Region:North America

Author(s):Rebecca

Product Code:KRAA1468

Pages:82

Published On:August 2025

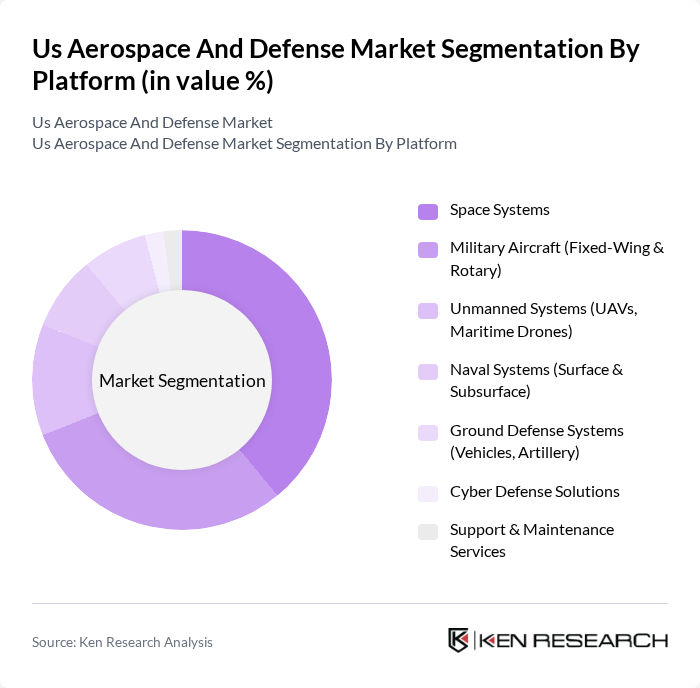

By Platform:The platform segmentation of the market includes Space Systems, Military Aircraft (Fixed-Wing & Rotary), Unmanned Systems (UAVs, Maritime Drones), Naval Systems (Surface & Subsurface), Ground Defense Systems (Vehicles, Artillery), Cyber Defense Solutions, and Support & Maintenance Services. Among these, Space Systems have emerged as the leading segment, driven by substantial government investment and the growing importance of satellite and space-based defense capabilities. Military Aircraft, particularly fixed-wing and rotary, remain critical due to ongoing modernization programs and the integration of advanced avionics and multi-role functionalities. Unmanned Systems and Cyber Defense Solutions are experiencing rapid growth, reflecting the sector's focus on autonomy, digitalization, and resilience .

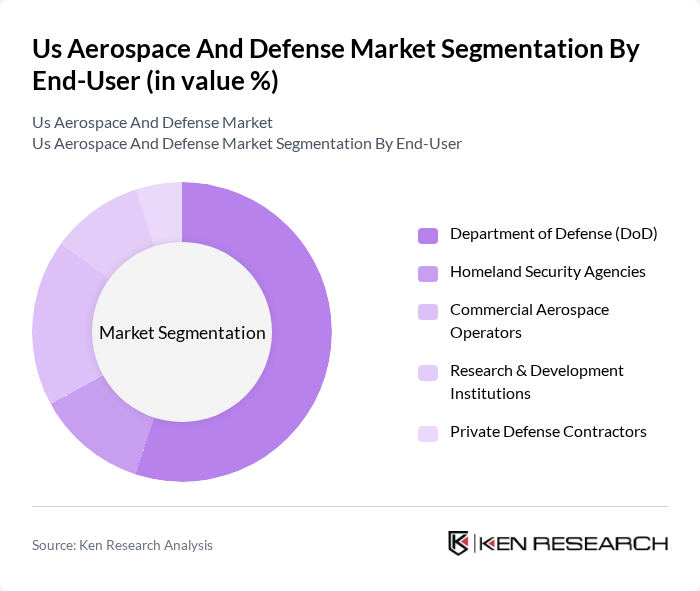

By End-User:The end-user segmentation includes the Department of Defense (DoD), Homeland Security Agencies, Commercial Aerospace Operators, Research & Development Institutions, and Private Defense Contractors. The Department of Defense is the leading end-user, accounting for the majority of the market due to its extensive procurement of advanced military systems and technologies. The growing emphasis on national security, modernization, and readiness continues to drive demand for innovative solutions tailored to military and homeland security needs .

