Region:Europe

Author(s):Shubham

Product Code:KRAA2254

Pages:86

Published On:August 2025

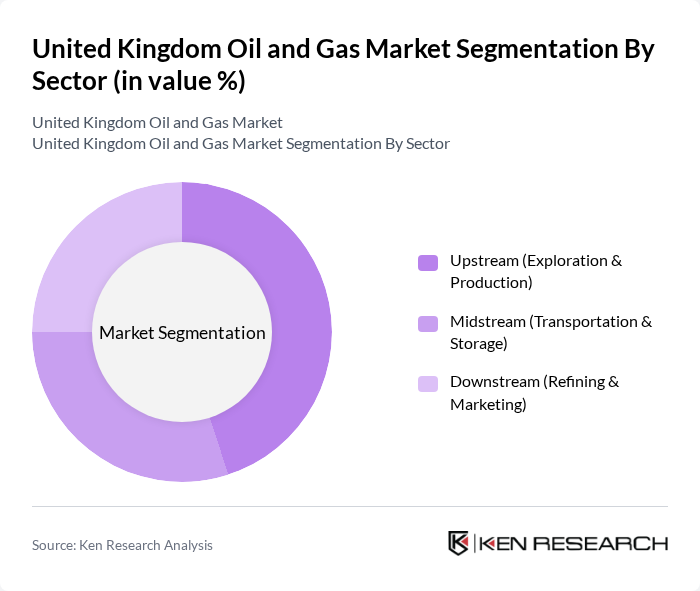

By Sector:The market is segmented into upstream (exploration & production), midstream (transportation & storage), and downstream (refining & marketing). The upstream sector focuses on resource extraction, including both offshore and onshore operations. Midstream encompasses the transportation and storage of oil and gas, leveraging the UK’s extensive pipeline and terminal infrastructure. Downstream involves refining crude oil and marketing petroleum products, serving both domestic and export markets.

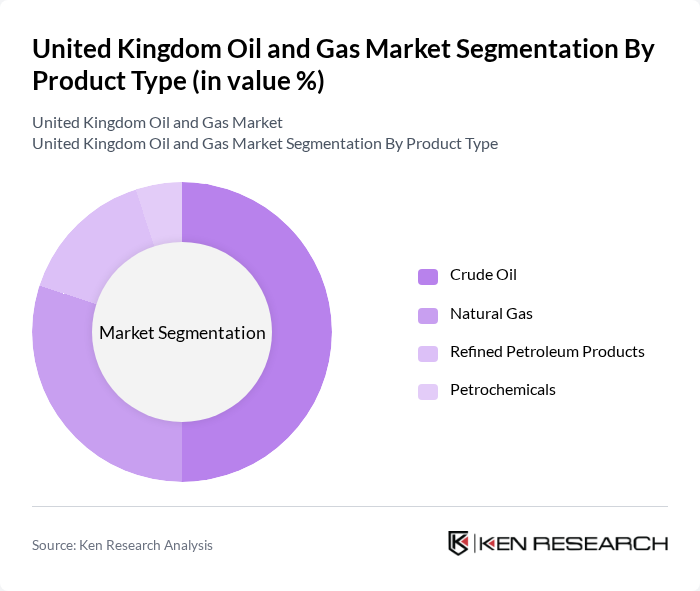

By Product Type:The market is also segmented by product type: crude oil, natural gas, refined petroleum products, and petrochemicals. Crude oil and natural gas remain the primary energy sources, with natural gas playing a critical role in heating and power generation. Refined petroleum products serve transportation and industrial needs, while petrochemicals support a range of manufacturing and chemical processes.

The United Kingdom Oil and Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as BP plc, Shell UK Ltd, TotalEnergies E&P UK Ltd, Harbour Energy plc, Equinor UK Limited, Centrica plc, Chevron North Sea Limited, Ithaca Energy plc, Serica Energy plc, Repsol Sinopec Resources UK Limited, CNOOC Petroleum Europe Limited, EnQuest PLC, Chrysaor Holdings Limited, Neptune Energy Group Limited, Cadent Gas Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK oil and gas market is poised for transformation, driven by a strong emphasis on decarbonization and technological innovation. As the government sets ambitious emission reduction targets, the industry is likely to pivot towards integrating renewable energy sources and enhancing operational efficiencies. Strategic partnerships between traditional oil and gas companies and renewable energy firms will become increasingly common, fostering a collaborative approach to energy production that aligns with sustainability goals while ensuring energy security.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Marketing) |

| By Product Type | Crude Oil Natural Gas Refined Petroleum Products Petrochemicals |

| By End-User Industry | Power Generation Transportation Industrial Residential & Commercial |

| By Application | Exploration Production Distribution & Transmission Refining |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Distribution Channel | Direct Sales Distributors Online Platforms |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Exploration | 60 | Geologists, Exploration Managers |

| Midstream Transportation and Storage | 50 | Logistics Coordinators, Operations Managers |

| Downstream Refining Operations | 40 | Refinery Managers, Process Engineers |

| Regulatory Compliance in Oil and Gas | 45 | Compliance Officers, Legal Advisors |

| Renewable Energy Integration | 35 | Sustainability Managers, Energy Analysts |

The United Kingdom Oil and Gas Market is valued at approximately USD 320 billion, reflecting a robust demand for energy in various sectors, including industrial and transportation, alongside a strong natural gas market for heating and power generation.