Singapore Smart Healthcare and E-Pharmacy Market Overview

- The Singapore Smart Healthcare and E-Pharmacy Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health technologies, rising healthcare expenditure, and a growing demand for convenient healthcare solutions among consumers. The integration of advanced technologies such as artificial intelligence, remote monitoring, and telemedicine has further propelled the market's expansion .

- Singapore is a dominant player in the Smart Healthcare and E-Pharmacy Market due to its robust healthcare infrastructure, high internet and smartphone penetration, and a tech-savvy population. The city-state's government initiatives to promote digital health solutions and the presence of over 400 healthcare startups contribute to its leadership in this sector. Additionally, the collaboration between public and private sectors enhances service delivery and innovation .

- In 2023, the Singapore government implemented the Healthier SG initiative, aimed at promoting preventive healthcare through digital platforms. This initiative encourages citizens to engage in regular health screenings and lifestyle management via mobile applications, thereby enhancing the overall efficiency of healthcare delivery and reducing long-term healthcare costs. The Healthier SG initiative is governed by the Healthier SG Act 2023, issued by the Ministry of Health, which mandates healthcare providers to integrate digital health records and preventive care programs into their service offerings .

Singapore Smart Healthcare and E-Pharmacy Market Segmentation

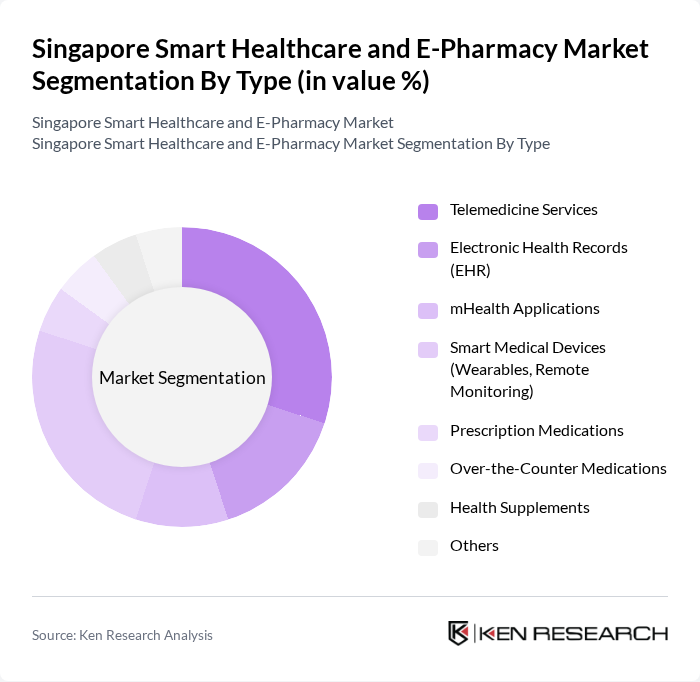

By Type:The market is segmented into various types, including Telemedicine Services, Electronic Health Records (EHR), mHealth Applications, Smart Medical Devices (Wearables, Remote Monitoring), Prescription Medications, Over-the-Counter Medications, Health Supplements, and Others. Among these, Telemedicine Services and Smart Medical Devices are gaining significant traction due to the increasing demand for remote healthcare solutions, the normalization of virtual consultations, and the growing trend of health monitoring through wearable technology .

