Region:Africa

Author(s):Shubham

Product Code:KRAB4971

Pages:99

Published On:October 2025

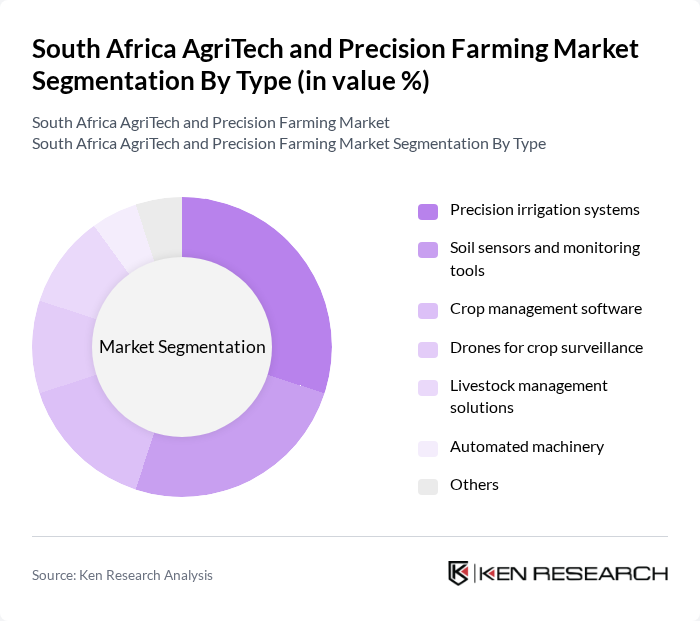

By Type:The AgriTech and Precision Farming Market can be segmented into various types, including precision irrigation systems, soil sensors and monitoring tools, crop management software, drones for crop surveillance, livestock management solutions, automated machinery, and others. Among these, precision irrigation systems and soil sensors are gaining significant traction due to their ability to optimize water usage and improve crop yields. The increasing focus on sustainable farming practices is driving the demand for these technologies.

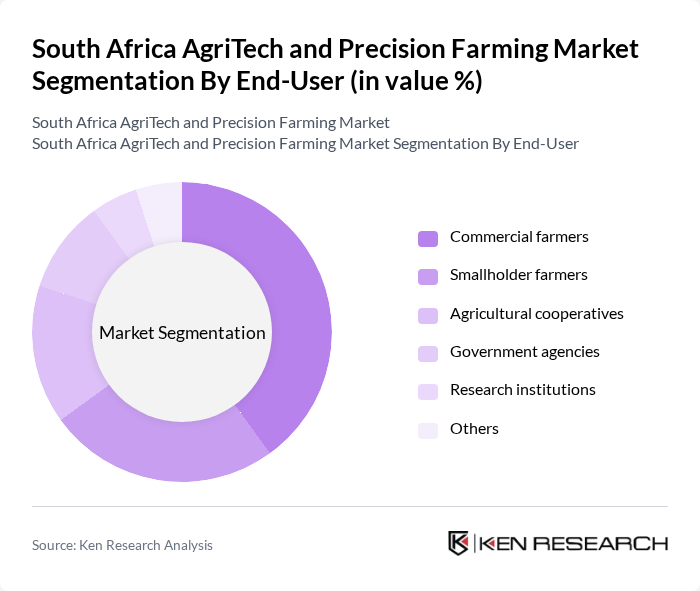

By End-User:The market is also segmented by end-users, which include commercial farmers, smallholder farmers, agricultural cooperatives, government agencies, research institutions, and others. Commercial farmers are the dominant segment, driven by their need for efficiency and productivity in large-scale operations. The increasing adoption of technology among smallholder farmers is also noteworthy, as they seek to enhance their agricultural practices and improve yields.

The South Africa AgriTech and Precision Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aerobotics, John Deere, Trimble Agriculture, Bayer CropScience, Yara International, Syngenta, CropX Technologies, AeroFarms, AgriWebb, FarmWise, The Climate Corporation, AG Leader Technology, Raven Industries, Taranis, Ecorobotix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African AgriTech and precision farming market appears promising, driven by increasing investments in technology and a growing emphasis on sustainable practices. In future, the integration of IoT and data analytics in farming operations is expected to enhance decision-making processes, leading to improved crop yields. Additionally, the collaboration between traditional farmers and tech startups is likely to foster innovation, creating a more resilient agricultural sector capable of adapting to changing environmental conditions and market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Precision irrigation systems Soil sensors and monitoring tools Crop management software Drones for crop surveillance Livestock management solutions Automated machinery Others |

| By End-User | Commercial farmers Smallholder farmers Agricultural cooperatives Government agencies Research institutions Others |

| By Application | Crop production Livestock farming Aquaculture Agroforestry Others |

| By Distribution Channel | Direct sales Online platforms Retail outlets Distributors and wholesalers Others |

| By Investment Source | Private investments Government funding International aid Public-private partnerships Others |

| By Policy Support | Subsidies for technology adoption Tax incentives for AgriTech investments Grants for research and development Others |

| By Technology Integration | IoT solutions AI and machine learning applications Blockchain for supply chain transparency Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Precision Farming Technology Adoption | 60 | Farm Owners, Agronomists, Technology Implementers |

| AgriTech Startups Insights | 40 | Founders, Product Managers, Business Development Leads |

| Government Policy Impact on AgriTech | 45 | Policy Makers, Agricultural Economists, Regulatory Experts |

| Farmer Perspectives on Technology | 55 | Smallholder Farmers, Commercial Farmers, Cooperative Leaders |

| Market Trends and Challenges | 40 | Industry Analysts, Market Researchers, Academic Experts |

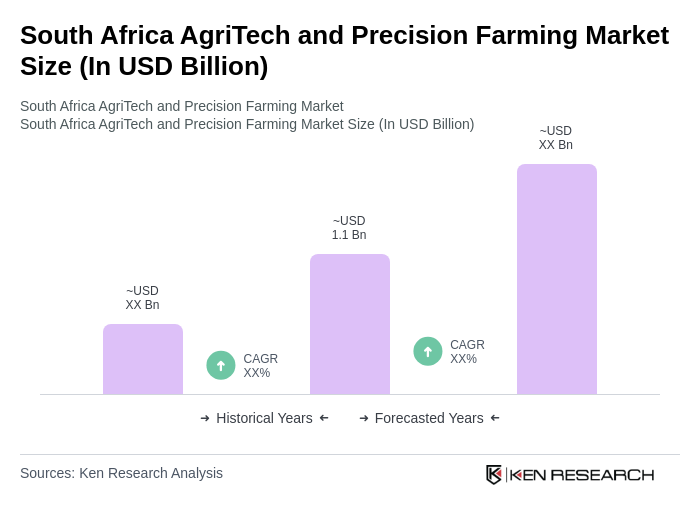

The South Africa AgriTech and Precision Farming Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of advanced agricultural technologies and the increasing demand for food security and sustainable farming practices.