Spain Agritech and Precision Farming Market Overview

- The Spain Agritech and Precision Farming Market is valued at USD 2.5 billion, based on a five-year historical analysis. This market value aligns with the broader crop protection and agri-inputs sector, which forms a significant portion of the agritech landscape in Spain. Growth is primarily driven by the increasing adoption of advanced agricultural technologies, heightened focus on food security, and the urgent need for sustainable farming practices. The integration of IoT, artificial intelligence, and data analytics is accelerating digital transformation in Spanish agriculture, enabling farmers to optimize resource use, improve yields, and reduce environmental impact. Recent trends highlight a surge in investment in digital farm management platforms, precision irrigation, and automation, as well as a growing ecosystem of agritech startups and multinational R&D centers in Spain .

- Key regions dominating the market include Catalonia, Andalusia, and Valencia. Catalonia leads due to its robust agricultural base and a vibrant ecosystem of agritech startups and innovation hubs. Andalusia benefits from its extensive agricultural land and diverse crop production, particularly olives, cereals, and horticulture, making it a major consumer of precision farming solutions. Valencia is recognized for its leadership in citrus fruit and vegetable exports, driving demand for advanced crop monitoring and irrigation technologies .

- The "Strategic Plan for the Sustainable Development of Agriculture 2023–2027" (Plan Estratégico para la Política Agraria Común 2023–2027), issued by the Ministry of Agriculture, Fisheries and Food, allocates EUR 1.5 billion to support the adoption of precision farming technologies. This binding instrument establishes operational measures for digitalization, sustainability, and innovation in Spanish agriculture, including direct subsidies for precision equipment, digital farm management tools, and climate-smart practices. Compliance requires farmers to meet specific digitalization and sustainability thresholds to access funding .