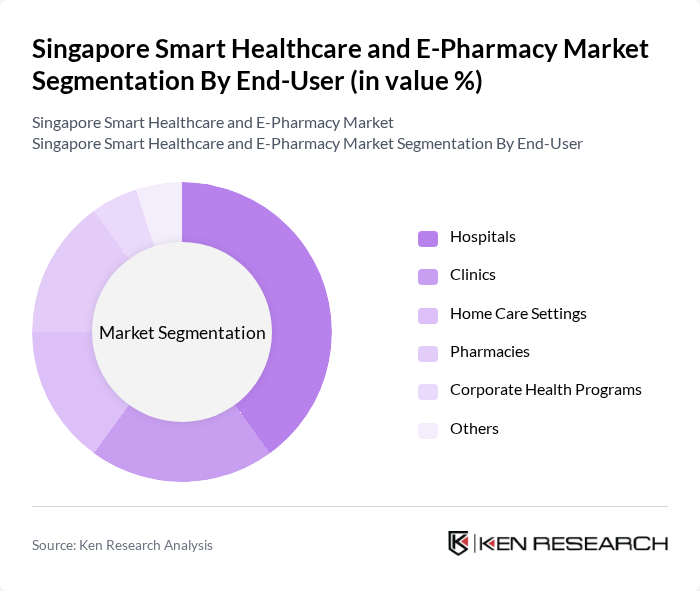

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Settings, Pharmacies, Corporate Health Programs, and Others. Hospitals and Clinics are the primary users of smart healthcare solutions, driven by the need for efficient patient management and improved healthcare delivery. The increasing focus on home healthcare and remote patient monitoring is also contributing to the growth of Home Care Settings .

Singapore Smart Healthcare and E-Pharmacy Market Competitive Landscape

The Singapore Smart Healthcare and E-Pharmacy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Razer Health, GrabHealth, Healthway Medical, MyDoc, Doctor Anywhere, WhiteCoat, Watsons Singapore, Guardian Health & Beauty, SingHealth, National Healthcare Group (NHG), Parkway Pantai, NTUC Health, AIA Singapore, Philips Healthcare, Zuellig Pharma contribute to innovation, geographic expansion, and service delivery in this space.

Singapore Smart Healthcare and E-Pharmacy Market Industry Analysis

Growth Drivers

- Increasing Demand for Telehealth Services:The telehealth sector in Singapore is projected to reach SGD 1.2 billion in future, driven by a growing preference for remote consultations. The COVID-19 pandemic accelerated this trend, with a reported 300% increase in telehealth usage in 2020. Additionally, the Ministry of Health's initiatives to integrate telehealth into primary care are expected to further boost adoption, making healthcare more accessible to the population.

- Rising Adoption of Wearable Health Technologies:The wearable health technology market in Singapore is anticipated to grow to SGD 500 million in future, fueled by increasing health consciousness among consumers. Approximately 40% of Singaporeans own at least one wearable device, such as fitness trackers or smartwatches. This trend is supported by the government’s push for preventive healthcare, encouraging individuals to monitor their health metrics actively and engage with healthcare providers.

- Government Initiatives for Digital Health Transformation:The Singapore government has allocated SGD 1.5 billion for digital health initiatives under the Smart Nation program. This funding aims to enhance healthcare infrastructure, promote e-health solutions, and improve interoperability among health systems. In future, these initiatives are expected to facilitate seamless access to healthcare services, thereby driving the growth of smart healthcare and e-pharmacy solutions across the nation.

Market Challenges

- Regulatory Compliance Issues:The e-pharmacy sector faces stringent regulatory compliance challenges, particularly under the Health Products Act. In future, e-pharmacies must adhere to new guidelines that require rigorous quality control and reporting standards. Non-compliance can lead to significant penalties, which may deter new entrants and stifle innovation within the market, ultimately affecting service delivery and consumer trust.

- Data Privacy and Security Concerns:With the rise of digital health solutions, data privacy and security remain paramount concerns. In future, Singapore reported over 1,000 data breaches, raising alarms about the safety of personal health information. As e-pharmacies and telehealth services expand, ensuring robust cybersecurity measures will be critical to maintaining consumer confidence and complying with the Personal Data Protection Act (PDPA).

Singapore Smart Healthcare and E-Pharmacy Market Future Outlook

The future of the Singapore smart healthcare and e-pharmacy market appears promising, driven by technological advancements and evolving consumer preferences. As the government continues to invest in digital health infrastructure, the integration of AI and big data analytics will enhance service delivery and patient outcomes. Furthermore, the increasing focus on preventive healthcare will likely lead to a surge in demand for personalized health solutions, positioning Singapore as a leader in innovative healthcare delivery.

Market Opportunities

- Expansion of Mobile Health Applications:The mobile health application market is expected to grow significantly, with over 1 million downloads projected in future. This growth presents opportunities for developers to create user-friendly applications that facilitate health monitoring, medication management, and teleconsultations, enhancing patient engagement and adherence to treatment plans.

- Integration of AI in Healthcare Services:The integration of AI technologies in healthcare services is set to revolutionize patient care. In future, AI-driven solutions are expected to improve diagnostic accuracy and treatment personalization, with an estimated 30% reduction in diagnostic errors. This presents a lucrative opportunity for healthcare providers to enhance operational efficiency and patient satisfaction.