Region:Middle East

Author(s):Geetanshi

Product Code:KRAB4624

Pages:87

Published On:October 2025

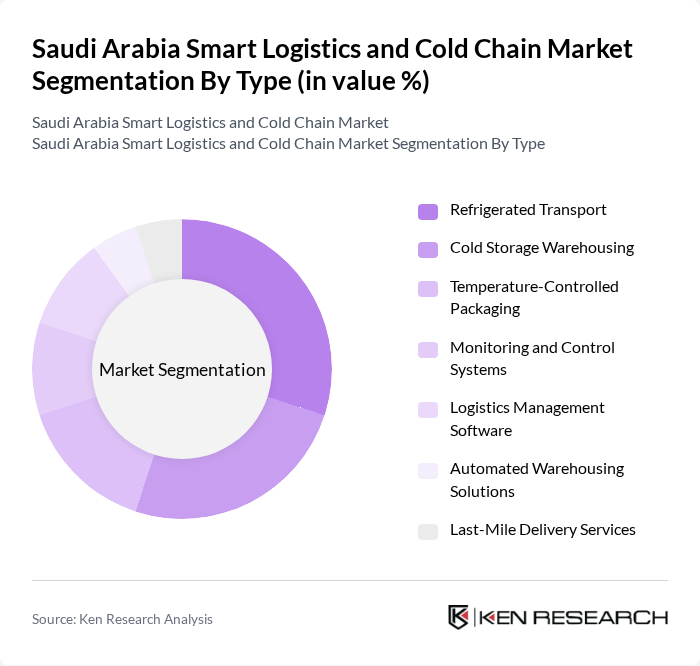

By Type:The market is segmented into Refrigerated Transport, Cold Storage Warehousing, Temperature-Controlled Packaging, Monitoring and Control Systems, Logistics Management Software, Automated Warehousing Solutions, and Last-Mile Delivery Services. Each segment is integral to maintaining the quality and safety of temperature-sensitive products throughout the supply chain. Refrigerated transport and cold storage warehousing are the largest segments, reflecting the critical need for reliable temperature management in food and pharmaceutical logistics. Monitoring and control systems, along with logistics management software, are increasingly adopted to enable real-time tracking, predictive maintenance, and regulatory compliance .

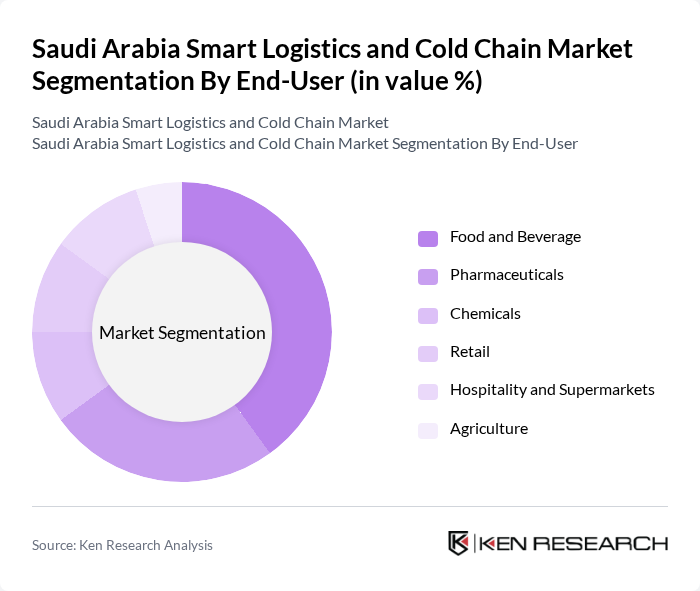

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Chemicals, Retail, Hospitality and Supermarkets, and Agriculture. Each sector has distinct cold chain logistics requirements. The food and beverage segment leads due to high demand for fresh and frozen products, while pharmaceuticals require stringent temperature control for vaccine and medicine distribution. Chemicals, retail, and hospitality sectors are also expanding their reliance on advanced cold chain solutions to ensure product integrity and regulatory compliance .

The Saudi Arabia Smart Logistics and Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Airlines Cargo, Agility Logistics, Almarai Company, Bahri Logistics, GAC Saudi Arabia, DHL Supply Chain, Kuehne + Nagel Saudi Arabia, DB Schenker Saudi Arabia, FedEx Express Saudi Arabia, UPS Supply Chain Solutions Saudi Arabia, Maersk Saudi Arabia, SISCO (Saudi Industrial Services Co.), Naqel Express, Al-Jabri Logistics, Al-Futtaim Logistics Saudi Arabia, Amazon.sa Logistics, Noon Logistics, Al Bawani Logistics, Gulf Warehousing Company (GWC), Almadinah Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia smart logistics and cold chain market appears promising, driven by technological advancements and increasing consumer expectations. The integration of IoT and AI technologies is expected to enhance operational efficiency, enabling real-time monitoring and predictive analytics. Furthermore, the growing emphasis on sustainability will likely lead to the adoption of eco-friendly practices, such as energy-efficient cold storage solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Warehousing Temperature-Controlled Packaging Monitoring and Control Systems Logistics Management Software Automated Warehousing Solutions Last-Mile Delivery Services |

| By End-User | Food and Beverage Pharmaceuticals Chemicals Retail Hospitality and Supermarkets Agriculture |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Special Economic Zones (SEZ) Distribution |

| By Application | Food Preservation Medical Supply Chain Hazardous Material Transport Vaccine Distribution Perishable Goods Export/Import |

| By Sales Channel | Online Sales Offline Sales Direct Sales Distributor/Agent Sales |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Logistics Companies Regulatory Support for Technology Adoption Public-Private Partnership Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain Logistics | 120 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Cold Storage Solutions | 90 | Operations Managers, Quality Assurance Heads |

| Retail Cold Chain Management | 70 | Procurement Officers, Inventory Managers |

| Temperature-Controlled Transportation | 60 | Fleet Managers, Logistics Coordinators |

| Cold Chain Technology Providers | 50 | Product Development Managers, Technical Directors |

The Saudi Arabia Smart Logistics and Cold Chain Market is valued at approximately USD 5 billion, driven by the increasing demand for temperature-sensitive products and advancements in logistics technology.