Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4192

Pages:99

Published On:December 2025

Market.png)

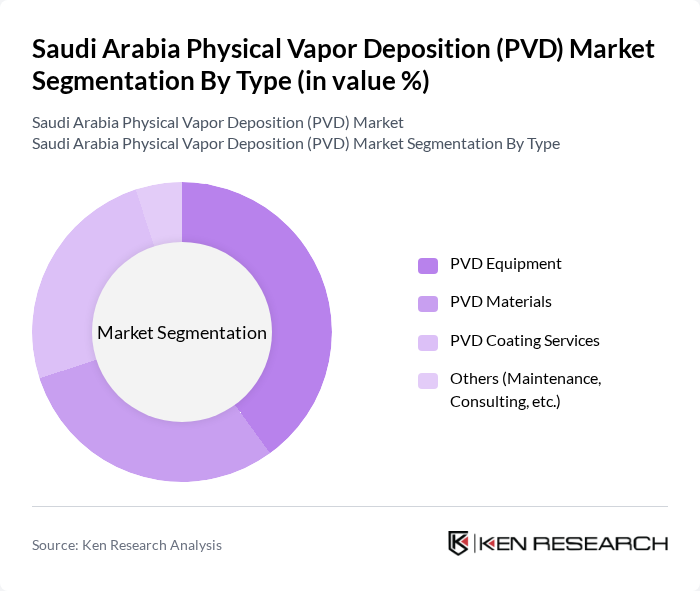

By Type:The market can be segmented into four main types: PVD Equipment, PVD Materials, PVD Coating Services, and Others (Maintenance, Consulting, etc.). This structure is consistent with global and regional PVD classifications, where equipment, materials, and services form the core revenue streams. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and user requirements driving their growth in cutting tools, semiconductors, optical coatings, decorative coatings, and medical devices.

The PVD Equipment segment is currently dominating the market due to the increasing demand for advanced coating technologies across various industries, in line with global trends where equipment represents the largest product/offering category in PVD. This segment includes a range of equipment used for the deposition process, such as sputtering systems, evaporation systems, and arc deposition systems, which are essential for achieving high-quality, uniform, and durable coatings on metals, plastics, glass, and semiconductor wafers. The growth in the electronics and automotive sectors, along with solar and medical device manufacturing in Gulf Cooperation Council economies, has significantly contributed to the demand for PVD equipment, as manufacturers increasingly use thin-film coatings for wear resistance, corrosion protection, optical performance, and functional surfaces. Additionally, technological advancements, including high-productivity magnetron sputtering tools, multi-target systems, and automation for high-throughput coating centers, have further fueled this segment's expansion as regional players invest in localized coating and semiconductor capabilities.

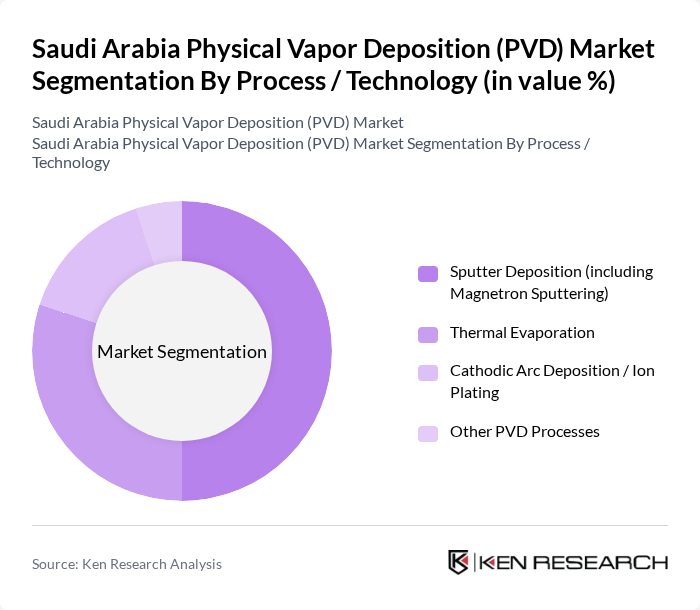

By Process / Technology:The market can be segmented into Sputter Deposition (including Magnetron Sputtering), Thermal Evaporation, Cathodic Arc Deposition / Ion Plating, and Other PVD Processes. This segmentation aligns with globally recognized process categories used in thin-film and coating applications. Each of these technologies has unique advantages in terms of film density, adhesion, coating rate, and substrate compatibility, enabling tailored solutions for microelectronics, optics, tooling, decorative finishes, and medical implants.

Sputter Deposition, particularly Magnetron Sputtering, is the leading technology in the market due to its versatility and ability to produce high-quality, dense, and adherent thin films with precise thickness control on a wide range of substrates. This method is widely used in the electronics industry for semiconductor wafers, displays, and data storage media, and in the automotive and tooling sectors for decorative and functional hard coatings such as nitrides and carbides. The increasing complexity of electronic devices, growth in solar and optical coatings, and the demand for high-performance, wear-resistant surfaces in automotive, oil and gas, and medical components have driven the adoption of this technology, making it a preferred choice among manufacturers and coating service providers in Saudi Arabia and the wider Middle East.

The Saudi Arabia Physical Vapor Deposition (PVD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oerlikon Balzers Coating AG, IHI Corporation, Applied Materials, Inc., Veeco Instruments Inc., ULVAC, Inc., CemeCon AG, Dynavac, LLC, KLA Corporation, Tokyo Electron Limited, AIXTRON SE, Materion Corporation, Satisloh AG, Bühler Leybold Optics GmbH, Hauzer Techno Coating B.V., Platit AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PVD market in Saudi Arabia appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt automation and IoT integration, PVD systems are expected to become more efficient and user-friendly. Furthermore, the shift towards customized coating solutions will cater to specific industry needs, enhancing product performance and customer satisfaction. This evolving landscape presents significant opportunities for growth and innovation in the PVD sector.

| Segment | Sub-Segments |

|---|---|

| By Type | PVD Equipment PVD Materials PVD Coating Services Others (Maintenance, Consulting, etc.) |

| By Process / Technology | Sputter Deposition (including Magnetron Sputtering) Thermal Evaporation Cathodic Arc Deposition / Ion Plating Other PVD Processes |

| By Application | Microelectronics & Semiconductors Data Storage & Display Solar & Other Renewable Energy Products Cutting Tools & Industrial Components Medical Implants & Equipment Decorative & Architectural Coatings Others |

| By End-User Industry | Electronics & Electrical Automotive & Transportation Aerospace & Defense Healthcare & Medical Devices Industrial Machinery & Tools Energy & Power (including Solar) Others |

| By Coating Material | Metallic Coatings (e.g., TiN, CrN, AlTiN) Ceramic & Nitride Coatings Alloy & Multilayer Coatings Others |

| By Offering | Standard Coating Solutions Customized / Application-Specific Coatings Contract PVD Job Coating Services In-house Integrated PVD Systems |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Makkah, Madinah) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 90 | Process Engineers, Production Managers |

| Solar Panel Production | 70 | Operations Directors, Quality Assurance Managers |

| Aerospace Component Coating | 50 | Manufacturing Engineers, R&D Managers |

| Automotive Parts Coating | 60 | Supply Chain Managers, Product Development Engineers |

| Consumer Electronics Applications | 80 | Product Managers, Technical Sales Representatives |

The Saudi Arabia Physical Vapor Deposition (PVD) Market is valued at approximately USD 1.0 billion, reflecting a robust growth trajectory driven by increasing demand for advanced coating technologies across various industries, including electronics, automotive, and renewable energy.