Region:Middle East

Author(s):Dev

Product Code:KRAA9606

Pages:89

Published On:November 2025

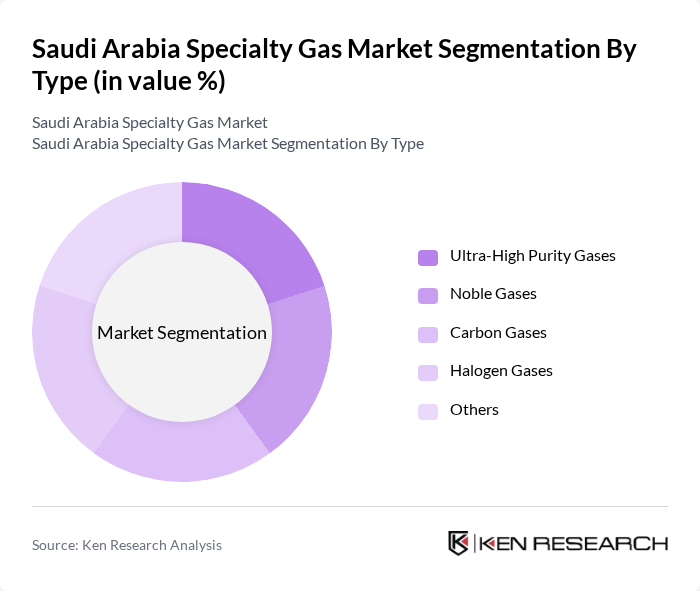

By Type:The specialty gas market can be segmented into various types, including Ultra-High Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, and Others. Each of these subsegments plays a crucial role in different industrial applications.Ultra-High Purity Gasesare particularly significant due to their essential use in semiconductor manufacturing, healthcare diagnostics, and laboratory research.Carbon Gasesrepresent a major revenue segment, especially for applications in oil and gas, welding, and chemical manufacturing.Noble Gasessuch as argon and helium are increasingly used in electronics and medical imaging, whileHalogen Gasesare important for specialty chemical synthesis and electronics etching processes .

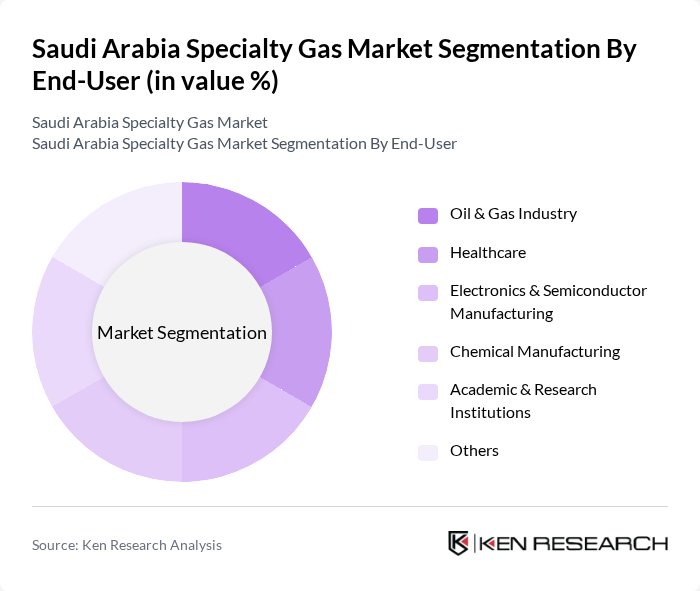

By End-User:The end-user segmentation includes industries such as Oil & Gas, Healthcare, Electronics & Semiconductor Manufacturing, Chemical Manufacturing, Academic & Research Institutions, and Others. TheOil & Gas industryis the largest consumer of specialty gases, driven by the need for enhanced oil recovery, refining, and petrochemical processes.Healthcareis a significant segment due to the demand for high-purity medical gases and diagnostics.Electronics & Semiconductor Manufacturingis rapidly growing, supported by investments in local electronics production and cleanroom technologies.Chemical ManufacturingandAcademic & Research Institutionsalso contribute to steady demand for specialty gases in analytical and process applications .

The Saudi Arabia Specialty Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Air Products and Chemicals, Inc., Linde plc, Air Liquide Arabia (ALAR), Gulf Cryo Saudi Arabia, National Industrialization Company (Tasnee), Abdullah Hashim Industrial Gases & Equipment Co. Ltd., Advanced Petrochemical Company, Saudi Basic Industries Corporation (SABIC), Saudi Specialty Chemicals Company, Al-Jubail Petrochemical Company (KEMYA), Saudi International Petrochemical Company (Sipchem), Methanol Chemicals Company (Chemanol), Arabian Industrial Gases Co. (AIGCO), Yanbu National Petrochemical Company (YANSAB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia specialty gas market appears promising, driven by ongoing government initiatives and increasing industrial demand. As the country continues to diversify its energy sources, investments in renewable gas solutions and infrastructure development are expected to gain momentum. Additionally, the digital transformation in gas management will enhance operational efficiency, allowing companies to optimize resource allocation and reduce costs. This evolving landscape presents significant opportunities for growth and innovation in the specialty gas sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultra-High Purity Gases Noble Gases Carbon Gases Halogen Gases Others |

| By End-User | Oil & Gas Industry Healthcare Electronics & Semiconductor Manufacturing Chemical Manufacturing Academic & Research Institutions Others |

| By Application | Manufacturing Processes Analytical & Calibration Refrigeration Medical & Diagnostic Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Consumption | 120 | Plant Managers, Operations Directors |

| Healthcare Sector Gas Usage | 100 | Medical Facility Administrators, Procurement Officers |

| Petrochemical Industry Insights | 120 | Process Engineers, Supply Chain Managers |

| Energy Sector Gas Applications | 80 | Energy Analysts, Project Managers |

| Research and Development in Specialty Gases | 70 | R&D Managers, Innovation Leads |

The Saudi Arabia Specialty Gas Market is valued at approximately USD 250 million, driven by increasing demand across various industries such as oil and gas, healthcare, and electronics, along with advancements in technology and industrialization.