Region:Middle East

Author(s):Rebecca

Product Code:KRAC0255

Pages:89

Published On:August 2025

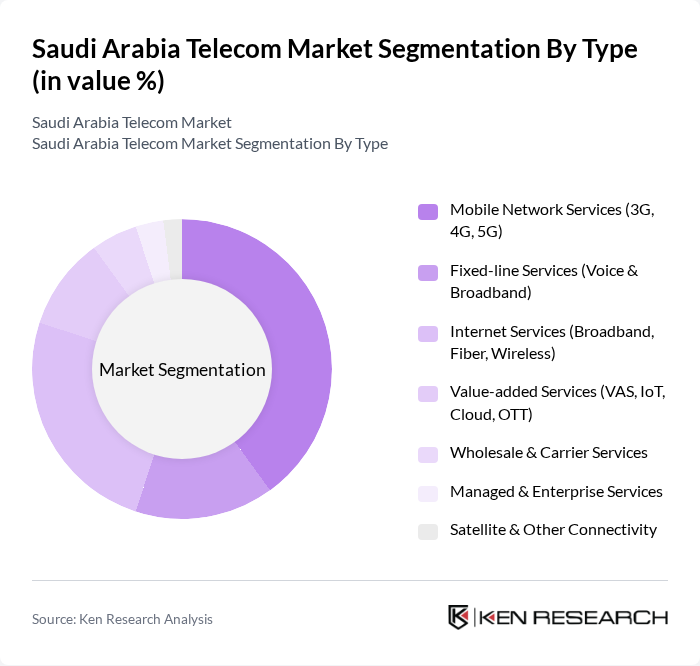

By Type:The segmentation by type includes a comprehensive range of services such as mobile network services (3G, 4G, 5G), fixed-line services (voice and broadband), internet services (broadband, fiber, wireless), value-added services (including IoT, cloud, and OTT), wholesale and carrier services, managed and enterprise services, and satellite and other connectivity options. Each subsegment addresses the evolving communication needs of both consumers and enterprises, with a particular emphasis on digital transformation, IoT integration, and cloud-based solutions .

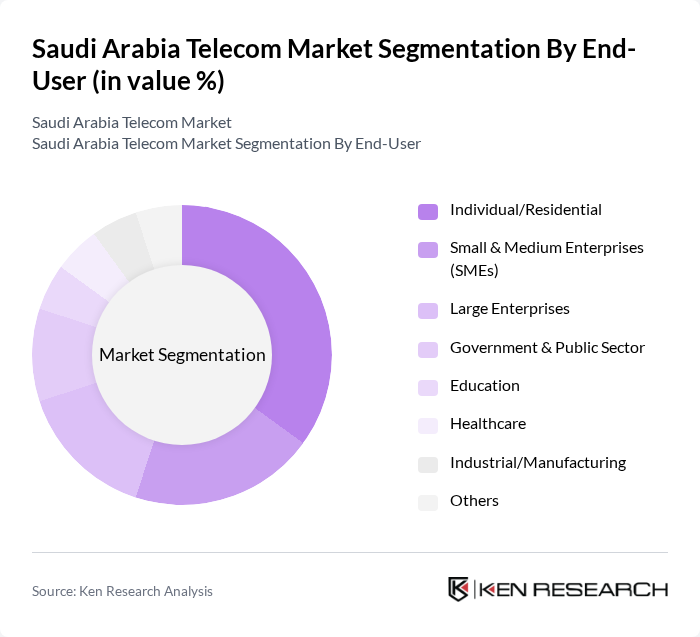

By End-User:The end-user segmentation encompasses individual/residential users, small and medium enterprises (SMEs), large enterprises, government and public sector, education, healthcare, industrial/manufacturing, and others. This segmentation reflects the diverse applications of telecom services, with a growing focus on digital government, smart education, telemedicine, and Industry 4.0 initiatives across Saudi Arabia .

The Saudi Arabia Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (stc), Etihad Etisalat Company (Mobily), Mobile Telecommunications Company Saudi Arabia (Zain KSA), Virgin Mobile Saudi Arabia, Integrated Telecom Company (ITC), Salam (formerly Atheeb Telecom), GO Telecom (Etihad Atheeb Telecommunications Company), Dawiyat Integrated Telecommunications & Information Technology Company, Bayanat Al Oula for Network Services, Saudi Networkers Services (SNS), stc Solutions, Huawei Tech Investment Saudi Arabia Co. Ltd., Ericsson Saudi Arabia, Cisco Saudi Arabia, Nokia Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia telecom market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The increasing integration of artificial intelligence and machine learning in operations is expected to enhance service delivery and operational efficiency. Additionally, the shift towards digital payment solutions and the rise of over-the-top (OTT) services will reshape the competitive landscape, compelling telecom operators to adapt their strategies to meet changing consumer demands and capitalize on emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Network Services (3G, 4G, 5G) Fixed-line Services (Voice & Broadband) Internet Services (Broadband, Fiber, Wireless) Value-added Services (VAS, IoT, Cloud, OTT) Wholesale & Carrier Services Managed & Enterprise Services Satellite & Other Connectivity |

| By End-User | Individual/Residential Small & Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education Healthcare Industrial/Manufacturing Others |

| By Service Model | Prepaid Postpaid Bundled/Converged Services Wholesale/Carrier Services Others |

| By Distribution Channel | Direct (Company-owned Stores, Online) Retail Partners & Franchises E-commerce/Online Platforms Third-party Distributors/Resellers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Penetration Pricing Value-based Pricing Others |

| By Customer Segment | Mass Market (Consumers) Business (SMEs & Large Enterprises) Government/Public Sector Others |

| By Technology Adoption | G LTE G Fiber Optic Satellite IoT/M2M Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-45, Urban Residents |

| Fixed-line Service Subscribers | 60 | Households, Small Business Owners |

| Broadband Internet Users | 80 | Tech-savvy Consumers, Remote Workers |

| Telecom Industry Experts | 40 | Regulatory Officials, Industry Analysts |

| Corporate Telecom Managers | 50 | IT Managers, Procurement Officers |

The Saudi Arabia Telecom Market is valued at approximately USD 18 billion, driven by increasing demand for mobile and internet services, a young population, and rapid urbanization. The market is expected to grow further, reaching USD 22.7 billion by 2033.