Region:Middle East

Author(s):Dev

Product Code:KRAB7223

Pages:93

Published On:October 2025

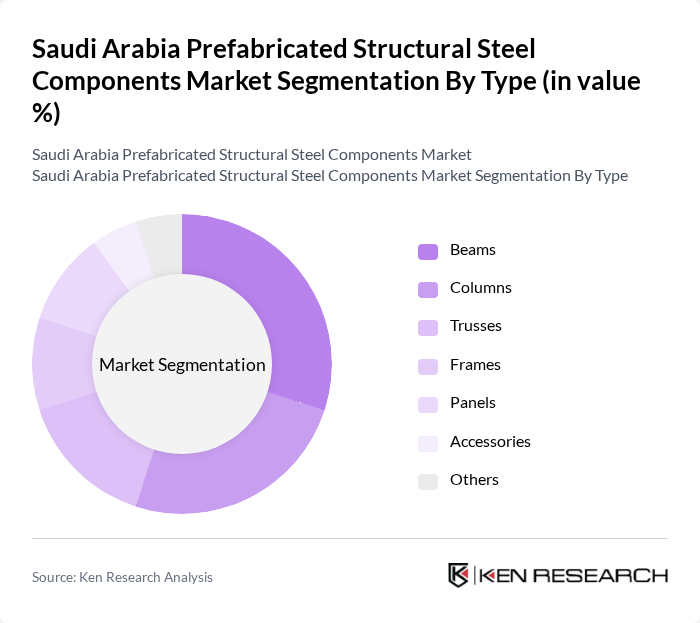

By Type:The market is segmented into various types of prefabricated structural steel components, including beams, columns, trusses, frames, panels, accessories, and others. Among these, beams and columns are the most widely used due to their essential roles in structural integrity and load-bearing capabilities. The increasing demand for high-rise buildings and large-scale infrastructure projects has further propelled the growth of these segments.

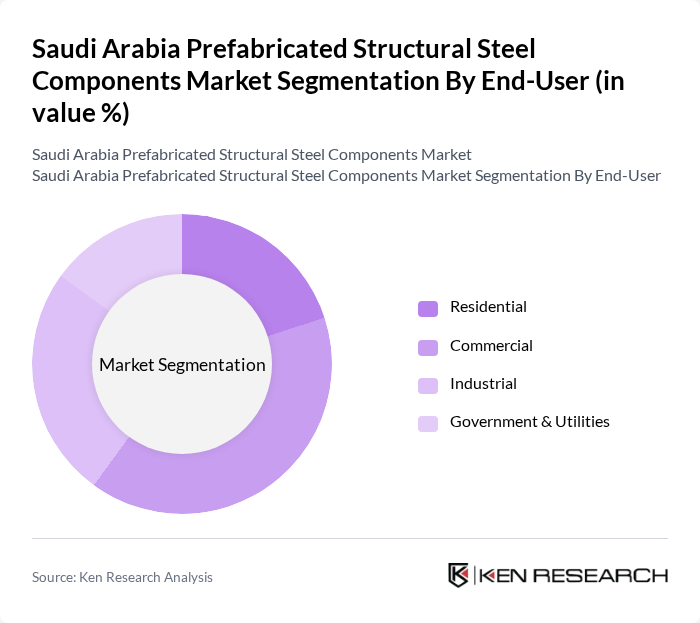

By End-User:The prefabricated structural steel components market serves various end-users, including residential, commercial, industrial, and government & utilities sectors. The commercial segment is currently leading the market due to the surge in commercial construction projects, such as office buildings, shopping malls, and hotels, driven by economic growth and urbanization trends.

The Saudi Arabia Prefabricated Structural Steel Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Steel Pipe Company, Al Rajhi Steel, Zamil Steel, Al-Falak Construction, Al-Babtain Group, Al-Muhaidib Group, Al-Jazira Steel Products, Al-Khodari & Sons, Saudi Arabian Amiantit Company, Al-Fouzan Trading & General Construction, Al-Habtoor Group, Al-Mansoori Specialized Engineering, Al-Suwaidi Industrial Services, Al-Tamimi Group, Saudi Arabian Oil Company (Saudi Aramco) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the prefabricated structural steel components market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and a commitment to sustainable construction. As urbanization accelerates, the demand for efficient building solutions will likely increase. Additionally, advancements in manufacturing technologies, such as automation and digitalization, are expected to enhance production capabilities. The integration of smart building technologies will further revolutionize the construction landscape, positioning prefabricated steel as a key player in the evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Beams Columns Trusses Frames Panels Accessories Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Construction Infrastructure Energy Transportation |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Retail Direct Delivery |

| By Price Range | Low Medium High |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Architects, Construction Supervisors |

| Industrial Facility Construction | 70 | Procurement Managers, Operations Directors |

| Infrastructure Projects (Bridges, Roads) | 60 | Civil Engineers, Project Coordinators |

| Prefabricated Steel Component Suppliers | 90 | Sales Managers, Product Development Leads |

The Saudi Arabia Prefabricated Structural Steel Components Market is valued at approximately USD 1.2 billion, driven by the rapid expansion of the construction sector, urbanization, and government initiatives focused on infrastructure development.