Region:Middle East

Author(s):Dev

Product Code:KRAD0369

Pages:89

Published On:August 2025

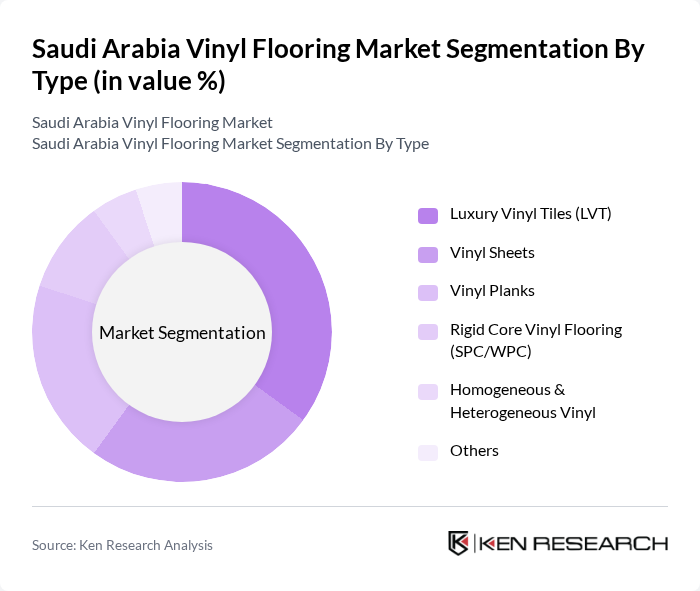

By Type:The market can be segmented into various types of vinyl flooring products, including Luxury Vinyl Tiles (LVT), Vinyl Sheets, Vinyl Planks, Rigid Core Vinyl Flooring (SPC/WPC), Homogeneous & Heterogeneous Vinyl, and Others. Each of these subsegments caters to different consumer preferences and applications.

The Luxury Vinyl Tiles (LVT) segment is currently dominating the market due to its aesthetic appeal, durability, and ease of installation. Consumers are increasingly opting for LVT as it mimics the look of natural materials like wood and stone while offering superior resistance to moisture and wear. This trend is particularly evident in residential renovations and commercial spaces where design flexibility is crucial. The growing preference for stylish yet practical flooring solutions is expected to sustain the demand for LVT in the coming years.

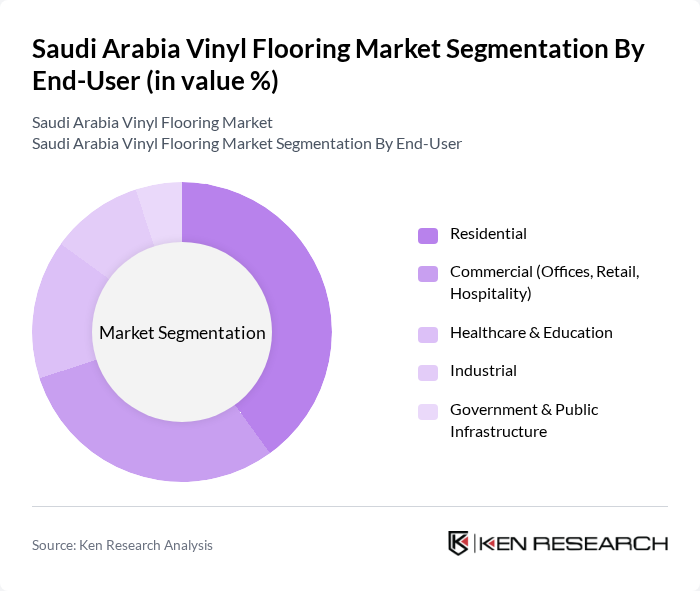

By End-User:The market can also be segmented based on end-users, which include Residential, Commercial (Offices, Retail, Hospitality), Healthcare & Education, Industrial, and Government & Public Infrastructure. Each segment has unique requirements and preferences for vinyl flooring products.

The Residential segment leads the market, driven by a surge in home renovations and new constructions. Homeowners are increasingly choosing vinyl flooring for its affordability, ease of maintenance, and variety of designs. Additionally, the rise in disposable income and changing lifestyle preferences are contributing to the growth of this segment. The Commercial sector follows closely, as businesses seek durable and attractive flooring options that can withstand high foot traffic while maintaining aesthetic appeal.

The Saudi Arabia Vinyl Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tarkett, Armstrong Flooring, Gerflor, Mohawk Industries, Shaw Industries, Forbo Flooring Systems, Beaulieu International Group, LG Hausys, Polyflor, Interface, Inc., Abdul Rahman Al Shareef Group, Al Sorayai Group, Al Sadoun Group, IVC Group, Karndean Designflooring contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian vinyl flooring market appears promising, driven by ongoing urbanization and infrastructure development. As the population is projected to reach 38 million by future, the demand for residential and commercial spaces will continue to rise. Additionally, the increasing focus on sustainable building practices will likely propel the adoption of eco-friendly vinyl flooring solutions, enhancing market growth. Companies that innovate and adapt to consumer preferences will be well-positioned to capitalize on these trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Vinyl Tiles (LVT) Vinyl Sheets Vinyl Planks Rigid Core Vinyl Flooring (SPC/WPC) Homogeneous & Heterogeneous Vinyl Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Healthcare & Education Industrial Government & Public Infrastructure |

| By Application | Flooring for Homes Flooring for Offices Flooring for Retail Spaces Flooring for Healthcare Facilities Flooring for Educational Institutions Flooring for Industrial Facilities |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Dealers |

| By Price Range | Economy Mid-Range Premium |

| By Design | Wood Look Stone/Marble Look Abstract Patterns Custom Designs |

| By Installation Type | Glue-Down Click-Lock (Floating) Loose Lay Self-Adhesive Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Vinyl Flooring Market | 120 | Homeowners, Interior Designers |

| Commercial Flooring Solutions | 90 | Facility Managers, Architects |

| Industrial Flooring Applications | 60 | Procurement Managers, Operations Managers |

| Retail Sector Vinyl Flooring | 50 | Store Managers, Retail Designers |

| Vinyl Flooring Installation Services | 40 | Contractors, Installation Supervisors |

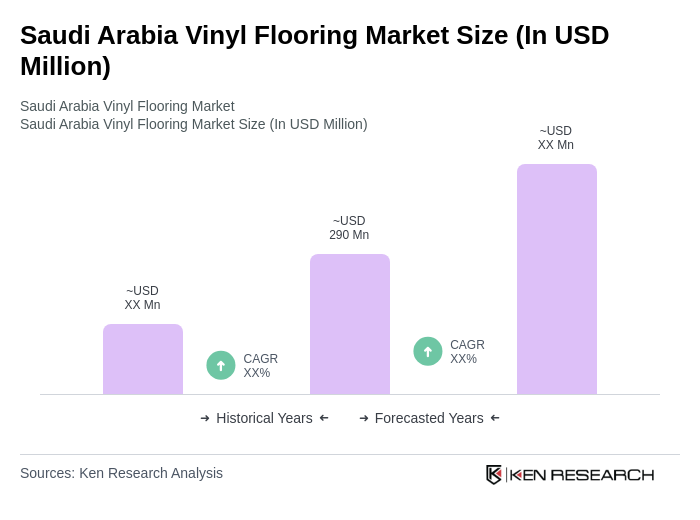

The Saudi Arabia Vinyl Flooring Market is valued at approximately USD 290 million, reflecting a significant growth trend driven by increasing demand for durable and cost-effective flooring solutions in both residential and commercial sectors.