Region:Middle East

Author(s):Shubham

Product Code:KRAD5321

Pages:95

Published On:December 2025

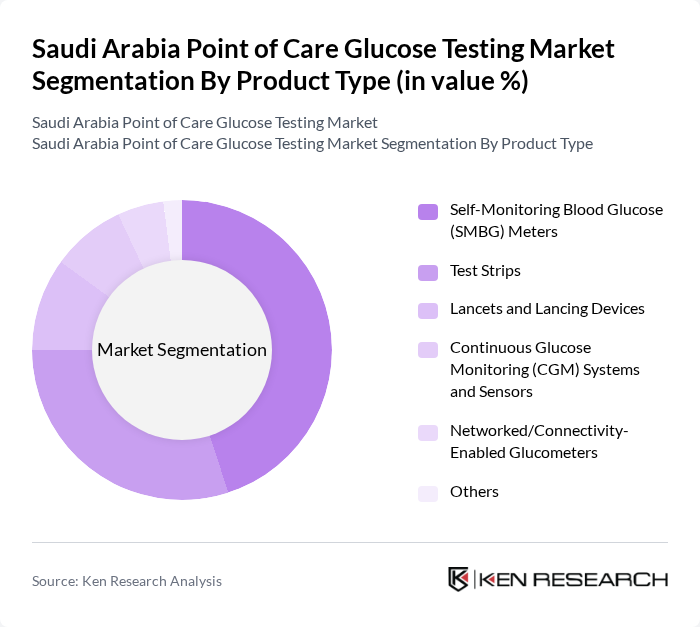

By Product Type:

The product type segmentation includes Self-Monitoring Blood Glucose (SMBG) Meters, Test Strips, Lancets and Lancing Devices, Continuous Glucose Monitoring (CGM) Systems and Sensors, Networked/Connectivity-Enabled Glucometers, and Others. Among these, Self-Monitoring Blood Glucose (SMBG) Meters dominate the market due to their widespread use among diabetic patients for daily monitoring. The convenience and accuracy of SMBG meters have made them a preferred choice for both healthcare providers and patients. Test strips also hold a significant share, as they are essential for the operation of SMBG meters. The increasing trend of home healthcare and self-monitoring further supports the growth of these segments.

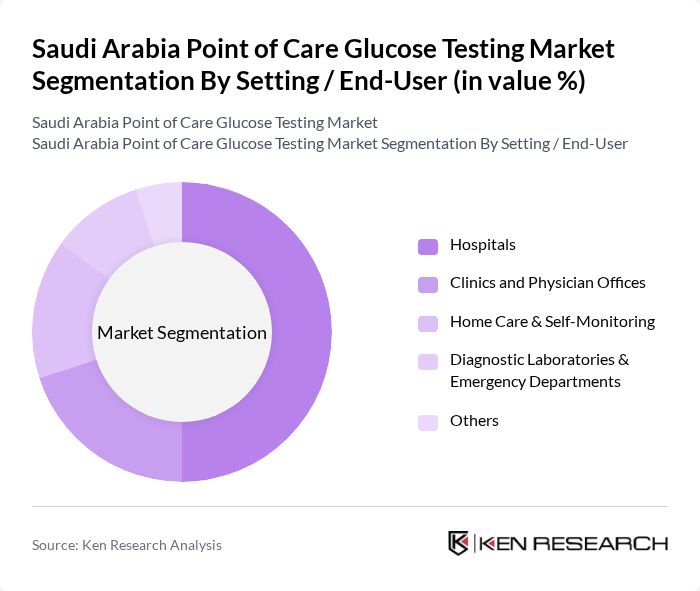

By Setting / End-User:

This segmentation includes Hospitals, Clinics and Physician Offices, Home Care & Self-Monitoring, Diagnostic Laboratories & Emergency Departments, and Others. Hospitals are the leading end-users of point-of-care glucose testing devices due to their need for immediate patient care and monitoring. The increasing number of diabetes patients requiring hospitalization has led to a higher demand for glucose testing in these settings. Home care and self-monitoring are also gaining traction as more patients prefer to manage their diabetes independently, further driving the market.