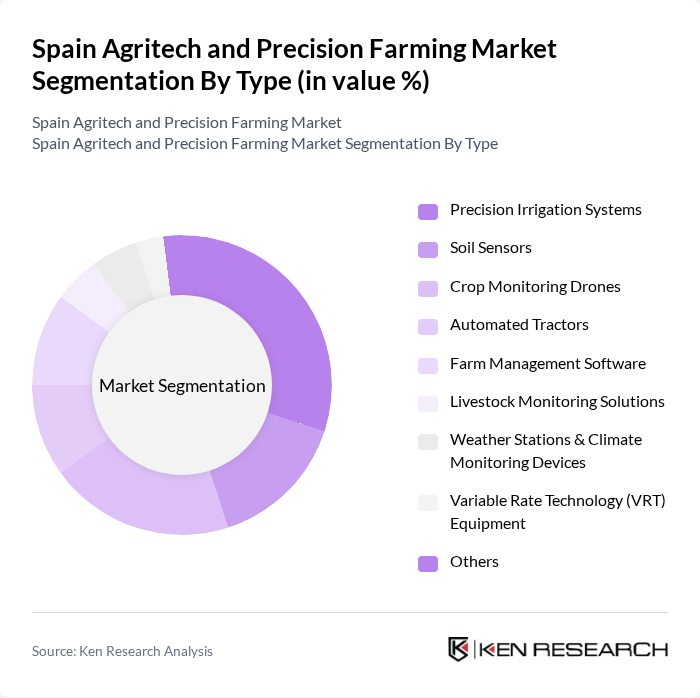

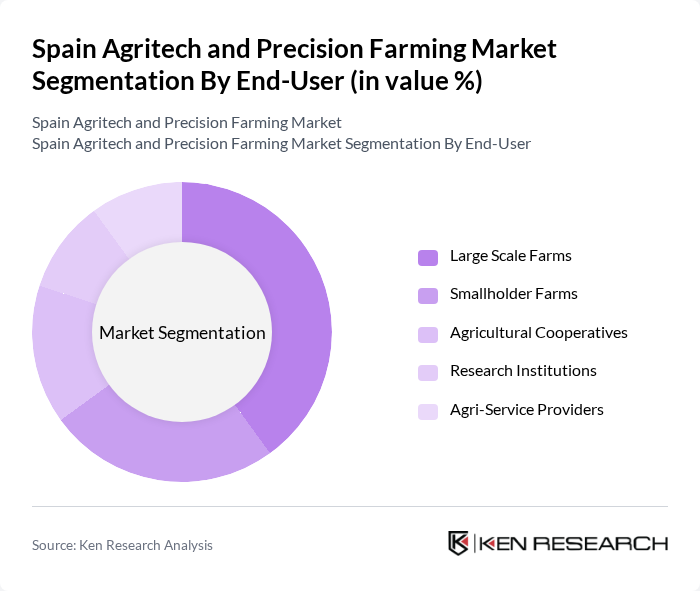

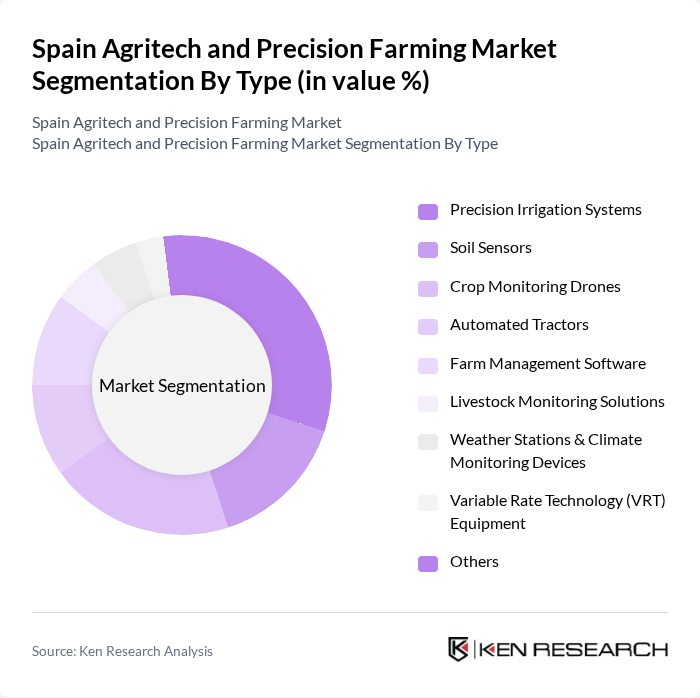

Spain Agritech and Precision Farming Market Segmentation

By Type:The market is segmented into various types of technologies that enhance agricultural productivity and efficiency. Key subsegments include Precision Irrigation Systems, Soil Sensors, Crop Monitoring Drones, Automated Tractors, Farm Management Software, Livestock Monitoring Solutions, Weather Stations & Climate Monitoring Devices, Variable Rate Technology (VRT) Equipment, and Others. Among these, Precision Irrigation Systems are leading due to their ability to conserve water and optimize irrigation schedules, which is crucial in Spain's arid and semi-arid regions. The adoption of soil sensors and crop monitoring drones is also accelerating, driven by the need for real-time data and resource optimization .

By End-User:The end-user segmentation includes Large Scale Farms, Smallholder Farms, Agricultural Cooperatives, Research Institutions, and Agri-Service Providers. Large Scale Farms dominate the market due to their greater capacity to invest in advanced technologies and their need for efficient resource management. These farms are increasingly adopting precision farming solutions to enhance yield, reduce operational costs, and comply with sustainability requirements under national and EU policies. Agricultural cooperatives and agri-service providers are also expanding their adoption of digital and precision tools to support member farms and clients .

Spain Agritech and Precision Farming Market Competitive Landscape

The Spain Agritech and Precision Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere Iberica, S.A., Trimble Inc., AGCO Iberia S.A., Topcon Positioning Spain S.L., Kubota España S.A., Spherag, Hispatec, Auravant, Yara Iberian S.A.U., BASF Española S.L., Syngenta España S.A., Bayer CropScience S.L., CNH Industrial España S.A., Climate LLC (The Climate Corporation), and Agroptima contribute to innovation, geographic expansion, and service delivery in this space.

Spain Agritech and Precision Farming Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Farming Practices:The Spanish agricultural sector is witnessing a significant shift towards sustainable practices, driven by a growing consumer preference for organic products. In future, organic farming accounted for approximately 10% of total agricultural land in Spain, translating to around 2.6 million hectares. This trend is supported by the European Union's Green Deal, which aims to increase organic farming to 25% by 2030, thereby enhancing market opportunities for agritech solutions that promote sustainability.

- Adoption of Advanced Technologies in Agriculture:The integration of advanced technologies such as IoT, AI, and big data analytics is transforming the Spanish agritech landscape. In future, it is estimated that investments in precision agriculture technologies will exceed €1.15 billion, reflecting a 15% increase from previous years. This surge is driven by the need for improved crop yields and resource efficiency, as farmers increasingly rely on data-driven insights to optimize their operations and reduce waste.

- Government Support and Funding for Agritech Innovations:The Spanish government has allocated over €500 million in funding for agritech innovations as part of its Recovery and Resilience Plan. This funding aims to support research and development in sustainable agriculture technologies. Additionally, various regional initiatives are promoting agritech startups, which are expected to create approximately 10,000 new jobs in the sector in future, further driving growth in the agritech market.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the agritech sector in Spain is the high initial investment required for advanced technologies. Many farmers, particularly smallholders, struggle to afford the upfront costs, which can range from €20,000 to €100,000 for precision farming equipment. This financial barrier limits the adoption of innovative solutions, hindering overall market growth and technological advancement in the agricultural sector.

- Limited Access to Technology in Rural Areas:Rural areas in Spain often face significant challenges in accessing modern agritech solutions. Approximately 30% of rural farmers report limited internet connectivity, which restricts their ability to utilize digital farming tools effectively. This digital divide not only hampers productivity but also exacerbates inequalities within the agricultural sector, as technologically advanced practices remain out of reach for many rural producers.

Spain Agritech and Precision Farming Market Future Outlook

The future of the agritech and precision farming market in Spain appears promising, driven by ongoing technological advancements and a strong push for sustainability. As farmers increasingly adopt smart farming practices, the integration of AI and IoT will enhance operational efficiency and crop management. Furthermore, the collaboration between agritech firms and research institutions is expected to foster innovation, leading to the development of new solutions that address emerging agricultural challenges, including climate change and resource scarcity.

Market Opportunities

- Expansion of Precision Farming Techniques:The growing recognition of precision farming's benefits presents a significant opportunity for market expansion. With an estimated 20% increase in the adoption of precision agriculture technologies expected by future, agritech companies can capitalize on this trend by offering tailored solutions that enhance productivity and sustainability for farmers across Spain.

- Development of Smart Irrigation Systems:The increasing water scarcity in Spain creates a pressing need for efficient irrigation solutions. The smart irrigation market is projected to grow by €150 million by future, driven by the demand for technologies that optimize water usage. Agritech firms can leverage this opportunity by developing innovative irrigation systems that utilize real-time data to improve water management in agriculture.