Saudi Arabia Smart Pills Market Overview

- The Saudi Arabia Smart Pills Market is valued at USD 7 million, based on a five-year historical analysis. This growth is primarily driven by advancements in healthcare technology, such as the integration of artificial intelligence and miniaturized electronics, the increasing prevalence of chronic diseases, and a growing demand for non-invasive diagnostic methods. The adoption of smart pills has enhanced patient monitoring, medication adherence, and remote health management, contributing to the market's expansion .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their advanced healthcare infrastructure, high concentration of medical facilities, and significant populations of healthcare professionals and patients. These urban centers facilitate the adoption of innovative medical technologies, including smart pills, through robust investment in digital health and connected care solutions .

- In 2023, the Saudi Food and Drug Authority (SFDA) issued the “Medical Devices Interim Regulation, 2023,” which introduced specific requirements for the registration, approval, and post-market surveillance of ingestible medical devices, including smart pills. The regulation mandates local representation, conformity assessment, and clinical data submission for market entry, enhancing the efficiency of bringing innovative products to market while ensuring patient safety and product efficacy .

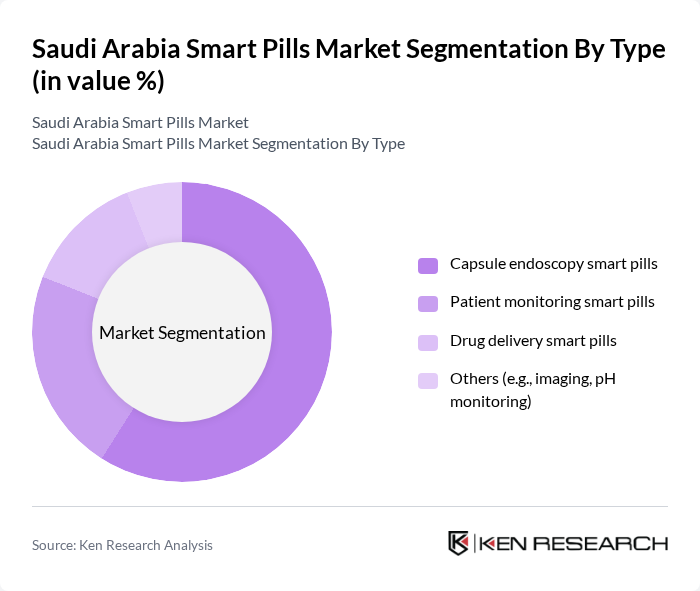

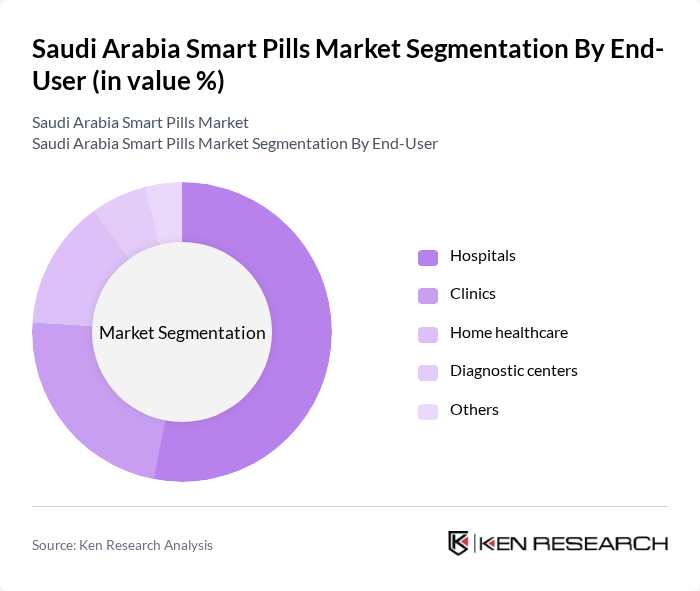

Saudi Arabia Smart Pills Market Segmentation

By Type:The market is segmented into various types of smart pills, including capsule endoscopy smart pills, patient monitoring smart pills, drug delivery smart pills, and others such as imaging and pH monitoring. Among these, capsule endoscopy smart pills hold the largest share due to their effectiveness in gastrointestinal diagnostics, while patient monitoring smart pills are increasingly utilized for chronic disease management and medication adherence .