The Saudi Arabia Point of Care Glucose Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Diabetes Care (Abbott Laboratories), Roche Diabetes Care (F. Hoffmann?La Roche AG), Ascensia Diabetes Care, LifeScan, Inc., ARKRAY, Inc., ACON Laboratories, Inc., Nova Biomedical Corporation, Dexcom, Inc., Medtronic plc, B. Braun Melsungen AG, Siemens Healthineers AG, Ypsomed AG, Terumo Corporation, Nipro Corporation, i-SENS, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the point-of-care glucose testing market in Saudi Arabia appears promising, driven by ongoing technological innovations and increasing healthcare investments. The government is expected to enhance its focus on preventive healthcare, which will likely lead to more comprehensive screening programs. Additionally, the integration of telehealth services is anticipated to facilitate remote monitoring, further expanding the market. As healthcare providers adapt to these trends, the demand for efficient and user-friendly testing solutions will continue to grow.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Self-Monitoring Blood Glucose (SMBG) Meters Test Strips Lancets and Lancing Devices Continuous Glucose Monitoring (CGM) Systems and Sensors Networked/Connectivity-Enabled Glucometers Others |

| By Setting / End-User | Hospitals Clinics and Physician Offices Home Care & Self-Monitoring Diagnostic Laboratories & Emergency Departments Others |

| By Distribution Channel | Hospital & Institutional Procurement Retail Pharmacies & Drug Stores Online Pharmacies & E?Commerce Platforms Direct Tenders and Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Enzymatic Electrochemical Technology Non?Enzymatic / Next?Generation Sensing Technology Others |

| By Application | Diabetes Self?Management In?Hospital Bedside Glucose Monitoring Critical Care & Emergency Care Clinical Research and Trials Others |

| By Payer & Policy Support | Government Reimbursement & Public Insurance Coverage Private Insurance Coverage Subsidies & Price Support for Point?of?Care Devices Incentives for Local Manufacturing & Localization Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administration | 100 | Hospital Administrators, Procurement Managers |

| Diabetes Care Clinics | 80 | Clinic Managers, Diabetes Educators |

| Home Care Providers | 70 | Home Health Care Coordinators, Patient Care Managers |

| Patient User Experience | 90 | Diabetes Patients, Caregivers |

| Healthcare Technology Experts | 60 | Medical Device Engineers, Health IT Specialists |

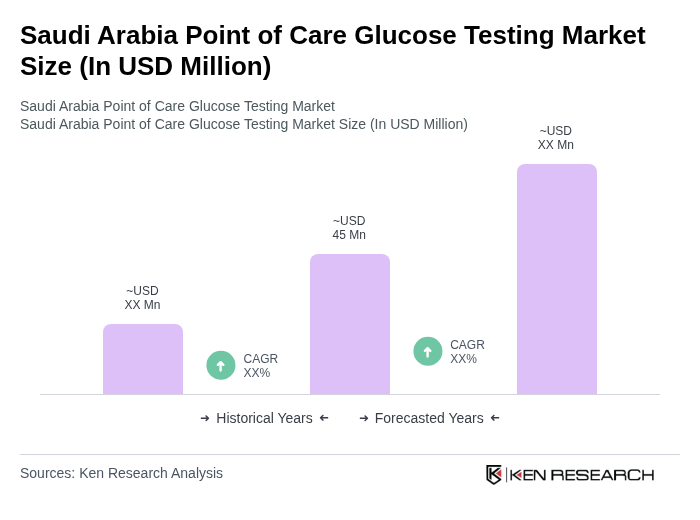

The Saudi Arabia Point of Care Glucose Testing Market is valued at approximately USD 45 million, reflecting a significant growth driven by the rising prevalence of diabetes and increasing demand for rapid diagnostic solutions.