Saudi Arabia Retinal Imaging Devices Market Overview

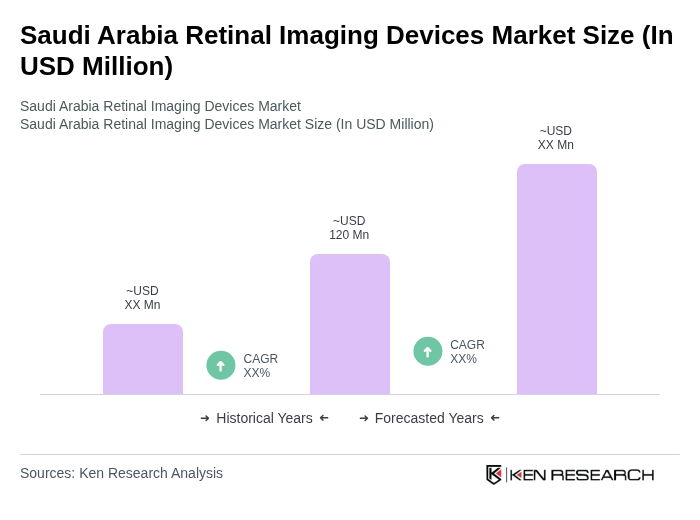

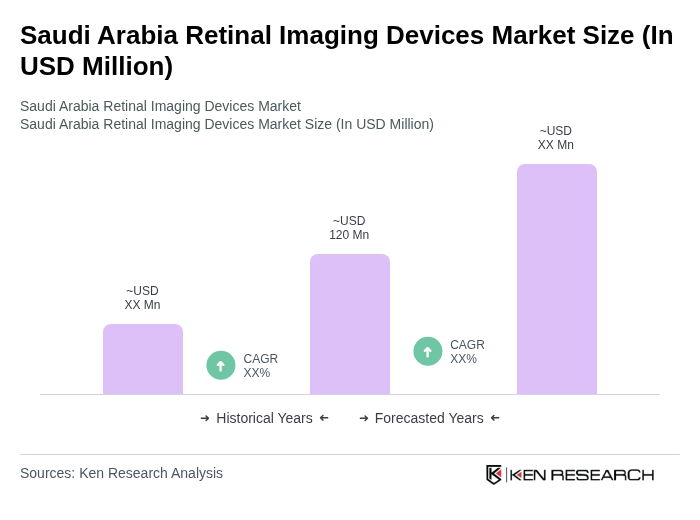

- The Saudi Arabia Retinal Imaging Devices Market is valued at USD 120 million, based on a five-year historical analysis of diagnostic and imaging device segments within the broader ophthalmic devices market. This growth is primarily driven by the increasing prevalence of eye diseases, especially diabetic retinopathy, advancements in imaging technology such as AI-enabled fundus cameras and cloud-connected OCT systems, and rising awareness about eye health among the population. The demand for retinal imaging devices has surged due to the growing elderly population and the high incidence of diabetes, which affects 31% of adults in the Kingdom and is a significant risk factor for retinal disorders.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their advanced healthcare infrastructure and concentration of specialized eye care facilities. These urban centers are equipped with state-of-the-art medical technology and attract a high volume of patients seeking advanced diagnostic and treatment options for retinal diseases, thereby driving the demand for retinal imaging devices. The Vision 2030 initiative and the emergence of public–private ophthalmic centers of excellence further reinforce the concentration of demand in these metropolitan areas.

- In 2024, the Saudi Arabian government, through the Ministry of Health, issued the “National Tele-Retinopathy Screening Program Mandate, 2024,” requiring hospitals and clinics to deploy advanced retinal imaging technologies—including AI-integrated fundus cameras and OCT systems—for early detection and management of diabetic retinopathy and other retinal diseases. This regulation mandates compliance with digital image management standards and periodic reporting to the National Health Command Center, aiming to improve patient outcomes and reduce preventable blindness.