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, diagnostic centers, and others. Hospitals are the leading end-users due to their advanced facilities, high patient inflow, and the need for innovative diagnostic tools to enhance patient care. Clinics and home healthcare services are also increasingly adopting smart pills for better patient monitoring, remote diagnostics, and treatment adherence .

Saudi Arabia Smart Pills Market Competitive Landscape

The Saudi Arabia Smart Pills Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otsuka Pharmaceutical Co., Ltd., Medtronic plc, CapsoVision, Inc., Olympus Corporation, Philips Healthcare, Abbott Laboratories, Medisafe Ltd., Check-Cap Ltd., IntroMedic Co., Ltd., Proteus Digital Health, Inc., Novartis AG, Siemens Healthineers, Bayer AG, Johnson & Johnson, and GE Healthcare contribute to innovation, geographic expansion, and service delivery in this space .

Saudi Arabia Smart Pills Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions is a significant growth driver for the smart pills market in Saudi Arabia. According to the World Health Organization, approximately 8 million adults in Saudi Arabia are living with diabetes. This growing patient population necessitates innovative drug delivery solutions, such as smart pills, to enhance medication adherence and improve health outcomes, thereby driving market demand.

- Rising Demand for Patient-Centric Healthcare Solutions:The shift towards patient-centric healthcare is evident in Saudi Arabia, where the Ministry of Health reported a 35% increase in telehealth consultations. This trend reflects a growing preference for personalized treatment options, including smart pills that provide real-time data on medication adherence. As patients seek more control over their health, the demand for innovative solutions that enhance engagement and outcomes is expected to rise significantly.

- Technological Advancements in Drug Delivery Systems:The integration of advanced technologies in drug delivery systems is propelling the smart pills market forward. In future, investments in health tech in Saudi Arabia are expected to reach $1.5 billion, with a significant portion directed towards developing smart pill technologies. These advancements not only improve the efficacy of medications but also facilitate better monitoring of patient health, thus driving adoption among healthcare providers and patients alike.

Market Challenges

- High Cost of Smart Pill Technology:One of the primary challenges facing the smart pills market in Saudi Arabia is the high cost associated with the technology. The average cost of smart pill systems can exceed SAR 1,800 per unit, which may limit accessibility for many patients. This financial barrier can hinder widespread adoption, particularly in a healthcare system where cost-effectiveness is a critical consideration for both providers and patients.

- Regulatory Hurdles in Product Approval:Regulatory challenges pose significant obstacles to the smart pills market in Saudi Arabia. The Saudi Food and Drug Authority (SFDA) has stringent guidelines for the approval of new medical technologies, which can delay market entry. In future, the average time for product approval is reported to be over 20 months, creating a bottleneck that can stifle innovation and limit the availability of smart pill solutions in the healthcare market.

Saudi Arabia Smart Pills Market Future Outlook

The future of the smart pills market in Saudi Arabia appears promising, driven by ongoing technological advancements and a growing emphasis on digital health solutions. As the healthcare sector continues to embrace telemedicine and remote monitoring, smart pills are likely to play a crucial role in enhancing patient adherence and outcomes. Furthermore, increased collaboration between healthcare providers and technology firms is expected to foster innovation, leading to the development of more effective and user-friendly smart pill solutions in the coming years.

Market Opportunities

- Expansion of Telemedicine Services:The rapid expansion of telemedicine services in Saudi Arabia presents a significant opportunity for smart pills. With telehealth consultations increasing by 35%, integrating smart pill technology can enhance remote patient monitoring and medication adherence, ultimately improving health outcomes and patient satisfaction.

- Collaborations with Tech Companies for Innovation:Collaborations between healthcare providers and technology companies are crucial for driving innovation in the smart pills market. By leveraging expertise in data analytics and AI, these partnerships can lead to the development of advanced smart pill solutions that offer personalized treatment options, thereby enhancing patient engagement and adherence.