Region:Middle East

Author(s):Rebecca

Product Code:KRAD8431

Pages:89

Published On:December 2025

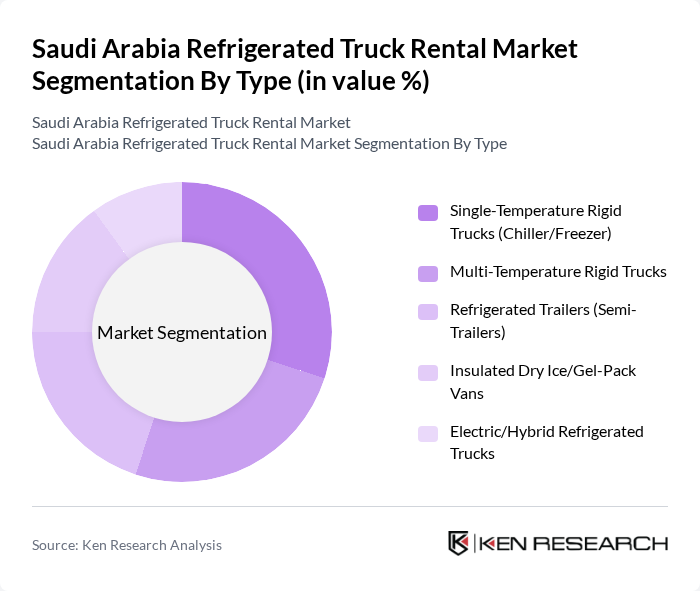

By Type:The market is segmented into various types of refrigerated trucks, including Single-Temperature Rigid Trucks (Chiller/Freezer), Multi-Temperature Rigid Trucks, Refrigerated Trailers (Semi-Trailers), Insulated Dry Ice/Gel-Pack Vans, and Electric/Hybrid Refrigerated Trucks. Each type serves different logistical needs, catering to various industries.

The Single-Temperature Rigid Trucks (Chiller/Freezer) segment is currently dominating the market due to their widespread use in transporting perishable food items, such as meat and dairy products. These trucks are preferred for their efficiency in maintaining a consistent temperature, which is crucial for food safety. The growing demand for fresh produce and frozen goods has further solidified their market position. Additionally, advancements in refrigeration technology have enhanced the reliability and performance of these vehicles, making them a popular choice among logistics providers.

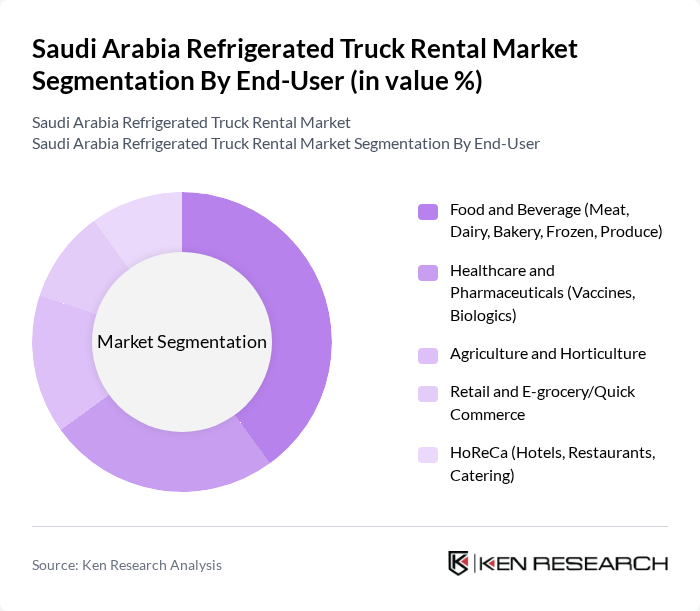

By End-User:The market is segmented based on end-users, including Food and Beverage (Meat, Dairy, Bakery, Frozen, Produce), Healthcare and Pharmaceuticals (Vaccines, Biologics), Agriculture and Horticulture, Retail and E-grocery/Quick Commerce, and HoReCa (Hotels, Restaurants, Catering). Each end-user segment has unique requirements for refrigerated transport.

