Region:Asia

Author(s):Shubham

Product Code:KRAC0742

Pages:91

Published On:August 2025

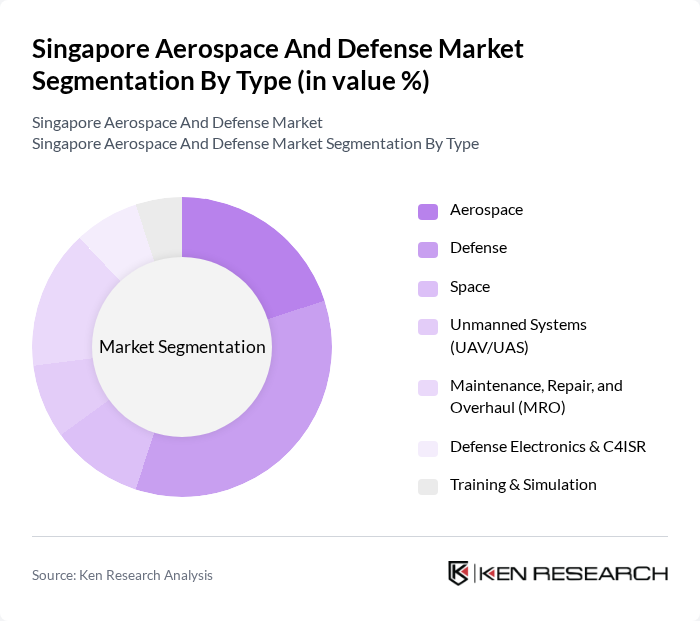

By Type:The market is segmented into various types, including Aerospace, Defense, Space, Unmanned Systems (UAV/UAS), Maintenance, Repair, and Overhaul (MRO), Defense Electronics & C4ISR, and Training & Simulation. Among these, the Defense segment is currently the most dominant due to heightened security concerns and increased military spending. The demand for advanced defense systems and technologies has surged, driven by geopolitical tensions and the need for enhanced national security. The Aerospace segment also plays a significant role, supported by the growth of commercial aviation and the increasing need for MRO services.

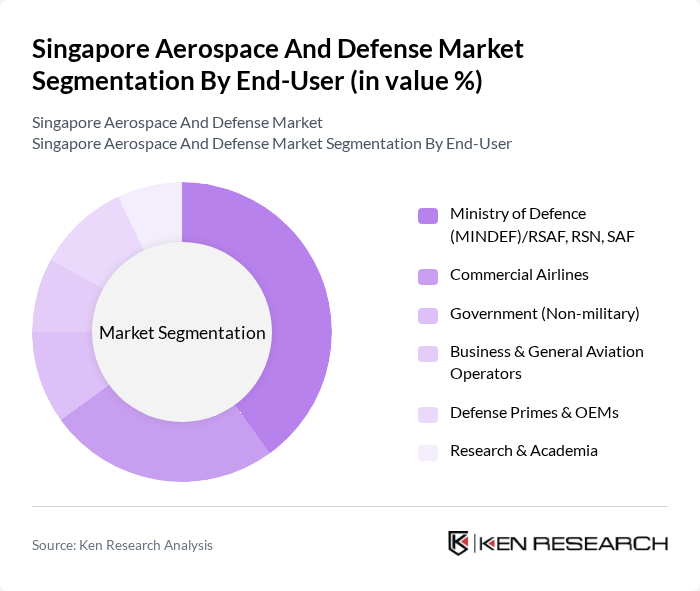

By End-User:The end-user segmentation includes the Ministry of Defence (MINDEF)/Republic of Singapore Armed Forces (RSAF, RSN, SAF), Commercial Airlines (e.g., Singapore Airlines, Scoot, Jetstar Asia), Government (Non-military: CAAS, MHA, HTX, SCDF, SPF), Business & General Aviation Operators, Defense Primes & OEMs Operating in Singapore, and Research & Academia (NUS, NTU, A*STAR, SIAEC Academy). The Ministry of Defence is the leading end-user, driven by the need for advanced military capabilities and modernization of defense systems. Commercial airlines also contribute significantly, particularly in the MRO segment, as they seek to enhance operational efficiency and safety.

