensive use in rapid testing for infectious diseases (such as respiratory infections and COVID-19), pregnancy testing, and selected chronic disease markers, and their ease of deployment in both clinical and home settings. The demand for these tests has surged during recent health crises and within routine screening programs, as they provide quick results without the need for complex instrumentation, trained laboratory personnel, or centralized lab infrastructure.

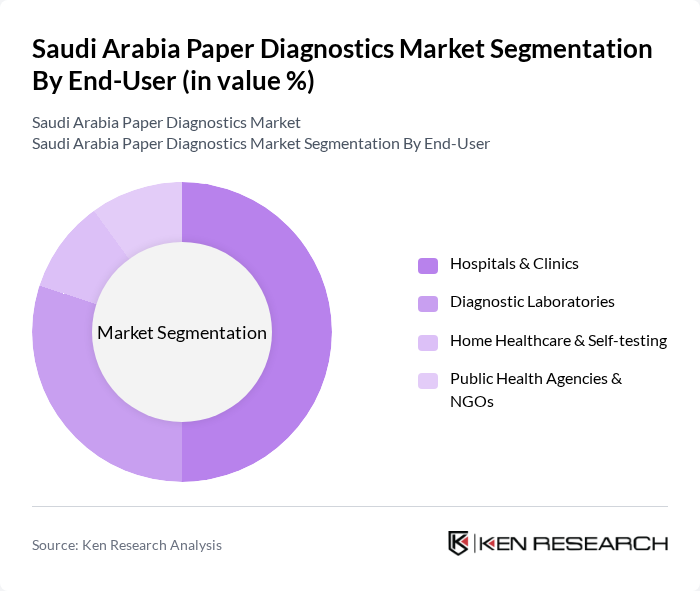

By End-User:The end-user segmentation includes Hospitals & Clinics, Diagnostic Laboratories, Home Healthcare & Self-testing, and Public Health Agencies & NGOs. Hospitals & Clinics represent the largest segment, supported by the increasing number of healthcare facilities, higher patient throughput, and the integration of rapid tests into emergency, outpatient, and perioperative pathways. The trend towards decentralization of healthcare services and primary care strengthening under the Health Sector Transformation Program has led to a growing preference for rapid diagnostic tests and paper-based point-of-care formats in clinical settings, complemented by rising adoption of self-testing and home-based kits for chronic disease monitoring and infectious disease screening.

The Saudi Arabia Paper Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (including BinaxNOW, Panbio and related lateral flow test portfolios), F. Hoffmann-La Roche Ltd (Roche Diagnostics), Siemens Healthineers AG, Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Danaher Corporation (including Cepheid and Beckman Coulter), QuidelOrtho Corporation, bioMérieux SA, Alere Sanitat (legacy Alere portfolios integrated under Abbott in KSA), Saudi Arabian Marketing & Agencies Company Ltd. (SAMACO Medical – key diagnostics distributor), Gulf Medical Co. Ltd. (regional distributor for POCT and paper-based diagnostics), Al-Jeel Medical & Trading Co., National Medical Care Co. (NMC) – as leading end-user / integrator for diagnostics solutions, Local & Regional Emerging Players in Paper-based POCT (e.g., GCC-based startups and university spin-offs) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the paper diagnostics market in Saudi Arabia appears promising, driven by increasing healthcare investments and a shift towards personalized medicine. As the government continues to enhance healthcare infrastructure, the integration of advanced technologies, including artificial intelligence, is expected to streamline diagnostic processes. Furthermore, the growing trend of telemedicine will likely facilitate remote diagnostics, making healthcare more accessible. These developments will create a conducive environment for the expansion of paper diagnostics, enhancing patient care and outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Lateral Flow Assays Paper-based Microfluidics Colorimetric Paper Tests Paper-based Electrochemical Tests |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Home Healthcare & Self-testing Public Health Agencies & NGOs |

| By Application | Infectious Disease Testing Chronic Disease & Metabolic Testing (e.g., diabetes, kidney function) Pregnancy & Fertility Testing Oncology & Biomarker Testing Environmental & Food Safety Testing |

| By Distribution Channel | Direct Institutional Sales Retail Pharmacies Online Pharmacies & E-commerce Platforms Local Distributors & Importers |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Al Khobar) Western Region (including Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Technology | Immunoassay-based Paper Diagnostics Nucleic Acid-based Paper Diagnostics Others (enzyme-based, electrochemical, biosensor-integrated) |

| By Policy Support | Government Procurement & Tendering Programs Reimbursement & Inclusion in National Formularies Localization & Manufacturing Incentives (Vision 2030) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 120 | Laboratory Managers, Chief Technologists |

| Diagnostic Centers | 90 | Operations Managers, Quality Assurance Officers |

| Healthcare Procurement Departments | 80 | Procurement Managers, Supply Chain Analysts |

| Research Institutions | 70 | Research Scientists, Clinical Researchers |

| Government Health Agencies | 60 | Policy Makers, Health Program Directors |

The Saudi Arabia Paper Diagnostics Market is valued at approximately USD 120 million, reflecting a significant growth driven by the rising prevalence of chronic diseases, demand for rapid diagnostic tests, and advancements in paper-based technologies.