Region:Middle East

Author(s):Dev

Product Code:KRAA8175

Pages:89

Published On:November 2025

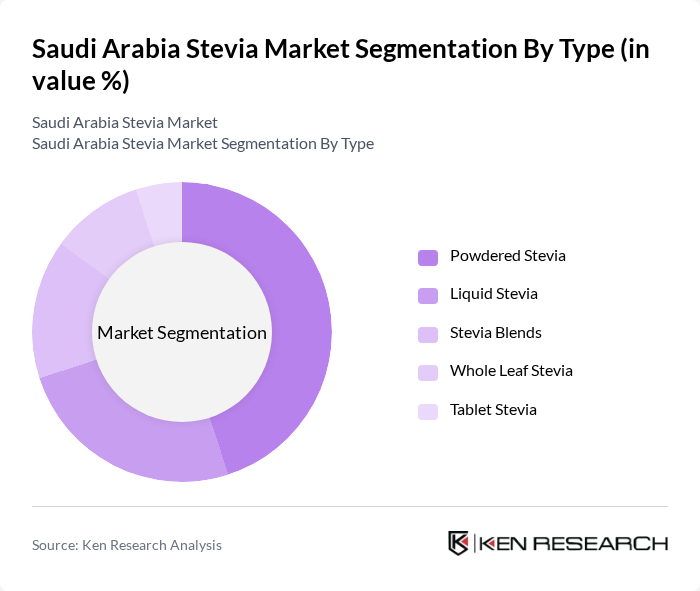

By Type:The market is segmented into various types of stevia products, including powdered stevia, liquid stevia, stevia blends, whole leaf stevia, and tablet stevia. Among these, powdered stevia remains the most popular due to its versatility and ease of use in baking, cooking, and packaged foods. Liquid stevia is experiencing rapid growth, particularly in the beverage industry, driven by its solubility and convenience for manufacturers reformulating drinks to meet sugar-reduction targets. The demand for stevia blends is increasing as manufacturers seek to combine stevia with other sweeteners to optimize taste and functionality in processed foods .

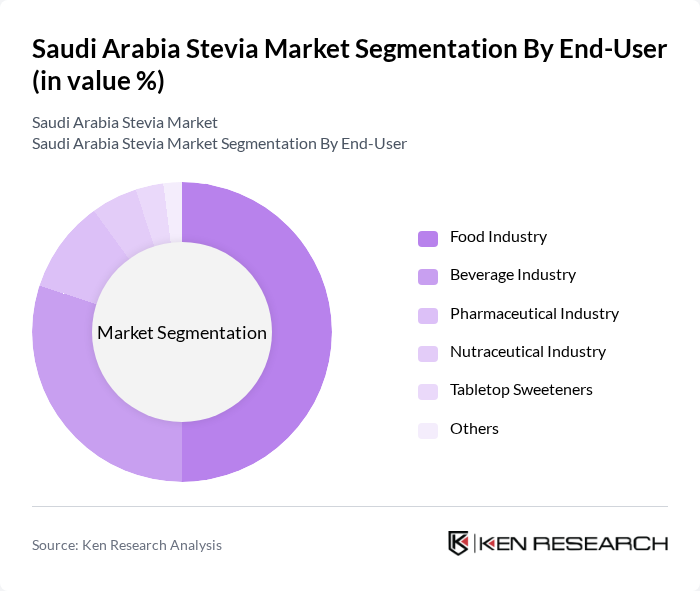

By End-User:The end-user segmentation includes the food industry, beverage industry, pharmaceutical industry, nutraceutical industry, tabletop sweeteners, and others. The food industry is the largest consumer of stevia, utilizing it in a wide range of products from baked goods to sauces, reflecting the strong demand for natural sugar alternatives in packaged and processed foods. The beverage industry follows closely, with many companies reformulating their drinks to include stevia in response to sugar taxation policies and consumer health campaigns. The pharmaceutical and nutraceutical industries are increasingly adopting stevia for its health benefits, particularly in products aimed at diabetic and weight-conscious consumers .

The Saudi Arabia Stevia Market is characterized by a dynamic mix of regional and international players. Leading participants such as PureCircle (a part of Ingredion Incorporated), Cargill, Incorporated, Tate & Lyle PLC, GLG Life Tech Corporation, Sunwin Stevia International, Inc., Sweet Green Fields (a part of Tate & Lyle), Ingredion Incorporated, Merisant Company (Whole Earth Brands), Stevia Corp, Biolotus Technology, Evolva Holding SA, The Coca-Cola Company, PepsiCo Inc., Herbalife Nutrition Ltd., Zydus Wellness Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia stevia market appears promising, driven by increasing health awareness and government initiatives supporting natural sweeteners. As consumer preferences shift towards healthier options, the demand for stevia is expected to rise. Innovations in product formulations and the expansion of e-commerce platforms will further enhance market accessibility. Additionally, collaborations between stevia producers and food manufacturers are likely to create new product lines, catering to the evolving tastes of health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Powdered Stevia Liquid Stevia Stevia Blends Whole Leaf Stevia Tablet Stevia |

| By End-User | Food Industry Beverage Industry Pharmaceutical Industry Nutraceutical Industry Tabletop Sweeteners Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Tenders Others |

| By Application | Beverages Dairy Products Bakery and Confectionery Tabletop Sweeteners Convenience Foods Pharmaceuticals Others |

| By Packaging Type | Bulk Packaging Retail Packaging Sachet Packaging Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Health Condition (e.g., Diabetic, Fitness-focused) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 60 | Product Development Managers, Quality Assurance Specialists |

| Health and Wellness Retailers | 45 | Store Managers, Nutritionists |

| Local Stevia Farmers | 40 | Farm Owners, Agricultural Consultants |

| Regulatory Bodies | 40 | Policy Makers, Food Safety Inspectors |

| Consumers of Natural Sweeteners | 80 | Health-Conscious Consumers, Dietitians |

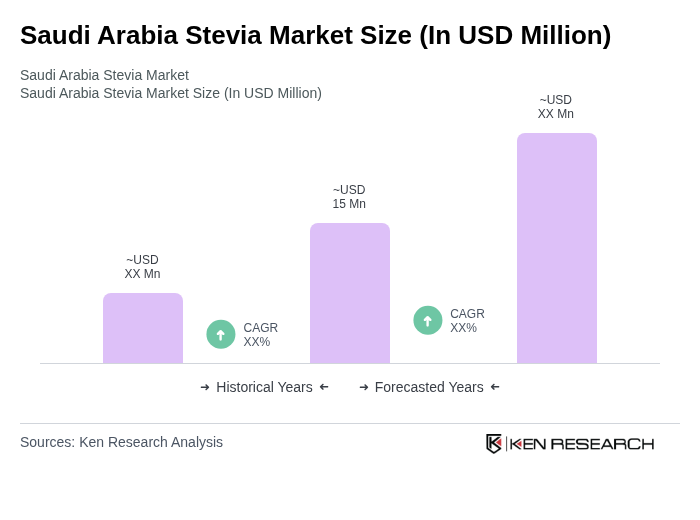

The Saudi Arabia Stevia Market is valued at approximately USD 15 million, reflecting a growing demand for natural sweeteners as consumers increasingly seek healthier alternatives to sugar, driven by rising health consciousness and government initiatives promoting sugar reduction.