Region:Global

Author(s):Rebecca

Product Code:KRAD2761

Pages:89

Published On:November 2025

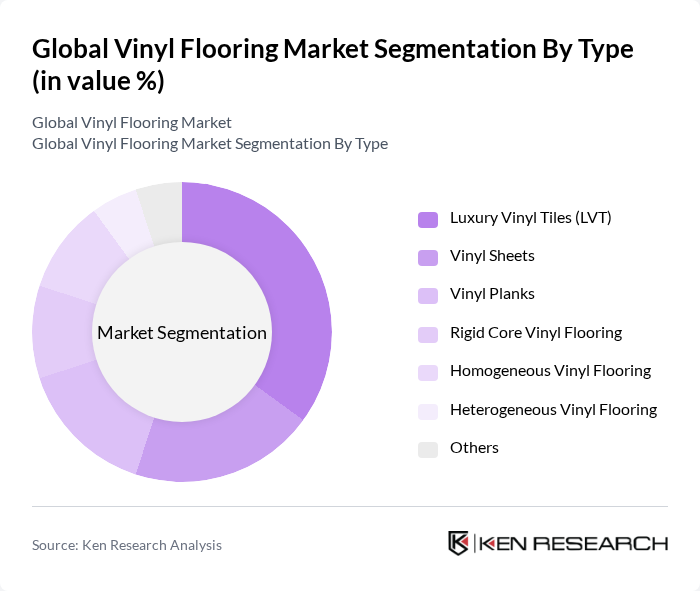

By Type:The vinyl flooring market is segmented into various types, including Luxury Vinyl Tiles (LVT), Vinyl Sheets, Vinyl Planks, Rigid Core Vinyl Flooring, Homogeneous Vinyl Flooring, Heterogeneous Vinyl Flooring, and Others. Among these, Luxury Vinyl Tiles (LVT) have gained significant traction due to their versatility, high aesthetic appeal, and ability to realistically replicate wood, stone, and tile finishes. LVT is increasingly favored for both residential and commercial applications, supported by technological advancements such as digital printing and improved wear layers .

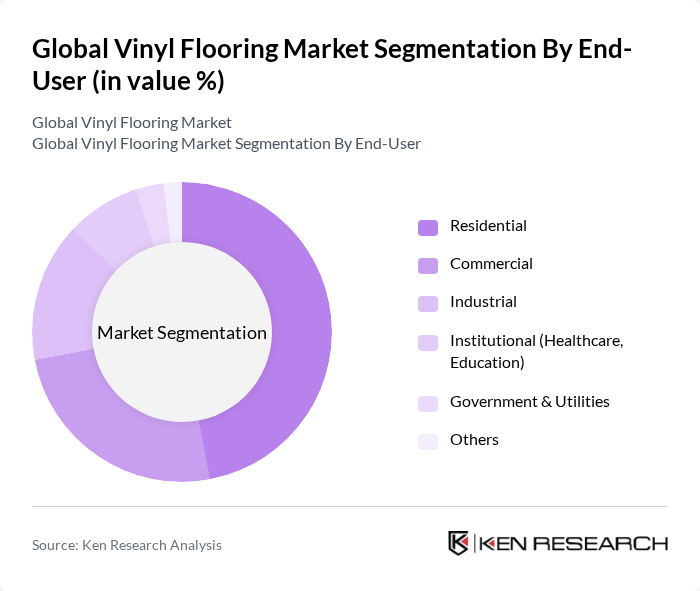

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Institutional (Healthcare, Education), Government & Utilities, and Others. The residential segment is currently leading the market, driven by increasing home renovation activities, a growing trend towards stylish yet affordable flooring solutions, and the popularity of DIY-friendly installation. The commercial segment is also expanding, supported by demand from offices, hospitality, and retail spaces seeking durable and easy-to-maintain flooring .

The Global Vinyl Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Shaw Industries Group, Inc., Armstrong Flooring, Inc., Tarkett S.A., Gerflor Group, Forbo Flooring Systems, Mannington Mills, Inc., Beaulieu International Group, IVC Group, LG Hausys (now LX Hausys), Polyflor Ltd., Daltile (a division of Mohawk Industries), Karndean Designflooring, Raskin Industries, AHF Products, Interface, Inc., Milliken & Company, Novalis Innovative Flooring, Congoleum Corporation, and CFL Flooring contribute to innovation, geographic expansion, and service delivery in this space .

The future of the vinyl flooring market appears promising, driven by ongoing innovations and a growing emphasis on sustainability. As consumer preferences evolve, manufacturers are likely to focus on developing eco-friendly products and enhancing design versatility. Additionally, the integration of smart technology into flooring solutions is expected to gain traction, appealing to tech-savvy consumers. The market is poised for growth as it adapts to these trends, ensuring a competitive edge in the evolving flooring landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Vinyl Tiles (LVT) Vinyl Sheets Vinyl Planks Rigid Core Vinyl Flooring Homogeneous Vinyl Flooring Heterogeneous Vinyl Flooring Others |

| By End-User | Residential Commercial Industrial Institutional (Healthcare, Education) Government & Utilities Others |

| By Application | New Construction Renovation DIY Projects Healthcare Facilities Retail Spaces Others |

| By Thickness | Below 2 mm mm to 4 mm Above 4 mm Others |

| By Texture | Smooth Textured Embossed Printed/Patterned Others |

| By Color | Light Colors Dark Colors Natural Wood Finishes Stone & Tile Finishes Others |

| By Installation Method | Glue-Down Click-Lock Loose Lay Peel & Stick Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Vinyl Flooring Installations | 100 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 60 | Facility Managers, Architects |

| Retail Sector Vinyl Sales | 50 | Store Managers, Sales Representatives |

| Construction and Renovation Insights | 40 | Contractors, Builders |

| Vinyl Flooring Product Development | 40 | Product Development Managers, R&D Specialists |

The Global Vinyl Flooring Market is valued at approximately USD 55 billion, reflecting significant growth driven by increasing demand for durable and aesthetically pleasing flooring solutions in both residential and commercial sectors.