Saudi Arabia Retinal Imaging Devices Market Segmentation

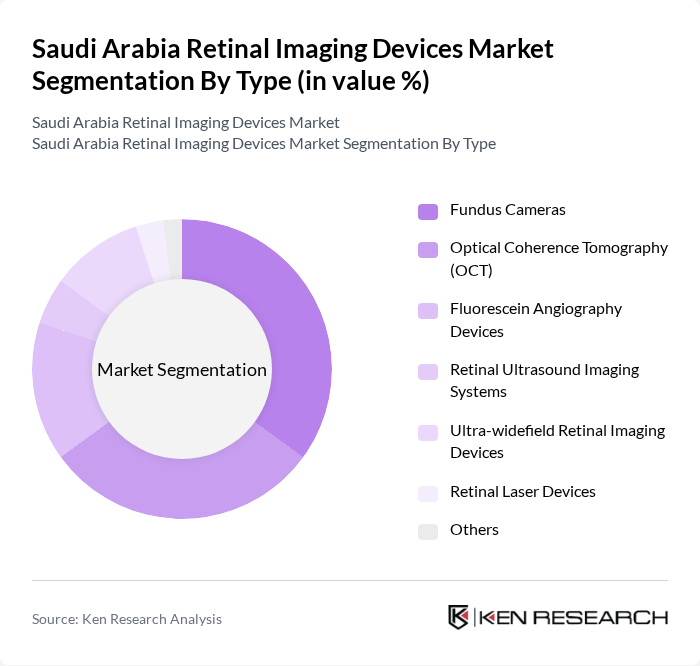

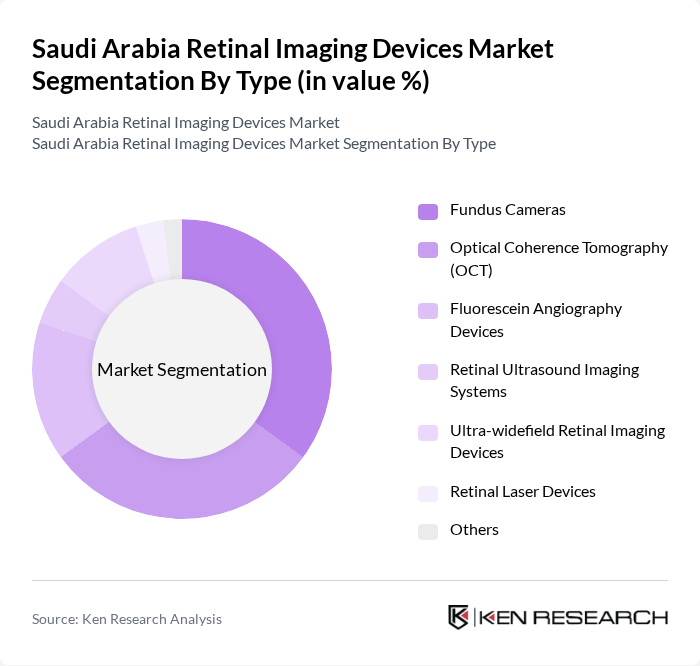

By Type:The market is segmented into various types of retinal imaging devices, including Fundus Cameras, Optical Coherence Tomography (OCT), Fluorescein Angiography Devices, Retinal Ultrasound Imaging Systems, Ultra-widefield Retinal Imaging Devices, Retinal Laser Devices, and Others. Among these, Fundus Cameras and Optical Coherence Tomography (OCT) are the most widely used due to their effectiveness in diagnosing diabetic retinopathy, macular degeneration, and other retinal conditions. OCT devices are favored for their superior retinal-layer visualization, while ultra-widefield imaging is increasingly adopted for comprehensive peripheral-retina assessment.

