Region:Middle East

Author(s):Rebecca

Product Code:KRAA9217

Pages:97

Published On:November 2025

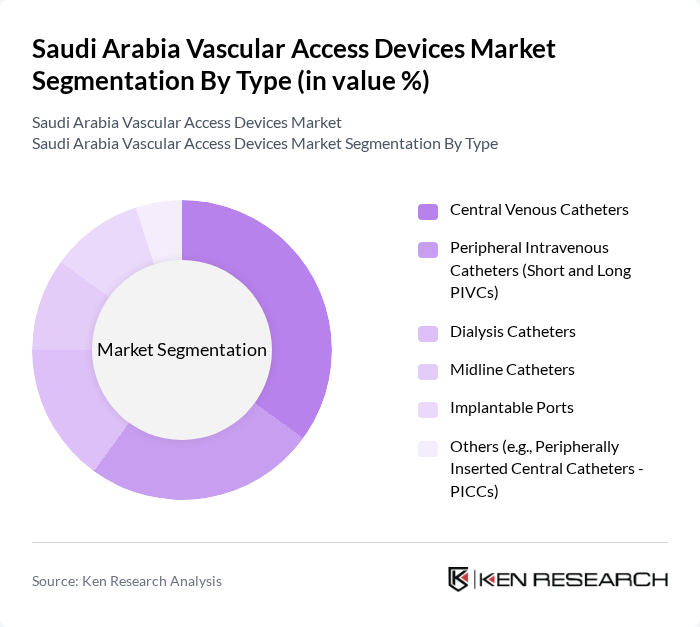

By Type:The vascular access devices market can be segmented into various types, including Central Venous Catheters, Peripheral Intravenous Catheters (Short and Long PIVCs), Dialysis Catheters, Midline Catheters, Implantable Ports, and Others (e.g., Peripherally Inserted Central Catheters - PICCs). Among these,Central Venous Cathetersare leading the market due to their extensive use in critical care settings and their ability to provide long-term access for patients requiring frequent medication administration or blood draws. Infection prevention, device durability, and ease of insertion are key factors driving adoption in Saudi Arabia.

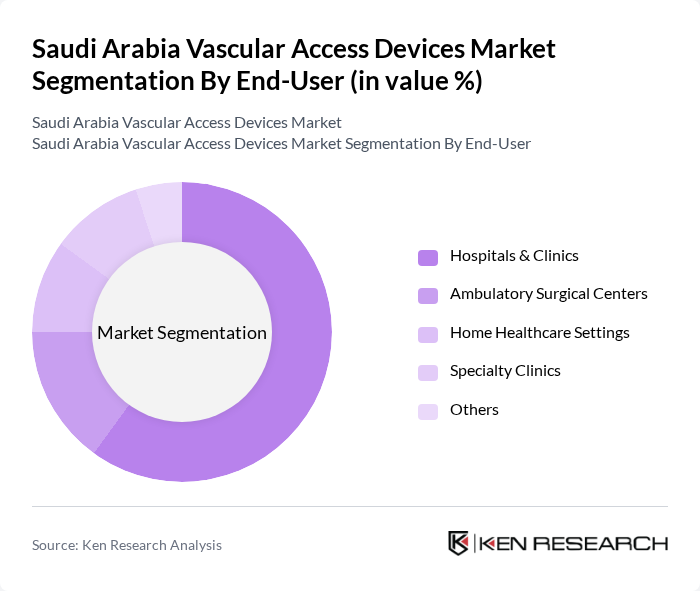

By End-User:The end-user segmentation includes Hospitals & Clinics, Ambulatory Surgical Centers, Home Healthcare Settings, Specialty Clinics, and Others.Hospitals & Clinicsdominate the market due to their high patient volume and the need for various vascular access procedures. The increasing number of surgical interventions, adoption of advanced vascular access technologies, and demand for critical care services in hospitals further drive the growth of this segment.

The Saudi Arabia Vascular Access Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, BD (Becton, Dickinson and Company), Medtronic plc, Teleflex Incorporated, Smiths Medical (now part of ICU Medical, Inc.), Terumo Corporation, Boston Scientific Corporation, Abbott Laboratories, Fresenius Kabi AG, AngioDynamics, Inc., Vygon S.A., Merit Medical Systems, Inc., Cook Medical Incorporated, Cardinal Health, Inc., Nipro Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vascular access devices market in Saudi Arabia appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare providers adopt more innovative solutions, the integration of digital health technologies will enhance patient monitoring and outcomes. Additionally, the expansion of outpatient care settings is expected to create new avenues for growth, allowing for more efficient use of vascular access devices in diverse healthcare environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Venous Catheters Peripheral Intravenous Catheters (Short and Long PIVCs) Dialysis Catheters Midline Catheters Implantable Ports Others (e.g., Peripherally Inserted Central Catheters - PICCs) |

| By End-User | Hospitals & Clinics Ambulatory Surgical Centers Home Healthcare Settings Specialty Clinics Others |

| By Application | Drug Administration Fluid and Nutrition Administration Blood Transfusion Diagnostics & Testing Chemotherapy Emergency Medicine Others |

| By Material | Silicone Polyurethane PVC Others |

| By Region | Riyadh Jeddah Dammam Khobar Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Model | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Directors |

| Clinical Usage in Vascular Surgery | 70 | Vascular Surgeons, Interventional Radiologists |

| Device Distribution Channels | 60 | Medical Device Distributors, Sales Representatives |

| Patient Care and Nursing Staff | 80 | Nurses, Clinical Coordinators |

| Regulatory and Compliance Insights | 40 | Regulatory Affairs Specialists, Quality Assurance Managers |

The Saudi Arabia Vascular Access Devices Market is valued at approximately USD 70 million, reflecting a five-year historical analysis. This market growth is driven by the increasing prevalence of chronic diseases and advancements in medical technology.