The Singapore Aerospace And Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as ST Engineering Ltd. (Singapore Technologies Engineering), Singapore Airlines Engineering Company (SIAEC), Rolls?Royce Singapore Pte. Ltd., Pratt & Whitney Singapore (Pratt & Whitney Component Solutions/Engine Center), Safran Aircraft Engines Asia Pte. Ltd., GE Aerospace Singapore (GE Engine Services Singapore), Airbus Singapore Pte. Ltd. (Airbus Asia Training Centre/Airbus Helicopters SEA), Boeing Asia Pacific Aviation Services (BAPAS), Thales Solutions Asia Pte. Ltd., Honeywell Aerospace (Honeywell Aerospace Asia Pacific Pte. Ltd.), Collins Aerospace Singapore (Raytheon Technologies), Lockheed Martin Global, Inc. – Singapore, Israel Aerospace Industries (IAI) – Bedek/Passenger-to-Freighter Partnerships in SG, Elbit Systems – Singapore, Leonardo S.p.A. (Leonardo Singapore) contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore aerospace and defense market is poised for significant growth, driven by increased defense spending and technological advancements. As the government prioritizes modernization and innovation, local firms are expected to enhance their capabilities, particularly in areas like cybersecurity and sustainable aviation. Additionally, the rising demand for commercial aviation will further stimulate the market, creating opportunities for collaboration and investment. Overall, the sector is likely to evolve rapidly, adapting to emerging trends and global challenges while maintaining its competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Aerospace Defense Space Unmanned Systems (UAV/UAS) Maintenance, Repair, and Overhaul (MRO) Defense Electronics & C4ISR Training & Simulation |

| By End-User | Ministry of Defence (MINDEF)/Republic of Singapore Armed Forces (RSAF, RSN, SAF) Commercial Airlines (e.g., Singapore Airlines, Scoot, Jetstar Asia) Government (Non?military: CAAS, MHA, HTX, SCDF, SPF) Business & General Aviation Operators Defense Primes & OEMs Operating in Singapore Research & Academia (NUS, NTU, A*STAR, SIAEC Academy) |

| By Application | Military Air, Land, and Naval Operations Commercial Air Transport MRO & Fleet Sustainment Intelligence, Surveillance, and Reconnaissance (ISR) Air Mobility & Cargo Space-based Services (Satcom, Earth Observation) Cybersecurity & Electronic Warfare |

| By Component | Engines & Engine MRO Airframes & Structures Avionics & Mission Systems Landing Gear & Aerostructure Components Propulsion Systems & APU Materials & Additive Manufacturing Ground Support Equipment |

| By Sales Channel | Direct OEM/Prime Contracts Tier-1/Tier-2 Suppliers & Partnerships Government-to-Government (e.g., FMS) Public Procurement & Tenders Distributors & Independent MRO Networks |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants (EDB, EnterpriseSG, RIE2025) Venture & Corporate Venture Capital |

| By Policy Support | Tax Incentives (Pioneer/Development and Expansion Incentive) R&D Grants (A*STAR, NRF, EDB) Aeronautical & Aviation Regulations (CAAS, SORA for drones) Defense Export Controls & Security Clearances Sustainability Programs (SAF decarbonization, SAF fuel initiatives) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aviation Sector | 100 | Airline Executives, Fleet Managers |

| Military Procurement | 80 | Defense Acquisition Officers, Program Managers |

| Aerospace Technology Development | 70 | R&D Directors, Innovation Managers |

| Defense Contracting Firms | 90 | Business Development Managers, Contract Officers |

| Regulatory Bodies and Associations | 60 | Policy Makers, Industry Analysts |

The Singapore Aerospace and Defense Market is valued at approximately USD 9 billion, reflecting a robust growth trajectory driven by increased defense budgets, technological advancements, and a strong focus on research and development within the sector.