Region:Middle East

Author(s):Shubham

Product Code:KRAE0460

Pages:99

Published On:December 2025

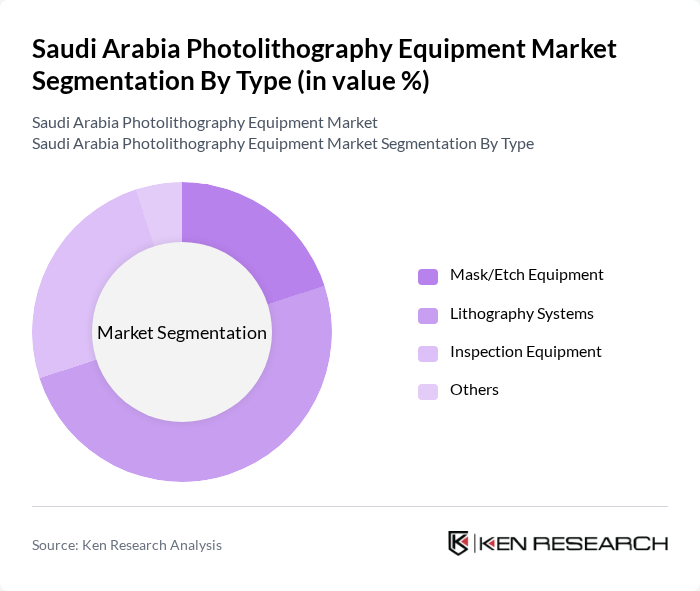

By Type:The photolithography equipment market is segmented into various types, including Mask/Etch Equipment, Lithography Systems, Inspection Equipment, and Others. Among these, Lithography Systems dominate the market due to their critical role in semiconductor manufacturing processes, enabling the production of high-density integrated circuits. The increasing complexity of chip designs and the demand for miniaturization further drive the adoption of advanced lithography systems.

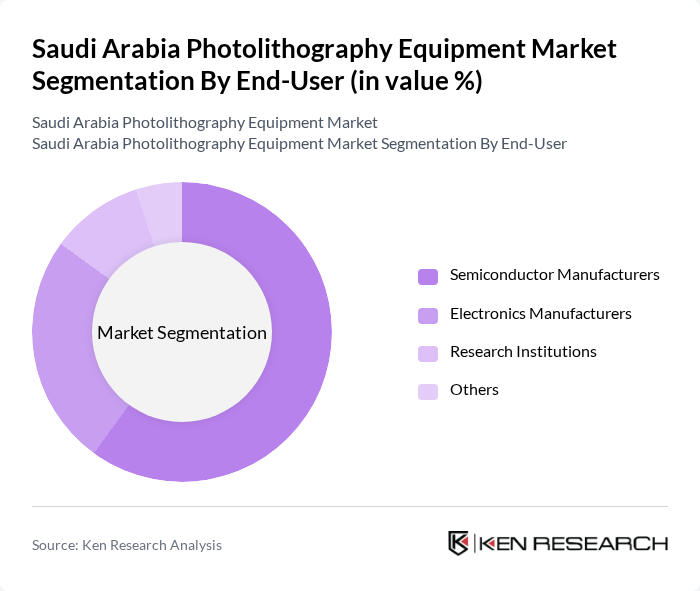

By End-User:The end-user segmentation includes Semiconductor Manufacturers, Electronics Manufacturers, Research Institutions, and Others. Semiconductor Manufacturers hold the largest share due to the increasing demand for chips in various applications, including consumer electronics, automotive, and industrial sectors. The growth of the electronics industry in Saudi Arabia, driven by digital transformation initiatives, further enhances the demand for photolithography equipment.

The Saudi Arabia Photolithography Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASML Holding N.V., Nikon Corporation, Canon Inc., Ultratech (acquired by Veeco Instruments Inc.), SUSS MicroTec SE, EV Group (EVG), Tokyo Electron Limited, Applied Materials, Inc., Lam Research Corporation, KLA Corporation, GlobalFoundries, Intel Corporation, Samsung Electronics, TSMC (Taiwan Semiconductor Manufacturing Company), Micron Technology, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia photolithography equipment market appears promising, driven by ongoing government support and technological advancements. As the Kingdom continues to invest in local semiconductor manufacturing, the demand for advanced photolithography solutions is expected to rise. Additionally, the integration of automation and energy-efficient technologies will likely enhance production capabilities, positioning Saudi Arabia as a key player in the global semiconductor supply chain. The focus on sustainability will also shape future developments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mask/Etch Equipment Lithography Systems Inspection Equipment Others |

| By End-User | Semiconductor Manufacturers Electronics Manufacturers Research Institutions Others |

| By Application | Integrated Circuits MEMS Photonic Devices Others |

| By Technology | Deep Ultraviolet (DUV) Lithography Extreme Ultraviolet (EUV) Lithography Nanoimprint Lithography Others |

| By Region | Central Region Eastern Region Western Region Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing Firms | 100 | Production Managers, R&D Directors |

| Photolithography Equipment Suppliers | 80 | Sales Executives, Product Managers |

| Industry Consultants | 50 | Market Analysts, Technology Advisors |

| Academic Researchers in Semiconductor Technology | 40 | Professors, Research Scientists |

| Government Regulatory Bodies | 30 | Policy Makers, Regulatory Affairs Specialists |

The Saudi Arabia Photolithography Equipment Market is valued at approximately USD 350 million, driven by the growth of the semiconductor manufacturing ecosystem and the adoption of advanced lithography tools like EUV and DUV scanners.