Region:Asia

Author(s):Geetanshi

Product Code:KRAA0032

Pages:97

Published On:August 2025

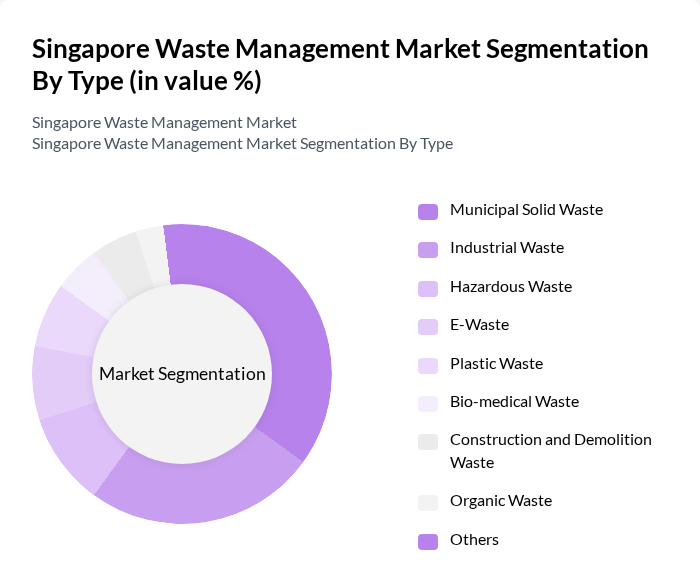

By Type:The waste management market can be segmented into various types, including Municipal Solid Waste, Industrial Waste, Hazardous Waste, E-Waste, Plastic Waste, Bio-medical Waste, Construction and Demolition Waste, Organic Waste, and Others. Among these,Municipal Solid Wasteis the most significant segment, driven by the increasing population and urbanization, leading to higher waste generation. TheIndustrial Wastesegment is also substantial, as industries continue to expand and produce various waste types .

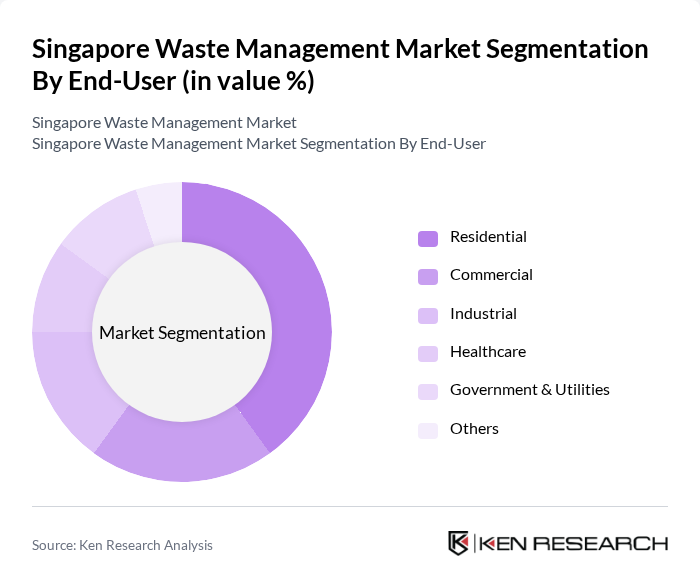

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Healthcare, Government & Utilities, and Others. TheResidentialsegment is the largest, driven by the increasing population and urbanization, leading to higher waste generation. TheIndustrialsegment also plays a crucial role, as industries produce significant amounts of waste, necessitating effective management solutions .

The Singapore Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SembWaste Pte Ltd (Sembcorp Environmental Management), Veolia Environmental Services Singapore Pte Ltd, ALBA W&H Smart City Pte Ltd, 800 Super Waste Management Pte Ltd, Wah & Hua Pte Ltd, EcoWise Holdings Limited, Colex Holdings Limited, Chye Thiam Maintenance Pte Ltd, Tay Paper Recycling Pte Ltd, SUEZ Singapore, Ramky Cleantech Services Pte Ltd, Greenpac (S) Pte Ltd, Bee Joo Industries Pte Ltd, AsiaPac Recycling Pte Ltd, Tiong Lam Supplies Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore waste management market is poised for significant transformation as it embraces sustainability and technological innovation. With increasing urbanization and government support, the sector is likely to see enhanced recycling initiatives and the development of waste-to-energy facilities. Additionally, the integration of smart technologies will streamline operations, making waste management more efficient. As public awareness of environmental issues grows, the demand for sustainable waste solutions will further drive market evolution, creating a more resilient waste management ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Municipal Solid Waste Industrial Waste Hazardous Waste E-Waste Plastic Waste Bio-medical Waste Construction and Demolition Waste Organic Waste Others |

| By End-User | Residential Commercial Industrial Healthcare Government & Utilities Others |

| By Waste Treatment Method | Recycling Incineration Landfilling Composting Anaerobic Digestion Waste-to-Energy Others |

| By Collection Method | Curbside Collection Drop-off Centers Collection Events Others |

| By Geographic Area | Central Region East Region North Region West Region Others |

| By Service Type | Collection Services Disposal Services Recycling Services Waste-to-Energy Services Environmental Consulting Services Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 60 | City Planners, Waste Management Officers |

| Industrial Waste Processing | 50 | Operations Managers, Environmental Compliance Officers |

| Recycling Initiatives | 40 | Recycling Facility Managers, Sustainability Coordinators |

| Hazardous Waste Management | 40 | Health and Safety Officers, Waste Disposal Specialists |

| Public Awareness Programs | 50 | Community Outreach Coordinators, Environmental Educators |

The Singapore Waste Management Market is valued at approximately USD 3.0 billion, driven by urbanization, stringent environmental regulations, and a focus on sustainability. This growth reflects the increasing waste generation due to a rising population and industrial activities.