Region:Middle East

Author(s):Shubham

Product Code:KRAD6642

Pages:87

Published On:December 2025

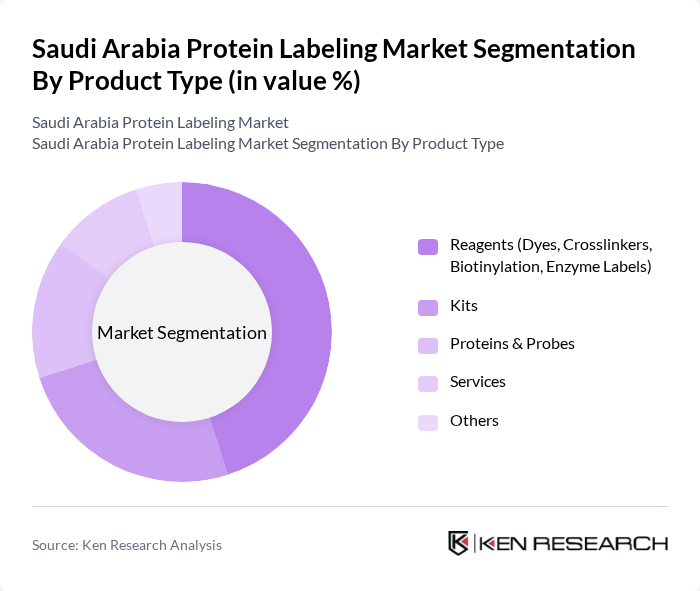

By Product Type:The product type segmentation includes various categories such as reagents, kits, proteins & probes, services, and others. Among these, reagents, which include dyes, crosslinkers, biotinylation, and enzyme labels, are leading the market due to their essential role in various labeling applications. The increasing demand for high-quality reagents in research and clinical laboratories drives this segment's growth, as they are critical for accurate protein analysis and diagnostics.

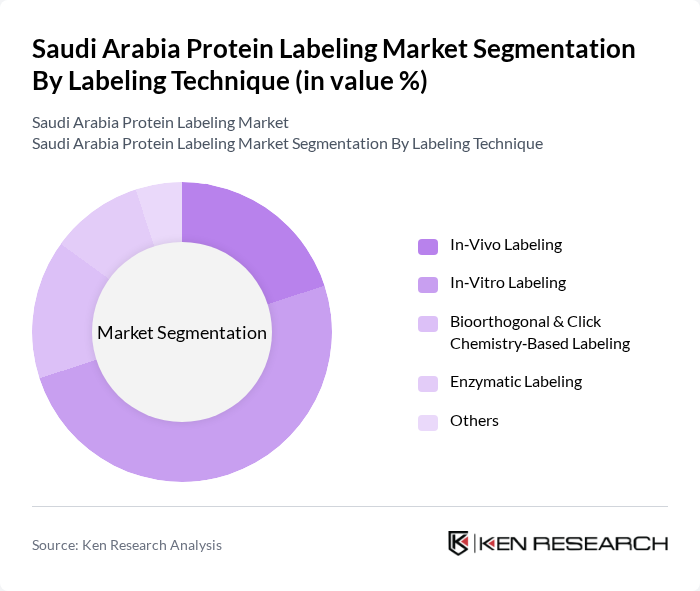

By Labeling Technique:The labeling technique segmentation encompasses in-vivo labeling, in-vitro labeling, bioorthogonal & click chemistry-based labeling, enzymatic labeling, and others. In-vitro labeling is the dominant technique, primarily due to its widespread application in laboratory settings for protein analysis and drug development. The growing focus on proteomics and the need for precise labeling in research are key factors contributing to the popularity of this technique.

The Saudi Arabia Protein Labeling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), PerkinElmer Inc. (Revvity, Inc.), GE Healthcare (Cytiva), F. Hoffmann?La Roche Ltd., New England Biolabs Inc., Promega Corporation, Bio?Rad Laboratories, Inc., Agilent Technologies, Inc., LI?COR Biosciences, Abcam plc, QIAGEN N.V., Takara Bio Inc., Local Distributors & Channel Partners in Saudi Arabia (e.g., Arabian Medical & Scientific Alliance, Gulf Scientific Corporation), Emerging Regional Players Serving the GCC Protein Labeling Segment contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia protein labeling market is poised for significant evolution, driven by increasing consumer demand for transparency and health-focused products. As the government continues to implement stricter food safety standards, manufacturers will need to adapt their labeling practices accordingly. Additionally, the rise of e-commerce platforms is expected to facilitate greater access to diverse protein products, enhancing consumer choice. This dynamic environment will likely foster innovation in labeling technologies and product offerings, aligning with global trends toward sustainability and health consciousness.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Reagents (Dyes, Crosslinkers, Biotinylation, Enzyme Labels) Kits Proteins & Probes Services Others |

| By Labeling Technique | In?Vivo Labeling In?Vitro Labeling Bioorthogonal & Click Chemistry?Based Labeling Enzymatic Labeling Others |

| By Application | Cell?Based Assays Fluorescence Microscopy & Imaging Mass Spectrometry & Proteomics Workflows Western Blotting & Immunoassays Drug Discovery & Development Others |

| By Label Type | Fluorescent Labels Enzyme Labels Radioactive Labels Stable Isotope Labels Biotin & Other Affinity Tags Others |

| By End User | Academic & Research Institutes Contract Research Organizations (CROs) Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Others |

| By Region in Saudi Arabia | Central Region (Including Riyadh) Western Region (Including Jeddah, Makkah, Madinah) Eastern Province (Including Dammam, Dhahran) Northern & Southern Regions Others |

| By Customer Type | Public Sector (Government & University Labs) Private Hospitals & Diagnostic Centers Private Research & Industrial Labs Distributors & System Integrators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Industry | 60 | Quality Control Managers, Production Supervisors |

| Dairy Product Manufacturers | 50 | Regulatory Affairs Specialists, R&D Managers |

| Plant-Based Protein Producers | 40 | Product Development Managers, Marketing Directors |

| Food Safety Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Retail Sector (Protein Products) | 50 | Category Managers, Supply Chain Analysts |

The Saudi Arabia Protein Labeling Market is valued at approximately USD 145 million, reflecting a significant growth driven by the demand for advanced diagnostic techniques and the rising prevalence of chronic diseases requiring precise protein analysis in clinical settings.