Region:Middle East

Author(s):Dev

Product Code:KRAD6451

Pages:98

Published On:December 2025

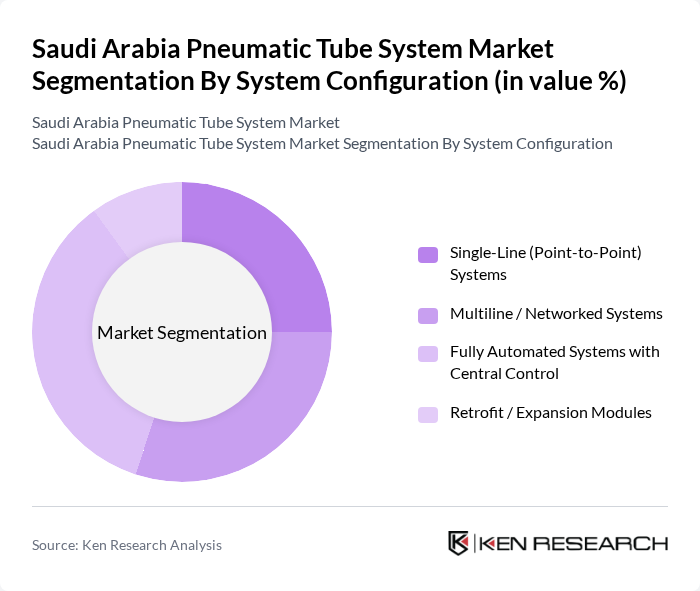

By System Configuration:The segmentation of the market by system configuration includes various types of systems designed to meet different operational needs. The subsegments are Single-Line (Point-to-Point) Systems, Multiline / Networked Systems, Fully Automated Systems with Central Control, and Retrofit / Expansion Modules. Each of these configurations serves specific purposes, with the demand for fully automated and networked systems increasing due to their efficiency, scalability, and ability to integrate with hospital information systems and pharmacy automation solutions.

The Fully Automated Systems with Central Control segment is currently leading the market due to the increasing demand for efficiency and automation in healthcare operations. These systems allow for real-time monitoring, tracking, and management of the transport process, integration with laboratory and pharmacy workflows, and prioritization of urgent items, which significantly reduces the time taken for specimen and medication delivery. The trend towards automation is driven by the need for improved patient care, infection control (reducing manual handling), and operational efficiency, making this subsegment a focal point for investment and development in large public and private hospitals.

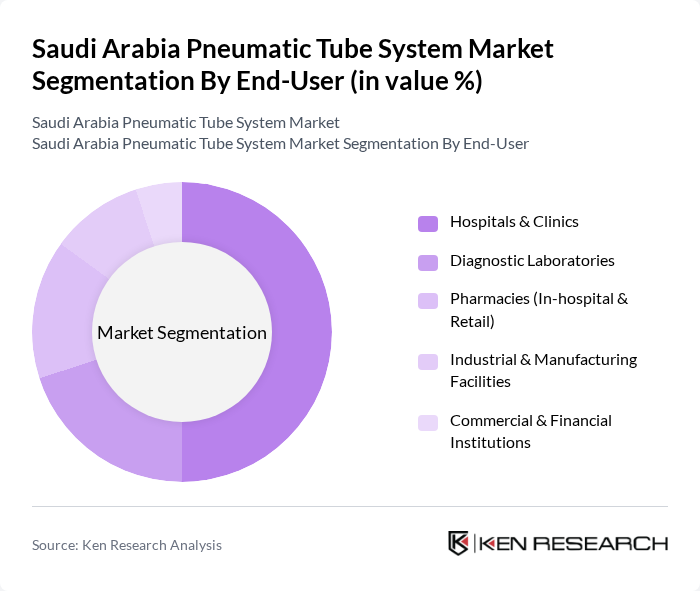

By End-User:The market segmentation by end-user includes Hospitals & Clinics, Diagnostic Laboratories, Pharmacies (In-hospital & Retail), Industrial & Manufacturing Facilities, and Commercial & Financial Institutions. Each end-user category has unique requirements and applications for pneumatic tube systems, with hospitals and clinics being the largest consumers due to their need for rapid, traceable, and secure transport of medical supplies, critical samples, and documents across multi-story and multi-building campuses.

Hospitals & Clinics dominate the market as the primary end-users of pneumatic tube systems, accounting for a significant share. The increasing number and expansion of healthcare facilities, greater adoption of centralized laboratories and automated pharmacies, and the growing emphasis on improving patient care, turnaround time for tests, and operational efficiency are driving this demand. Hospitals require efficient systems for the quick and secure transport of specimens, medications, blood products, and documents across emergency departments, operating rooms, intensive care units, and laboratories, making them the largest segment in the market.

The Saudi Arabia Pneumatic Tube System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swisslog Healthcare AG, Atlas Copco Group (TransLogic / PTS Solutions), Hanazeder Electronic GmbH, Telecom Bedika Ltd., Aerocom GmbH & Co. KG, Pevco Systems International, Inc., Air Link International, SIEBTECHNIK TEMA, Härtel GmbH & Co. KG, Air-Log International GmbH, Colombo Pneumatic Tube Systems, Hospitalia Internacional (Regional Integrator), Al Kifah Holding Co. – Building Technologies Division (Local Partner / Integrator), Nesma & Partners Contracting Co. Ltd. (EPC / Healthcare Projects Partner), Saudi Bugshan – Healthcare & Medical Division (Distributor / Systems Integrator) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pneumatic tube system market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As hospitals increasingly adopt automation and smart technologies, the demand for efficient logistics solutions will rise. Furthermore, the government's commitment to improving healthcare services will likely lead to greater awareness and acceptance of pneumatic tube systems, positioning them as essential components in modern healthcare facilities across the nation.

| Segment | Sub-Segments |

|---|---|

| By System Configuration | Single-Line (Point-to-Point) Systems Multiline / Networked Systems Fully Automated Systems with Central Control Retrofit / Expansion Modules |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Pharmacies (In-hospital & Retail) Industrial & Manufacturing Facilities Commercial & Financial Institutions |

| By Application | Specimen & Blood Sample Transport Medication & Pharmacy Items Delivery Cash & Document Transfer Supplies, Consumables & Small Parts Handling |

| By Component | Carriers & Tubes Stations & Transfer Units Blowers, Motors & Power Units Control Hardware (PLCs, Sensors) Software & Integration Layer |

| By Technology | Single-Phase Systems Three-Phase Systems IoT-Enabled / Smart Monitoring Systems Integration with Hospital Information Systems (HIS/LIS) |

| By Region | Central Region (Riyadh and Surrounding Areas) Eastern Region (Dammam, Al Khobar, Dhahran) Western Region (Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Market Maturity | Tier-1 Cities / Mega Medical Complexes Tier-2 & Tier-3 Cities Greenfield vs. Retrofit Installations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Infrastructure Management | 100 | Facility Managers, Operations Directors |

| Healthcare Logistics Providers | 80 | Logistics Coordinators, Supply Chain Managers |

| Pneumatic Tube System Suppliers | 60 | Sales Managers, Technical Support Engineers |

| Healthcare IT Integration | 70 | IT Managers, System Analysts |

| Regulatory Compliance in Healthcare | 50 | Compliance Officers, Quality Assurance Managers |

The Saudi Arabia Pneumatic Tube System Market is valued at approximately USD 10 million, driven by the increasing demand for efficient transportation of medical supplies and documents within healthcare facilities, as well as the expansion of hospitals under Saudi Vision 2030.