Region:Asia

Author(s):Dev

Product Code:KRAA1625

Pages:83

Published On:August 2025

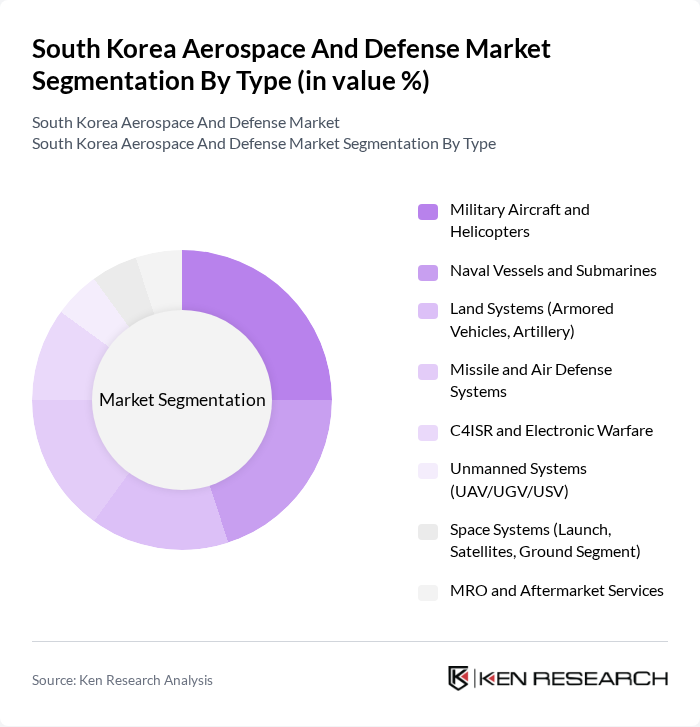

By Type:The aerospace and defense market can be segmented into various types, including military aircraft and helicopters, naval vessels and submarines, land systems, missile and air defense systems, C4ISR and electronic warfare, unmanned systems, space systems, and MRO and aftermarket services. Each of these segments plays a crucial role in enhancing the overall defense capabilities of South Korea.

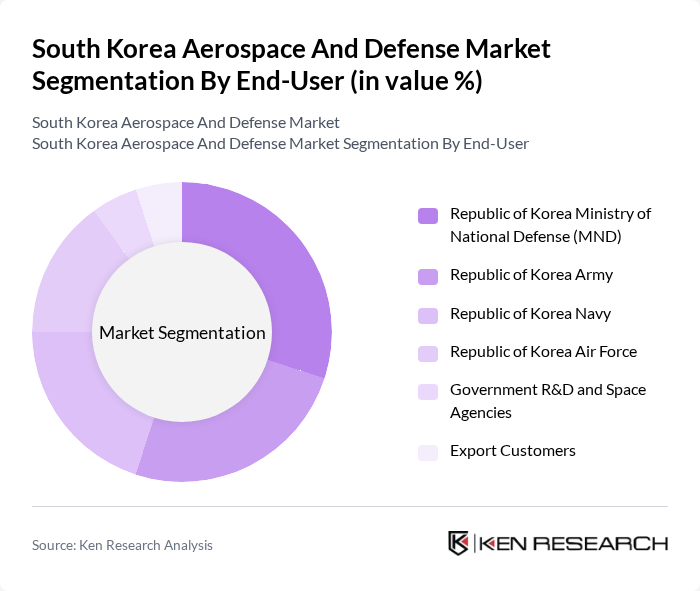

By End-User:The end-user segmentation includes the Republic of Korea Ministry of National Defense (MND), Republic of Korea Army, Republic of Korea Navy, Republic of Korea Air Force, government R&D and space agencies, and export customers. Each of these end-users has specific requirements and plays a vital role in shaping the demand for aerospace and defense products.

The South Korea Aerospace And Defense Market is characterized by a dynamic mix of regional and international players. Leading participants such as Korea Aerospace Industries Ltd. (KAI), Hanwha Aerospace Co., Ltd., Hanwha Ocean Co., Ltd. (formerly Daewoo Shipbuilding & Marine Engineering), Hanwha Systems Co., Ltd., LIG Nex1 Co., Ltd., Hyundai Rotem Company, HD Hyundai Heavy Industries Co., Ltd., HD Korea Shipbuilding & Offshore Engineering Co., Ltd. (KSOE), HJ Shipbuilding & Construction (formerly Hanjin Heavy Industries & Construction), Korea Aerospace Research Institute (KARI), Agency for Defense Development (ADD), LIG Nex1 Space & Strategic Systems (EW/Guidance units), Hanwha Defense Systems (Land Systems Division), Poongsan Corporation, SNT Dynamics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean aerospace and defense market is poised for significant transformation in the coming years, driven by technological innovations and increased defense spending. As the government prioritizes modernization and strategic partnerships, the focus will shift towards integrating advanced technologies such as artificial intelligence and unmanned systems. Additionally, the emphasis on sustainability and environmental compliance will shape future projects, ensuring that the industry adapts to global standards while enhancing national security capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Military Aircraft and Helicopters Naval Vessels and Submarines Land Systems (Armored Vehicles, Artillery) Missile and Air Defense Systems C4ISR and Electronic Warfare Unmanned Systems (UAV/UGV/USV) Space Systems (Launch, Satellites, Ground Segment) MRO and Aftermarket Services |

| By End-User | Republic of Korea Ministry of National Defense (MND) Republic of Korea Army Republic of Korea Navy Republic of Korea Air Force Government R&D and Space Agencies Export Customers |

| By Application | Intelligence, Surveillance, and Reconnaissance (ISR) Combat and Strike Air and Missile Defense Training, Simulation, and Readiness Logistics, MRO, and Support Cyber Defense and Secure Communications |

| By Component | Platforms Payloads and Mission Systems Propulsion and Power Systems Avionics and Sensors Software and Cyber Solutions Services |

| By Sales Channel | Direct Government Procurement (DAPA) Foreign Military Sales/Offsets OEM and Prime Contractor Sales Tier-1/Tier-2 Supplier Sales |

| By Distribution Mode | Domestic Production and Delivery Co-production/Technology Transfer Imports Exports |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Defense Procurement | 80 | Procurement Officers, Contract Managers |

| Cyber Defense Solutions | 70 | IT Security Managers, Cyber Analysts |

| Naval Systems Development | 60 | Naval Engineers, Project Managers |

| Land Defense Equipment | 90 | Field Operations Managers, Logistics Coordinators |

The South Korea Aerospace and Defense Market is valued at approximately USD 15 billion, reflecting a five-year historical analysis. This growth is attributed to increased defense spending, technological advancements, and a focus on self-reliance in military capabilities.