Region:Middle East

Author(s):Rebecca

Product Code:KRAD4305

Pages:98

Published On:December 2025

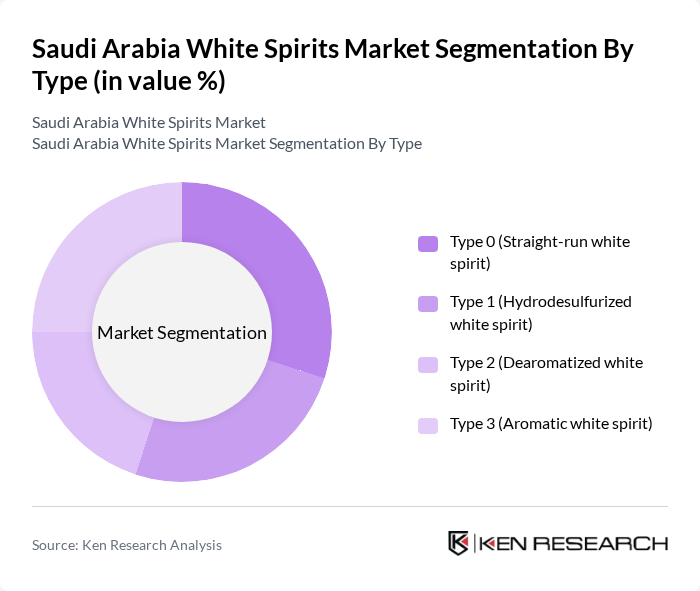

By Type:The market is segmented into four types of white spirits: Type 0 (Straight-run white spirit), Type 1 (Hydrodesulfurized white spirit), Type 2 (Dearomatized white spirit), and Type 3 (Aromatic white spirit). Each type serves different industrial applications, with varying levels of purity and aromatic content. Type 0 is commonly used in general applications, while Type 1 is preferred for its lower sulfur content, making it suitable for more sensitive uses. Type 2 is favored in applications requiring minimal odor, and Type 3 is utilized where aromatic properties are desired.

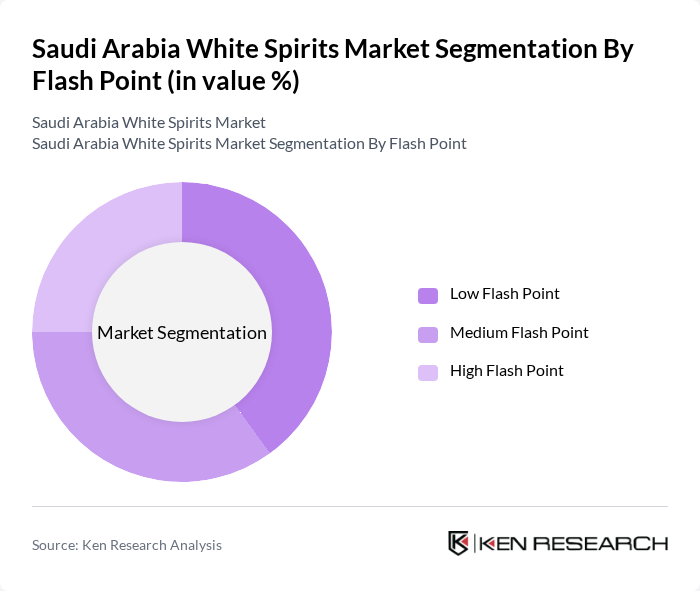

By Flash Point:The segmentation by flash point includes Low Flash Point, Medium Flash Point, and High Flash Point white spirits. Low Flash Point spirits are typically used in applications requiring quick evaporation, while Medium Flash Point spirits are versatile for various industrial uses. High Flash Point spirits are preferred in applications where safety and reduced flammability are critical, such as in certain manufacturing processes.

The Saudi Arabia White Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Saudi Basic Industries Corporation (SABIC), Saudi Aramco Total Refining and Petrochemical Company (SATORP), Rabigh Refining & Petrochemical Company (Petro Rabigh), Saudi Chevron Phillips Company, Tasnee (National Industrialization Company), Sahara International Petrochemical Company (Sipchem), Saudi International Petrochemical Company – Local Solvents Units, National Petrochemical Industrial Company, Yanbu National Petrochemical Company (Yansab), Jubail United Petrochemical Company, Saudi Kayan Petrochemical Company, Advanced Petrochemical Company, Saudi Top Plastic Factory (Solvents and Chemicals Division), Key Regional Importers and Distributors of White Spirits in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia white spirits market appears promising, driven by evolving consumer preferences and a burgeoning hospitality sector. As the government continues to promote tourism, the demand for premium spirits is expected to rise, particularly in urban areas. Additionally, the increasing acceptance of alcohol in social settings may further enhance market dynamics. Brands that focus on innovative product offerings and sustainable practices are likely to capture a larger share of the market, positioning themselves favorably for future growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Type 0 (Straight-run white spirit) Type 1 (Hydrodesulfurized white spirit) Type 2 (Dearomatized white spirit) Type 3 (Aromatic white spirit) |

| By Flash Point | Low Flash Point Medium Flash Point High Flash Point |

| By Application | Paint Thinner and Solvent Cleaning and Degreasing Agent Fuels and Heating Other Industrial Uses |

| By End-Use Industry | Paints and Coatings Construction and Infrastructure Automotive and Transportation Industrial and Manufacturing Household and Institutional Cleaning |

| By Distribution Channel | Direct Sales (B2B) Chemical Distributors Retail and Wholesale Outlets Online and E-Procurement Platforms |

| By Compliance / Grade | Low-Aromatic / Low-VOC Grades Standard Industrial Grades Premium High-Purity Grades |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for White Spirits | 140 | Regular Consumers, Occasional Drinkers |

| Retail Distribution Channels | 110 | Retail Managers, Store Owners |

| Hospitality Sector Insights | 90 | Bar Managers, Restaurant Owners |

| Market Trends and Innovations | 75 | Industry Analysts, Beverage Consultants |

| Regulatory Impact Assessment | 65 | Legal Advisors, Compliance Officers |

The Saudi Arabia White Spirits Market is valued at approximately USD 1.2 billion, reflecting a steady growth driven by increasing demand for solvents in various industries, including paints, coatings, and cleaning products.