Region:Middle East

Author(s):Rebecca

Product Code:KRAB6847

Pages:100

Published On:October 2025

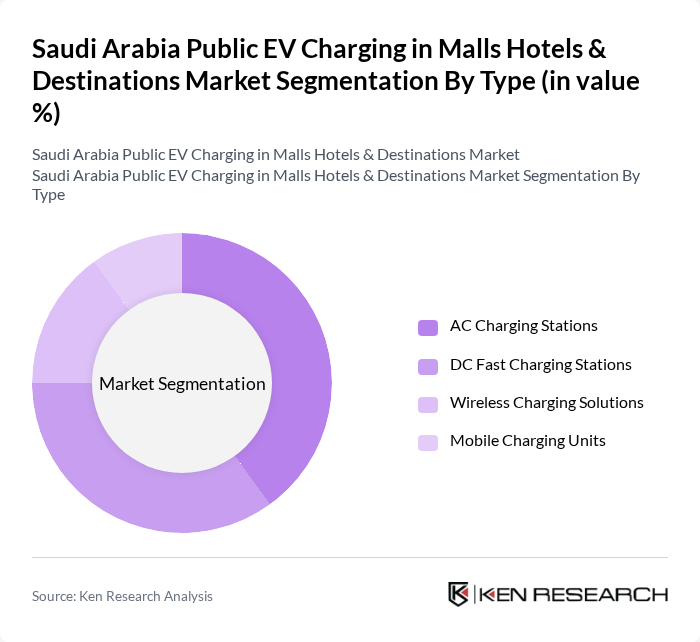

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, and Mobile Charging Units. Each type serves different consumer needs and preferences, with AC and DC stations being the most widely adopted due to their efficiency and speed.

The AC Charging Stations segment is currently dominating the market due to their widespread availability and lower installation costs compared to DC Fast Charging Stations. AC chargers are commonly used in residential and commercial settings, making them a preferred choice for users who require longer charging times while shopping or staying at hotels. The growing number of electric vehicles on the road is also contributing to the increased demand for AC charging solutions, as they provide a reliable and cost-effective option for EV owners.

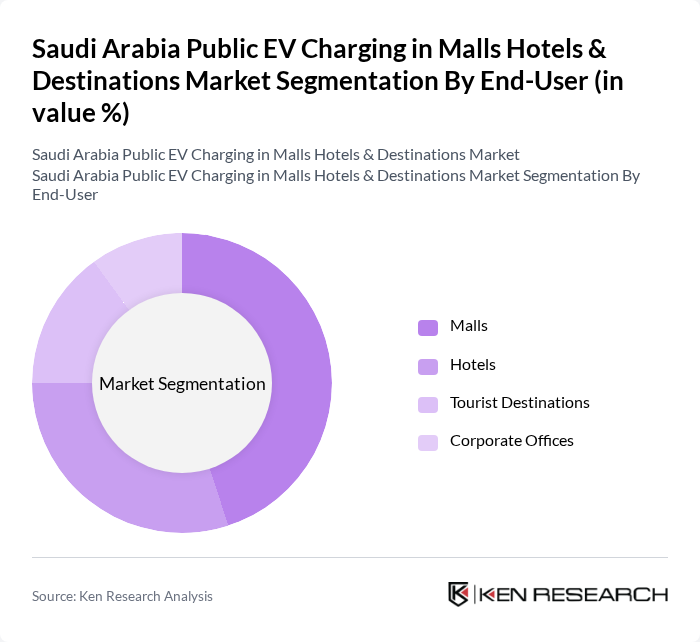

By End-User:The market is segmented by end-users, including Malls, Hotels, Tourist Destinations, and Corporate Offices. Each segment has unique requirements and usage patterns, with malls and hotels being the primary drivers of growth due to their high foot traffic and the need for convenient charging solutions for customers.

The Malls segment is leading the market due to the high volume of visitors and the increasing trend of consumers seeking convenience while shopping. Malls are increasingly integrating EV charging stations to enhance customer experience and attract eco-conscious shoppers. Additionally, the growing emphasis on sustainability among retailers is driving the installation of charging infrastructure in these locations, further solidifying their market leadership.

The Saudi Arabia Public EV Charging in Malls, Hotels & Destinations Market is characterized by a dynamic mix of regional and international players. Leading participants such as ChargePoint, Inc., EVBox, Blink Charging Co., Siemens AG, ABB Ltd., Schneider Electric, Tesla, Inc., Electrify America, Greenlots, Ionity, Shell Recharge, Engie, TotalEnergies, NIO Inc., Rivian Automotive, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the public EV charging market in Saudi Arabia appears promising, driven by increasing government support and consumer demand for sustainable solutions. In future, the integration of smart charging technologies and fast charging stations is expected to enhance user experience significantly. Furthermore, as urban planning policies evolve to support EV infrastructure, the market is likely to witness accelerated growth, positioning Saudi Arabia as a leader in the Middle East's transition to electric mobility.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Mobile Charging Units |

| By End-User | Malls Hotels Tourist Destinations Corporate Offices |

| By Charging Speed | Level 1 Charging Level 2 Charging Fast Charging |

| By Payment Model | Pay-per-Use Subscription-Based Free Charging |

| By Location Type | Indoor Charging Stations Outdoor Charging Stations Multi-Level Parking Charging |

| By User Demographics | Individual Users Fleet Operators Tourists |

| By Service Type | Charging as a Service (CaaS) Maintenance and Support Services Installation Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Malls with EV Charging Stations | 100 | Facility Managers, Operations Directors |

| Hotels Offering EV Charging | 80 | Hotel Managers, Sustainability Coordinators |

| Tourist Destinations with Charging Facilities | 70 | Destination Managers, Visitor Services Directors |

| EV Owners Utilizing Public Charging | 150 | EV Users, Charging Network Subscribers |

| Government Officials on EV Policy | 50 | Policy Makers, Urban Planners |

The Saudi Arabia Public EV Charging Market in malls, hotels, and destinations is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased electric vehicle adoption and government initiatives promoting sustainable transportation.