Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7164

Pages:91

Published On:December 2025

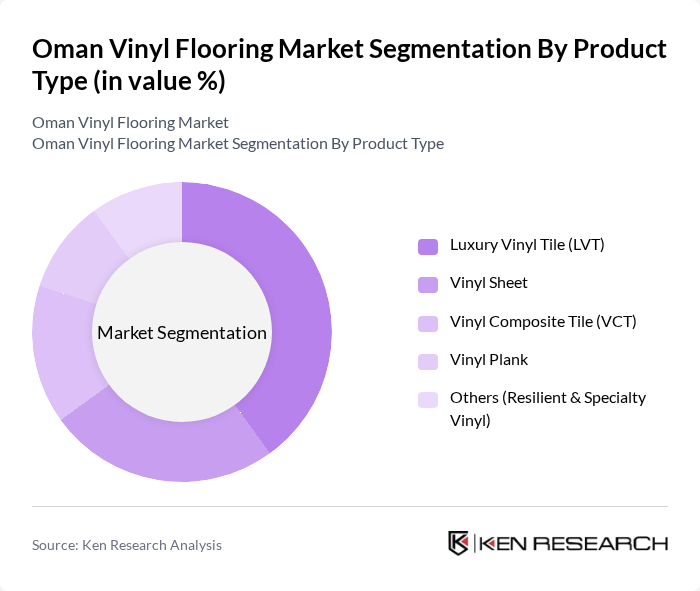

By Product Type:The product type segmentation includes Luxury Vinyl Tile (LVT), Vinyl Sheet, Vinyl Composite Tile (VCT), Vinyl Plank, and Others (Resilient & Specialty Vinyl). Among these, Luxury Vinyl Tile (LVT) is the leading sub-segment due to its aesthetic appeal, durability, and ease of installation, making it a preferred choice for both residential and commercial applications. The trend towards high-quality, visually appealing flooring solutions has significantly boosted the demand for LVT in recent years.

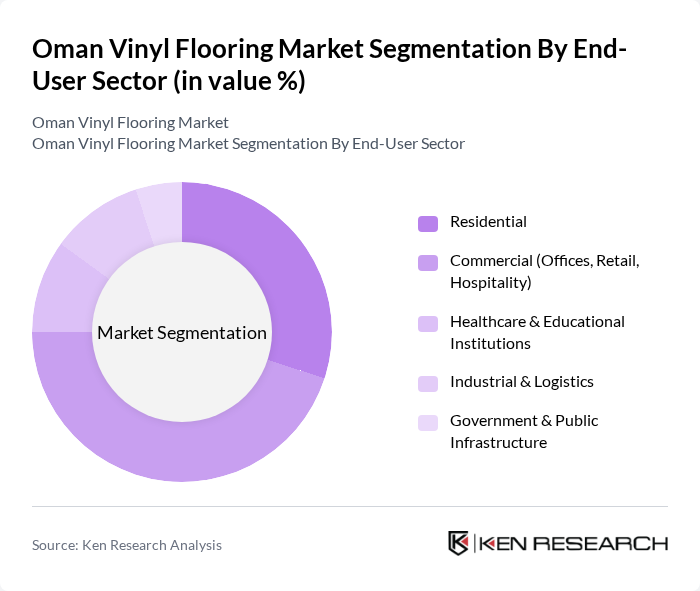

By End-User Sector:The end-user sector segmentation includes Residential, Commercial (Offices, Retail, Hospitality), Healthcare & Educational Institutions, Industrial & Logistics, and Government & Public Infrastructure. The Commercial sector is the dominant segment, driven by the rapid growth of the retail and hospitality industries in Oman. The increasing number of hotels, restaurants, and office spaces has led to a higher demand for durable and aesthetically pleasing flooring solutions, making it a key driver in the market.

The Oman Vinyl Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tarkett S.A., Gerflor Group, Forbo Flooring Systems (Forbo Holding AG), Polyflor Ltd (Altro Group), LG Hausys (LX Hausys, Ltd.), Karndean Designflooring, Armstrong Flooring, Inc. (Brand Assets under AHF Products), Beaulieu International Group, Shaw Industries Group, Inc. (Berkshire Hathaway), Interface, Inc., IVC Group (Mohawk Industries), Mapei S.p.A. (Flooring Adhesives & Installation Systems), Dutco Tennant LLC (Regional Distributor), Red Magma General Trading LLC, Key Omani & GCC Distributors (e.g., Al Sorayai Group, Regional Vinyl Importers) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman vinyl flooring market is poised for significant transformation, driven by evolving consumer preferences and regulatory frameworks. As sustainability becomes a priority, manufacturers are likely to focus on developing eco-friendly products that comply with emerging environmental standards. Additionally, the growth of e-commerce platforms is expected to enhance product accessibility, allowing consumers to explore a wider range of options. This shift will likely foster innovation in design and customization, further stimulating market growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Luxury Vinyl Tile (LVT) Vinyl Sheet Vinyl Composite Tile (VCT) Vinyl Plank Others (Resilient & Specialty Vinyl) |

| By End-User Sector | Residential Commercial (Offices, Retail, Hospitality) Healthcare & Educational Institutions Industrial & Logistics Government & Public Infrastructure |

| By Application | New Construction Renovation & Refurbishment Fit-out for Leasing & Tenant Improvements Facility Upgrades for Compliance & Standards Others |

| By Design & Aesthetics | Wood-look Vinyl Stone & Ceramic-look Vinyl Abstract & Geometric Patterns Custom & Branded Designs Others |

| By Thickness / Wear Layer | ?2 mm (Light-duty) >2 mm to 4 mm (Medium-duty) >4 mm (Heavy-duty & Rigid Core) Others |

| By Installation Method | Glue-down Click-lock / Floating Loose-lay Others (Self-adhesive, Hybrid) |

| By Region | Muscat Salalah Sohar Nizwa Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Vinyl Flooring Market | 120 | Homeowners, Interior Designers |

| Commercial Flooring Solutions | 100 | Facility Managers, Architects |

| Industrial Applications of Vinyl Flooring | 80 | Procurement Managers, Operations Directors |

| Retail Sector Insights | 70 | Store Managers, Merchandising Heads |

| Construction and Renovation Projects | 90 | Contractors, Project Managers |

The Oman Vinyl Flooring Market is valued at approximately USD 145 million, reflecting a robust growth trend driven by urbanization, rising disposable incomes, and the demand for durable flooring solutions in both residential and commercial sectors.