Region:Middle East

Author(s):Dev

Product Code:KRAD3210

Pages:97

Published On:November 2025

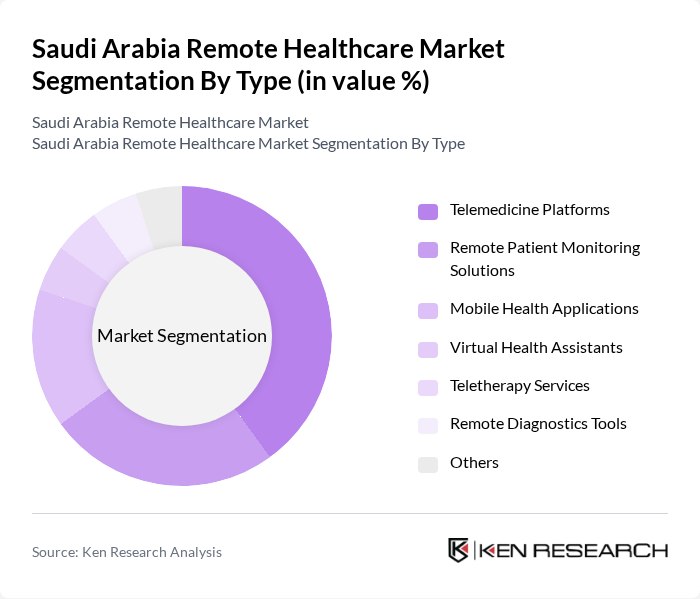

By Type:The market is segmented into various types, including Telemedicine Platforms, Remote Patient Monitoring Solutions, Mobile Health Applications, Virtual Health Assistants, Teletherapy Services, Remote Diagnostics Tools, and Others. Among these, Telemedicine Platforms are leading due to their ability to provide real-time consultations and access to healthcare professionals, which has become increasingly important in the wake of the pandemic. The convenience and efficiency of these platforms have driven their adoption among both healthcare providers and patients. Real-time virtual health services are the largest revenue-generating segment, while remote patient monitoring is the fastest-growing segment, reflecting the increasing focus on chronic disease management and elderly care .

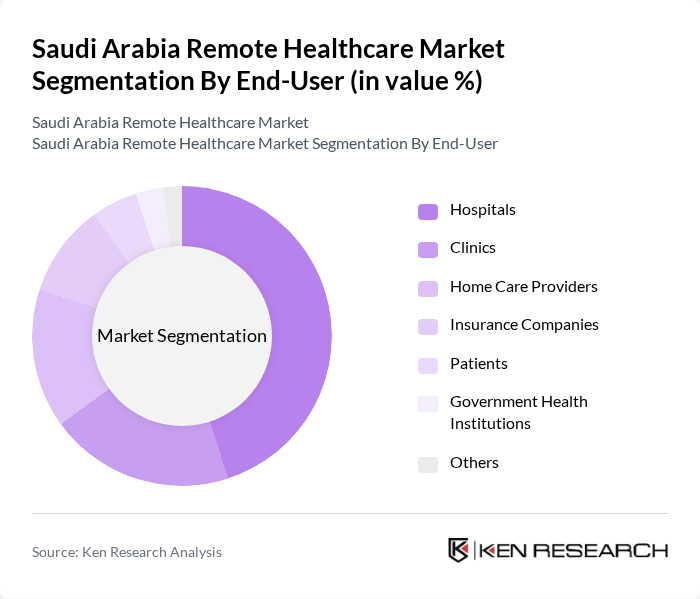

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, Government Health Institutions, and Others. Hospitals are the leading end-user segment, as they increasingly adopt remote healthcare solutions to enhance patient care and streamline operations. The integration of remote monitoring and telehealth services allows hospitals to manage patient loads more effectively and improve health outcomes. Clinics and home care providers are also significant adopters, driven by the need for cost-efficient and scalable healthcare delivery models .

The Saudi Arabia Remote Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telemedicine Company, Seha Virtual Hospital, Altibbi, Vezeeta, Okadoc, Medisense, Cura Healthcare, Shifa App, Mawid (Ministry of Health), Cloud Solutions Company, Aster DM Healthcare, Saudi German Hospitals, Al Nahdi Medical Company, Dr. Sulaiman Al Habib Medical Group, Mouwasat Medical Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the remote healthcare market in Saudi Arabia appears promising, driven by ongoing government support and technological advancements. As the population ages and chronic diseases become more prevalent, the demand for remote healthcare solutions will likely increase. Innovations in artificial intelligence and machine learning are expected to enhance telemedicine capabilities, improving patient outcomes. Additionally, the integration of wearable health technology will facilitate real-time monitoring, further driving the adoption of remote healthcare services across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Platforms Remote Patient Monitoring Solutions Mobile Health Applications Virtual Health Assistants Teletherapy Services Remote Diagnostics Tools Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Government Health Institutions Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Service Delivery Model | Synchronous Telehealth Asynchronous Telehealth Hybrid Models Others |

| By Technology Used | Video Conferencing Tools Mobile Applications Wearable Devices Cloud-Based Health Management Systems AI-Enabled Diagnostic Tools IoT-Integrated Medical Devices Others |

| By Geographic Coverage | Urban Areas Rural Areas Others |

| By Payment Model | Fee-for-Service Subscription-Based Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telehealth Service Providers | 100 | CEOs, Operations Managers |

| Healthcare Professionals | 120 | Doctors, Nurses, Telehealth Coordinators |

| Patients Using Remote Healthcare | 140 | Individuals aged 18-65, Chronic Disease Patients |

| Healthcare Policy Makers | 80 | Government Officials, Health Administrators |

| Technology Providers in Healthcare | 70 | Product Managers, IT Directors |

The Saudi Arabia Remote Healthcare Market is valued at approximately USD 435 million, driven by the increasing adoption of digital health technologies and the demand for accessible healthcare services, particularly accelerated by the COVID-19 pandemic.