By End-User:The end-user segmentation includes Hospitals, Eye Clinics, Ambulatory Surgery Centers (ASCs), Research Institutions, and Others. Hospitals are the primary end-users due to their comprehensive facilities, ability to provide specialized care, and integration with national screening programs, which drives the demand for advanced retinal imaging devices. Eye clinics and ASCs are also expanding their adoption of imaging technologies, supported by Vision 2030’s privatization and infrastructure initiatives.

Saudi Arabia Retinal Imaging Devices Market Competitive Landscape

The Saudi Arabia Retinal Imaging Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Medical Systems, Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Optovue, Inc., Topcon Corporation, NIDEK Co., Ltd., Bausch + Lomb, Alcon Laboratories, Inc., Optos plc, Visionix, iCare Finland Oy, Sonomed Escalon, Eyenuk, Inc., DGH Technology, Inc., CenterVue SpA contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Retinal Imaging Devices Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Eye Diseases:The prevalence of eye diseases in Saudi Arabia is rising, with an estimated1.5 million people affected by diabetic retinopathy aloneas of in future. This increase is driven by lifestyle changes and a growing diabetic population, projected to reach4.5 millionin future. The demand for retinal imaging devices is expected to surge as healthcare providers seek advanced diagnostic tools to manage these conditions effectively, thereby enhancing patient outcomes and reducing healthcare costs.

- Advancements in Imaging Technology:The retinal imaging devices market is significantly influenced by technological advancements, with innovations such as optical coherence tomography (OCT) and fundus photography enhancing diagnostic accuracy. In future, the market is expected to see a20% increase in the adoption of these advanced imaging technologies, driven by their ability to provide detailed retinal images and facilitate early detection of diseases, ultimately improving treatment efficacy and patient care.

- Government Initiatives for Healthcare Improvement:The Saudi government has committed to enhancing healthcare infrastructure, with a budget allocation ofSAR 172 billion (approximately USD 46 billion)for health services in future. This investment aims to improve access to advanced medical technologies, including retinal imaging devices. Initiatives such as Vision 2030 emphasize the importance of preventive healthcare, which is expected to drive demand for innovative diagnostic solutions in the retinal imaging sector.

Market Challenges

- High Cost of Advanced Devices:The high cost of advanced retinal imaging devices poses a significant challenge for healthcare providers in Saudi Arabia. Prices for state-of-the-art devices can exceedSAR 500,000 (approximately USD 133,000), making them less accessible for smaller clinics and hospitals. This financial barrier limits the widespread adoption of these technologies, hindering the overall growth of the retinal imaging market in the region.

- Limited Awareness Among Healthcare Providers:Despite the benefits of retinal imaging devices, there remains a notable lack of awareness among healthcare providers regarding their capabilities and advantages. A survey conducted in future indicated that only40% of ophthalmologists in Saudi Arabia were familiar with the latest imaging technologies. This knowledge gap can lead to underutilization of advanced diagnostic tools, ultimately affecting patient care and market growth.

Saudi Arabia Retinal Imaging Devices Market Future Outlook

The future of the retinal imaging devices market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging devices is expected to enhance diagnostic accuracy and efficiency. Additionally, the shift towards preventive healthcare will likely encourage more healthcare facilities to adopt advanced imaging technologies, improving early detection and treatment of eye diseases. As the market evolves, collaboration between healthcare providers and technology developers will be crucial for innovation and growth.

Market Opportunities

- Expansion of Telemedicine Services:The rise of telemedicine in Saudi Arabia presents a significant opportunity for retinal imaging devices. With an estimated30% increase in telehealth consultations expected in future, integrating imaging technologies into remote care can enhance access to eye care, particularly in rural areas, improving patient outcomes and driving market growth.

- Development of Portable Imaging Devices:The demand for portable retinal imaging devices is on the rise, particularly in underserved regions. In future, the market for portable devices is projected to grow by25%, driven by their ability to provide accessible and efficient eye care solutions. This trend presents a lucrative opportunity for manufacturers to innovate and cater to diverse healthcare settings.