Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3722

Pages:83

Published On:October 2025

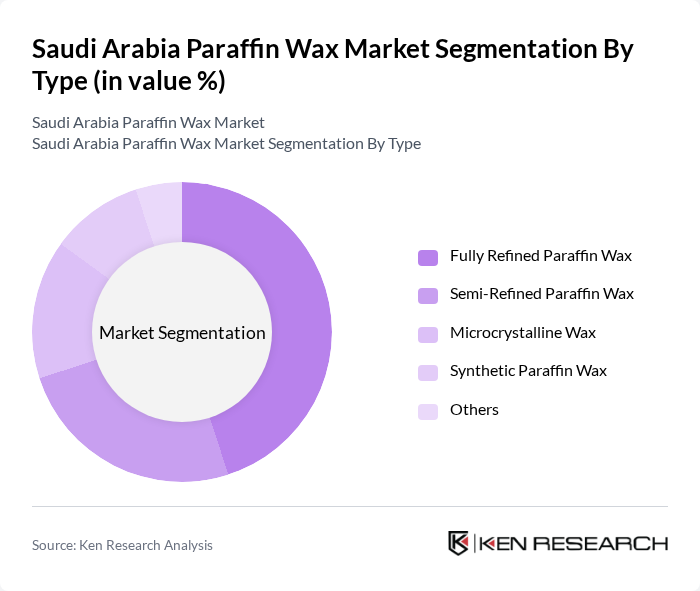

By Type:The paraffin wax market can be segmented into Fully Refined Paraffin Wax, Semi-Refined Paraffin Wax, Microcrystalline Wax, Synthetic Paraffin Wax, and Others. Among these, Fully Refined Paraffin Wax is the leading sub-segment due to its high purity and versatility, making it suitable for applications in cosmetics, food packaging, and candle manufacturing. The demand for Fully Refined Paraffin Wax is driven by its superior quality and performance characteristics, which are essential for high-end products .

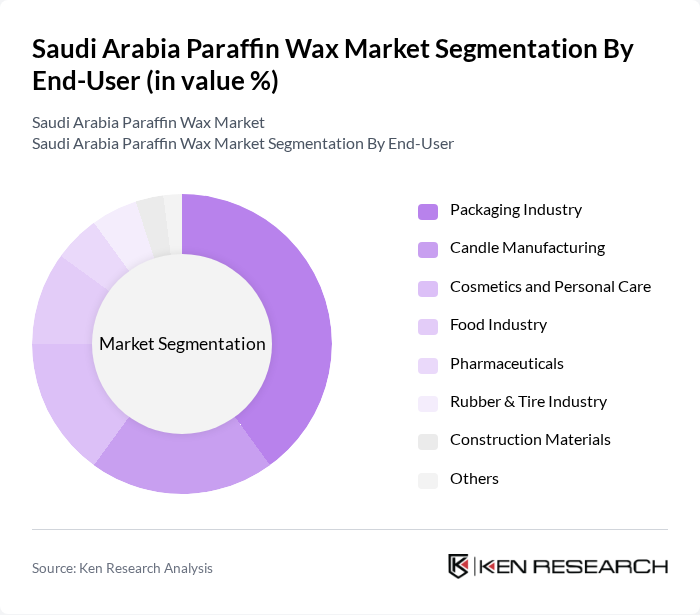

By End-User:The paraffin wax market is segmented by end-user industries, including Packaging Industry, Candle Manufacturing, Cosmetics and Personal Care, Food Industry, Pharmaceuticals, Rubber & Tire Industry, Construction Materials, and Others. The Packaging Industry is the dominant segment, driven by the increasing demand for high-quality packaging solutions that require paraffin wax for moisture resistance and barrier properties. Growth in e-commerce, food exports, and retail logistics has further fueled the demand for paraffin wax in packaging applications .

The Saudi Arabia Paraffin Wax Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Saudi Basic Industries Corporation (SABIC), National Petrochemical Industrial Company (NATPET), Alujain Corporation, Arabian Petroleum Supply Company (APSCO), Petromin Corporation, ExxonMobil Saudi Arabia Inc., Sasol Middle East & India, Sinopec (Saudi Branch), Gulf Petrochemicals and Chemicals Association (GPCA), Al-Fanar Group, Al-Babtain Group, Al-Rajhi Holding Group, Al-Muhaidib Group, and Al-Jomaih Group contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia paraffin wax market is poised for growth, driven by increasing demand across various sectors, including packaging and cosmetics. Technological advancements in production processes are expected to enhance efficiency and reduce costs. Additionally, the market is likely to see a shift towards sustainable practices, with manufacturers exploring eco-friendly alternatives. As consumer preferences evolve, the focus on quality and innovation will play a crucial role in shaping the future landscape of the paraffin wax industry in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Refined Paraffin Wax Semi-Refined Paraffin Wax Microcrystalline Wax Synthetic Paraffin Wax Others |

| By End-User | Packaging Industry Candle Manufacturing Cosmetics and Personal Care Food Industry Pharmaceuticals Rubber & Tire Industry Construction Materials Others |

| By Application | Coatings Adhesives Sealants Board Sizing Hot Melts Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry Usage | 100 | Product Development Managers, Procurement Officers |

| Food Packaging Applications | 80 | Quality Assurance Managers, Packaging Engineers |

| Candle Manufacturing Sector | 60 | Production Supervisors, Supply Chain Managers |

| Industrial Applications | 90 | Operations Managers, Technical Directors |

| Export Market Insights | 50 | Export Managers, Trade Compliance Officers |

The Saudi Arabia Paraffin Wax Market is valued at approximately USD 2.6 billion, reflecting a robust growth trajectory driven by demand from packaging, cosmetics, and candle manufacturing industries, alongside the expansion of the petrochemical sector in the region.