Region:Middle East

Author(s):Rebecca

Product Code:KRAC2578

Pages:88

Published On:October 2025

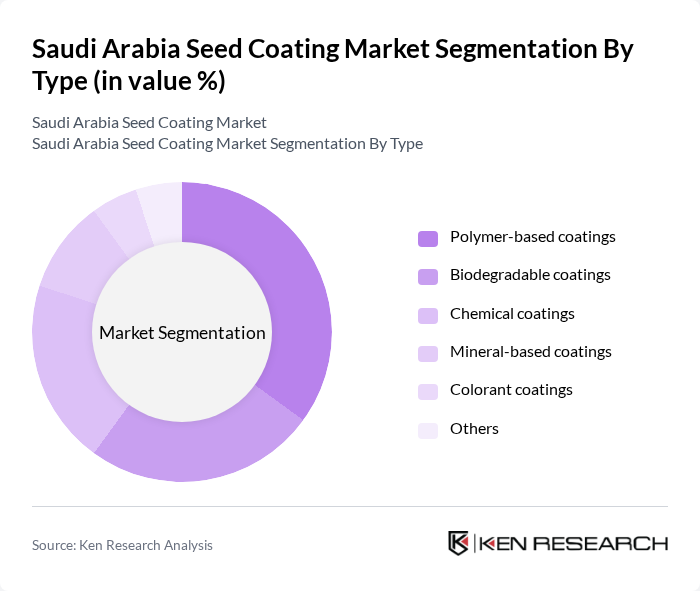

By Type:The seed coating market can be segmented into various types, including polymer-based coatings, biodegradable coatings, chemical coatings, mineral-based coatings, colorant coatings, and others. Among these, polymer-based coatings are gaining traction due to their durability, superior adhesion, and effectiveness in protecting seeds from pests and diseases. Biodegradable coatings are also becoming popular as they align with the growing trend towards sustainable agriculture and regulatory encouragement for green agrochemicals .

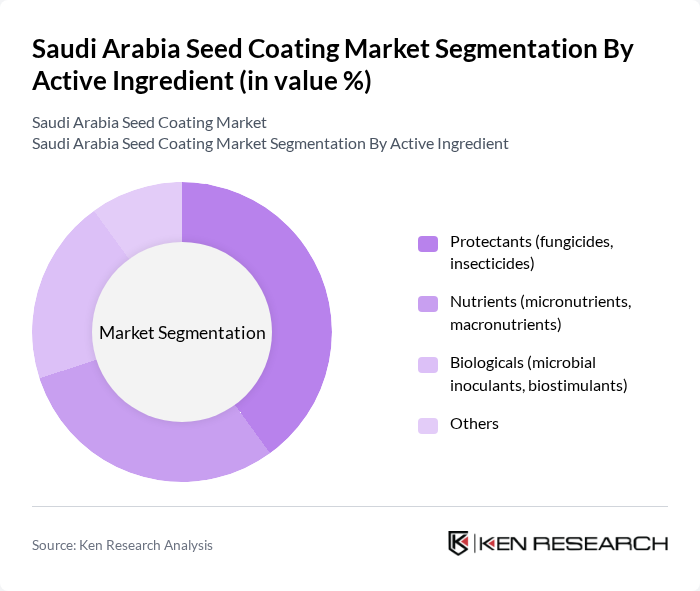

By Active Ingredient:This segmentation includes protectants (fungicides, insecticides), nutrients (micronutrients, macronutrients), biologicals (microbial inoculants, biostimulants), and others. Protectants are the leading sub-segment due to the increasing need for pest and disease management in agriculture and the adoption of integrated pest management practices. Nutrients are also significant as they enhance seed performance and crop yield, and biologicals are gaining importance with the shift towards sustainable and environmentally friendly seed treatments .

The Saudi Arabia Seed Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, UPL Limited, FMC Corporation, Novozymes A/S, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions Ltd., Nufarm Limited, Croda International Plc, KWS SAAT SE & Co. KGaA, Clariant AG, Solvay SA, DSM (Koninklijke DSM N.V.), Associated British Foods plc, Precision Planting LLC, Saudi Modern Seeds Co., Arabian Agricultural Services Company (ARASCO), Al-Rowad Seeds contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia seed coating market appears promising, driven by increasing investments in agricultural research and development, projected to exceed SAR 1.2 billion in future. The integration of smart agriculture technologies, such as precision farming, is expected to enhance seed treatment solutions, improving efficiency and sustainability. Additionally, the growing focus on eco-friendly practices will likely lead to innovations in seed coating materials, aligning with global sustainability trends and consumer preferences for organic products.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer-based coatings Biodegradable coatings Chemical coatings Mineral-based coatings Colorant coatings Others |

| By Active Ingredient | Protectants (fungicides, insecticides) Nutrients (micronutrients, macronutrients) Biologicals (microbial inoculants, biostimulants) Others |

| By Crop Type | Cereals & grains Oilseeds & pulses Fruits & vegetables Flowers & ornamentals Others |

| By Formulation | Liquid Powder |

| By Application | Crop seeds Vegetable seeds Flower seeds Others |

| By End-User | Commercial farmers Agricultural cooperatives Research institutions Seed producers Others |

| By Distribution Channel | Direct sales Retail outlets Online platforms Agricultural input distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Price Range | Low price Mid-range Premium |

| By Packaging Type | Bulk packaging Retail packaging Custom packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Coating Manufacturers | 50 | Product Managers, R&D Directors |

| Agricultural Input Distributors | 40 | Sales Managers, Distribution Coordinators |

| Farmers Utilizing Coated Seeds | 100 | Farm Owners, Agronomists |

| Research Institutions in Agriculture | 40 | Research Scientists, Policy Analysts |

| Government Agricultural Agencies | 40 | Policy Makers, Agricultural Advisors |

The Saudi Arabia Seed Coating Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is influenced by the increasing demand for high-quality seeds and advancements in agricultural technologies.