The Us Aerospace And Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, The Boeing Company, Northrop Grumman Corporation, RTX Corporation (formerly Raytheon Technologies), General Dynamics Corporation, BAE Systems plc, L3Harris Technologies, Inc., Leidos Holdings, Inc., Textron Inc., Huntington Ingalls Industries, Inc., Space Exploration Technologies Corp. (SpaceX), Palantir Technologies Inc., Leonardo S.p.A., Elbit Systems Ltd., Sierra Nevada Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. aerospace and defense market is poised for significant transformation driven by technological advancements and increased defense spending. As nations prioritize modernization, the demand for innovative military solutions will rise. Companies are expected to focus on integrating AI and automation into their systems, enhancing operational efficiency. Additionally, the expansion of partnerships with private sector firms will facilitate the development of cutting-edge technologies, ensuring that the U.S. remains at the forefront of global defense capabilities while addressing emerging threats effectively.

| Segment | Sub-Segments |

|---|---|

| By Platform | Space Systems Military Aircraft (Fixed-Wing & Rotary) Unmanned Systems (UAVs, Maritime Drones) Naval Systems (Surface & Subsurface) Ground Defense Systems (Vehicles, Artillery) Cyber Defense Solutions Support & Maintenance Services |

| By End-User | Department of Defense (DoD) Homeland Security Agencies Commercial Aerospace Operators Research & Development Institutions Private Defense Contractors |

| By Application | Surveillance & Reconnaissance Combat Operations Logistics & Support Training & Simulation Space Exploration & Satellite Deployment |

| By Component | Avionics & Electronics Propulsion Systems Weapon Systems Communication & Navigation Systems Structural Components |

| By Sales Channel | Direct Government Contracts Defense Contractors & Integrators Commercial Sales Online & Digital Procurement |

| By Distribution Mode | Air Transport Sea Transport Land Transport Space Launch |

| By Price Range | Low-End Mid-Range High-End Ultra-High-End (Space & Strategic Systems) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Defense Contracting | 80 | Procurement Officers, Contract Managers |

| Cybersecurity Solutions | 60 | IT Security Managers, Cyber Defense Analysts |

| Military Technology Development | 70 | R&D Directors, Project Engineers |

| Naval Systems Integration | 50 | Systems Engineers, Program Managers |

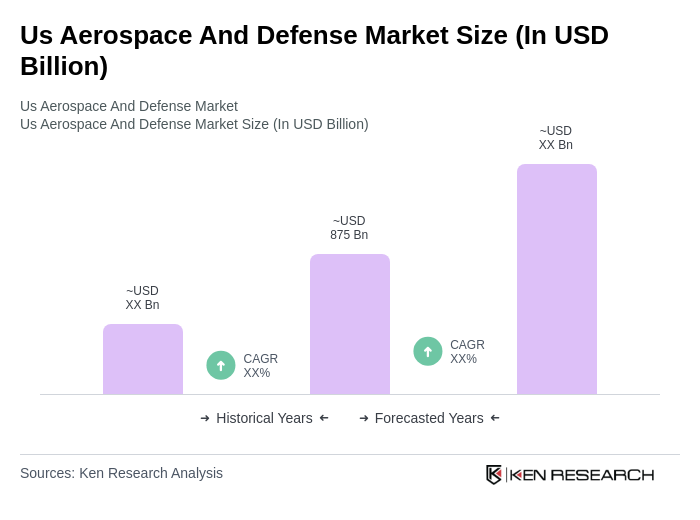

The US Aerospace and Defense Market is valued at approximately USD 875 billion, reflecting significant growth driven by increased defense spending, technological advancements, and rising demand for advanced aerospace platforms.