Region:Africa

Author(s):Shubham

Product Code:KRAB4387

Pages:97

Published On:October 2025

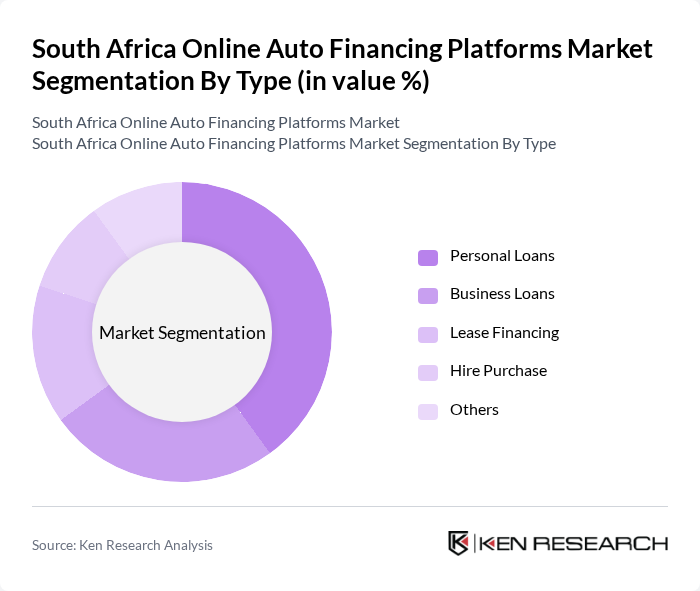

By Type:The market is segmented into various types of financing options, including Personal Loans, Business Loans, Lease Financing, Hire Purchase, and Others. Each of these subsegments caters to different consumer needs and preferences, with Personal Loans being particularly popular among individual consumers seeking to finance their vehicle purchases.

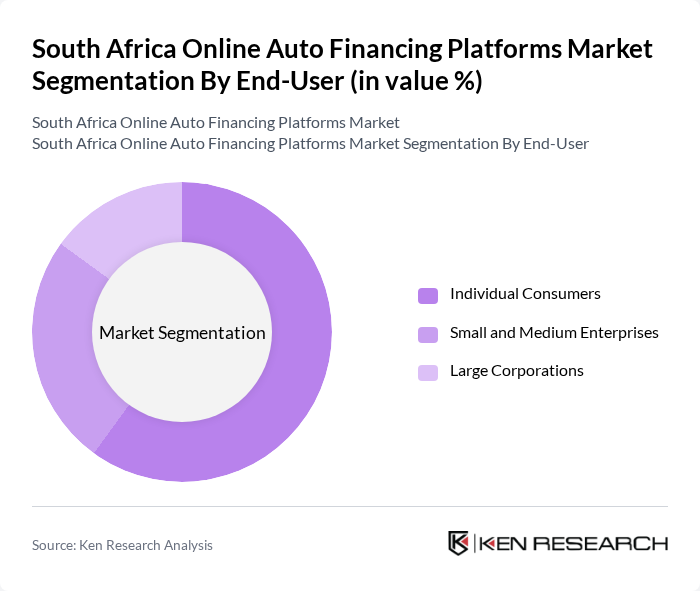

By End-User:The market is also segmented by end-users, which include Individual Consumers, Small and Medium Enterprises (SMEs), and Large Corporations. Individual Consumers represent the largest segment, driven by the increasing number of people seeking personal vehicles and the convenience of online financing options.

The South Africa Online Auto Financing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Absa Group Limited, Standard Bank Group, Nedbank Group Limited, Capitec Bank Holdings Limited, FirstRand Limited, MFC (a division of Nedbank), WesBank (a division of FirstRand), Toyota Financial Services South Africa, Volkswagen Financial Services South Africa, BMW Financial Services South Africa, Mercedes-Benz Financial Services South Africa, Investec Bank Limited, African Bank Limited, DirectAxis (a division of the Absa Group), iMasFinance contribute to innovation, geographic expansion, and service delivery in this space.

The South African online auto financing market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As digital payment solutions become more prevalent, platforms that integrate seamless payment options will likely attract more users. Additionally, partnerships with automotive dealers can enhance service offerings, providing consumers with comprehensive financing solutions. The increasing focus on eco-friendly vehicles will also create new financing opportunities, as consumers seek sustainable options in their vehicle purchases.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Lease Financing Hire Purchase Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations |

| By Vehicle Type | New Cars Used Cars Commercial Vehicles |

| By Financing Model | Traditional Financing Online Financing Peer-to-Peer Financing |

| By Loan Amount | Low-Value Loans Mid-Value Loans High-Value Loans |

| By Duration | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Sales Channel | Direct Online Platforms Third-Party Aggregators Automotive Dealerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Auto Financing Users | 150 | Recent car buyers, Loan applicants |

| Automotive Dealerships | 100 | Sales Managers, Finance Managers |

| Financial Institutions | 80 | Product Managers, Risk Analysts |

| Consumer Advocacy Groups | 50 | Consumer Rights Advocates, Financial Educators |

| Industry Experts | 30 | Market Analysts, Automotive Consultants |

The South Africa Online Auto Financing Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased vehicle ownership and the adoption of digital financial services.