The Food and Beverage segment is the largest end-user in the market, accounting for a significant share due to the high demand for perishable goods. The increasing consumer preference for fresh and frozen food products drives the need for efficient refrigerated transport solutions. Additionally, the rise of e-commerce in the food sector has further amplified the demand for reliable cold chain logistics, making this segment a key player in the refrigerated truck rental market.

The Saudi Arabia Refrigerated Truck Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Transicold, Thermo King, Daikin, Frigoblock, Foton Group, Al-Futtaim Logistics, Al-Muhaidib Group, Al-Jazira Equipment Co., Al-Watania for Industries, Al-Mansour Automotive contribute to innovation, geographic expansion, and service delivery in this space.

The future of the refrigerated truck rental market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer demand for fresh products. The integration of IoT in fleet management is expected to enhance operational efficiency, while the shift towards rental models will provide businesses with flexible logistics solutions. As sustainability becomes a priority, the market is likely to see a rise in eco-friendly refrigerated vehicles, aligning with global trends towards greener transportation options.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Temperature Rigid Trucks (Chiller/Freezer) Multi-Temperature Rigid Trucks Refrigerated Trailers (Semi-Trailers) Insulated Dry Ice/Gel-Pack Vans Electric/Hybrid Refrigerated Trucks |

| By End-User | Food and Beverage (Meat, Dairy, Bakery, Frozen, Produce) Healthcare and Pharmaceuticals (Vaccines, Biologics) Agriculture and Horticulture Retail and E-grocery/Quick Commerce HoReCa (Hotels, Restaurants, Catering) |

| By Vehicle Size | Light Commercial Vehicles (LCV) Medium Commercial Vehicles (MCV) Heavy Commercial Vehicles (HCV) |

| By Tonnage Capacity | Less than 10 tons 10-20 tons More than 20 tons |

| By Fleet Size | Small Fleet (1-10 trucks) Medium Fleet (11-50 trucks) Large Fleet (51+ trucks) |

| By Rental Duration | Short-term Rentals Long-term Rentals Seasonal Rentals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Sector | 45 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Supply Chain | 40 | Operations Managers, Quality Assurance Heads |

| Retail Grocery Chains | 35 | Procurement Officers, Store Managers |

| Event Catering Services | 30 | Event Coordinators, Catering Managers |

| Cold Chain Logistics Providers | 45 | Fleet Managers, Business Development Executives |

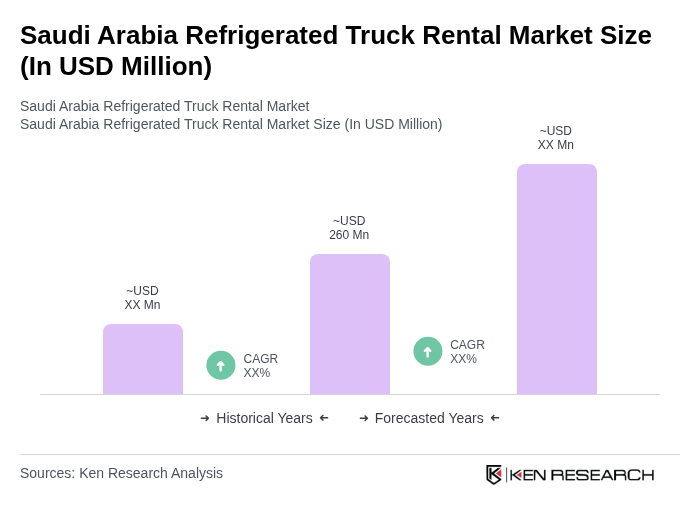

The Saudi Arabia Refrigerated Truck Rental Market is valued at approximately USD 260 million, driven by the increasing demand for temperature-sensitive goods in sectors like food and beverage, as well as healthcare and e-commerce logistics.