Region:Middle East

Author(s):Shubham

Product Code:KRAE0362

Pages:86

Published On:December 2025

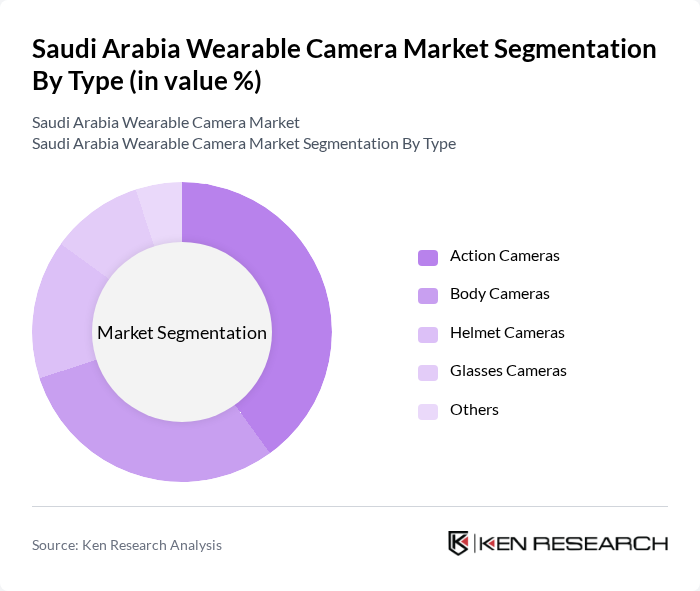

By Type:The wearable camera market is segmented into various types, including action cameras, body cameras, helmet cameras, glasses cameras, and others. Among these, action cameras are particularly popular due to their versatility and high-quality video capabilities, appealing to both amateur and professional users. Body cameras are gaining traction in law enforcement and security sectors, driven by the need for accountability and transparency. The demand for helmet and glasses cameras is also rising, especially in sports and adventure activities, where hands-free operation is essential.

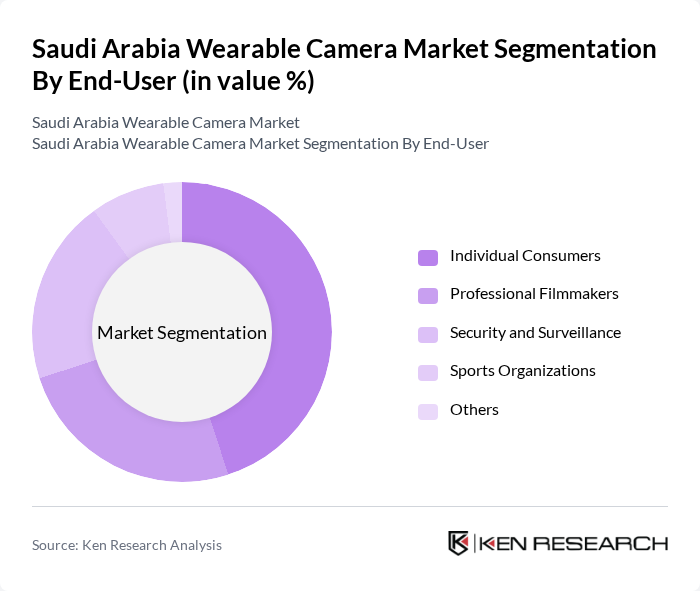

By End-User:The end-user segmentation includes individual consumers, professional filmmakers, security and surveillance, sports organizations, and others. Individual consumers dominate the market, driven by the popularity of action sports and vlogging. Professional filmmakers utilize high-end wearable cameras for their projects, while security and surveillance sectors increasingly adopt body cameras for enhanced safety and accountability. Sports organizations leverage wearable cameras for training and performance analysis, contributing to the overall growth of the market.

The Saudi Arabia Wearable Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as GoPro Inc., Sony Corporation, Garmin Ltd., DJI Technology Co., Ltd., Insta360, Olympus Corporation, Panasonic Corporation, Yi Technology, Vuze XR, Kodak, Ricoh Company, Ltd., Veho, SJCAM, Akaso, AEE Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable camera market in Saudi Arabia appears promising, driven by the increasing integration of advanced technologies and the growing interest in outdoor activities. As the government continues to promote tourism and adventure sports, the demand for innovative camera solutions is likely to rise. Additionally, the trend towards eco-friendly products may lead to the development of sustainable wearable cameras, appealing to environmentally conscious consumers and enhancing market viability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Action Cameras Body Cameras Helmet Cameras Glasses Cameras Others |

| By End-User | Individual Consumers Professional Filmmakers Security and Surveillance Sports Organizations Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Feature | Video Quality Battery Life Connectivity Options Durability Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Recreational Use Professional Use Educational Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Representatives |

| Professional Users in Security | 75 | Security Personnel, Operations Managers |

| Tourism and Adventure Sports | 80 | Tour Guides, Adventure Sports Instructors |

| Technology Enthusiasts | 90 | Gadget Reviewers, Tech Bloggers |

| Healthcare Professionals | 60 | Medical Staff, Health Tech Innovators |

The Saudi Arabia Wearable Camera Market is valued at approximately USD 195 million, reflecting a five-year historical analysis. This growth is attributed to increasing demand across various sectors, including law enforcement, consumer wearables, and sports.