Region:Middle East

Author(s):Rebecca

Product Code:KRAD0326

Pages:81

Published On:August 2025

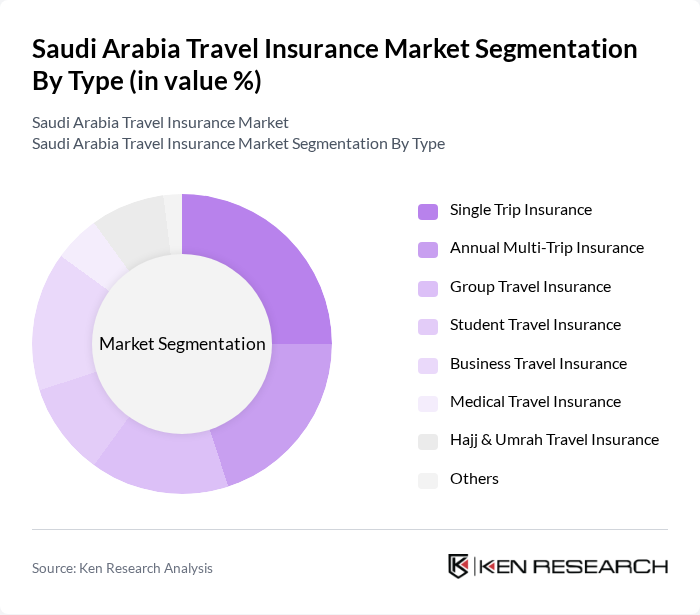

By Type:The travel insurance market can be segmented into various types, including Single Trip Insurance, Annual Multi-Trip Insurance, Group Travel Insurance, Student Travel Insurance, Business Travel Insurance, Medical Travel Insurance, Hajj & Umrah Travel Insurance, and Others. Each of these segments caters to different traveler needs and preferences, reflecting the diverse nature of travel in Saudi Arabia. Single Trip Insurance remains the most popular due to the high volume of short-term travel, especially for religious and business purposes. Hajj & Umrah Travel Insurance is a significant segment, driven by the large influx of pilgrims annually .

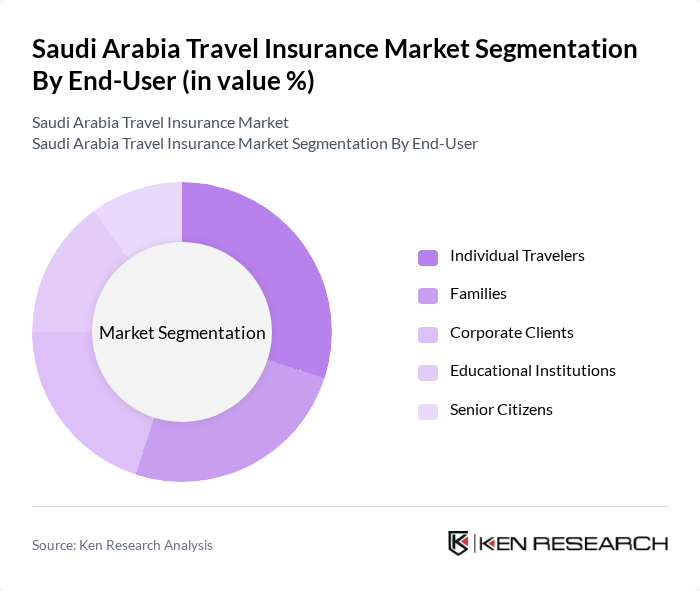

By End-User:The end-user segmentation includes Individual Travelers, Families, Corporate Clients, Educational Institutions, and Senior Citizens. Each group has unique travel insurance needs, influenced by factors such as travel frequency, purpose, and risk tolerance. Individual Travelers and Families constitute the largest segments, reflecting the growing trend of leisure and family travel, while Corporate Clients drive demand for tailored business travel insurance solutions .

The Saudi Arabia Travel Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya (The Company for Cooperative Insurance), Bupa Arabia for Cooperative Insurance, Allianz Saudi Fransi Cooperative Insurance Company, Gulf Insurance Group (GIG Saudi), Al Rajhi Takaful, Medgulf (The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company), Alinma Tokio Marine, United Cooperative Assurance Company (UCA), Walaa Cooperative Insurance Company, AXA Cooperative Insurance Company, Al Sagr Cooperative Insurance Company, Al-Etihad Cooperative Insurance Co., Malath Cooperative Insurance Co., Arabian Shield Cooperative Insurance Company, Salama Cooperative Insurance Company contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia travel insurance market is poised for significant growth, driven by increasing international travel and heightened awareness of travel risks. As the government continues to invest in tourism infrastructure, the demand for travel insurance is expected to rise. Additionally, advancements in technology will facilitate easier access to insurance products, enhancing customer experience. Providers that adapt to these trends and focus on comprehensive coverage will likely capture a larger share of the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Trip Insurance Annual Multi-Trip Insurance Group Travel Insurance Student Travel Insurance Business Travel Insurance Medical Travel Insurance Hajj & Umrah Travel Insurance Others |

| By End-User | Individual Travelers Families Corporate Clients Educational Institutions Senior Citizens |

| By Distribution Channel | Online Platforms (including OTAs) Travel Agencies Insurance Brokers & Intermediaries Direct Sales (Insurer Websites/Branches) |

| By Coverage Type | Medical Coverage Trip Cancellation & Interruption Coverage Lost Luggage & Personal Belongings Coverage Personal Liability Coverage Emergency Evacuation & Repatriation |

| By Duration | Short-Term Insurance Long-Term Insurance |

| By Age Group | Youth (18-30) Adults (31-50) Seniors (51 and above) |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies Others |

| By Region | Central Western Eastern Southern Northern |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Travel Insurance Providers | 60 | Product Managers, Underwriters |

| Travel Agencies | 50 | Agency Owners, Travel Consultants |

| Frequent Travelers | 100 | Business Travelers, Leisure Travelers |

| Tour Operators | 40 | Operations Managers, Sales Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Saudi Arabia Travel Insurance Market is valued at approximately USD 1.0 billion, reflecting significant growth driven by an increase in outbound travelers and rising awareness of travel risks among consumers.