Region:Africa

Author(s):Dev

Product Code:KRAB4274

Pages:98

Published On:October 2025

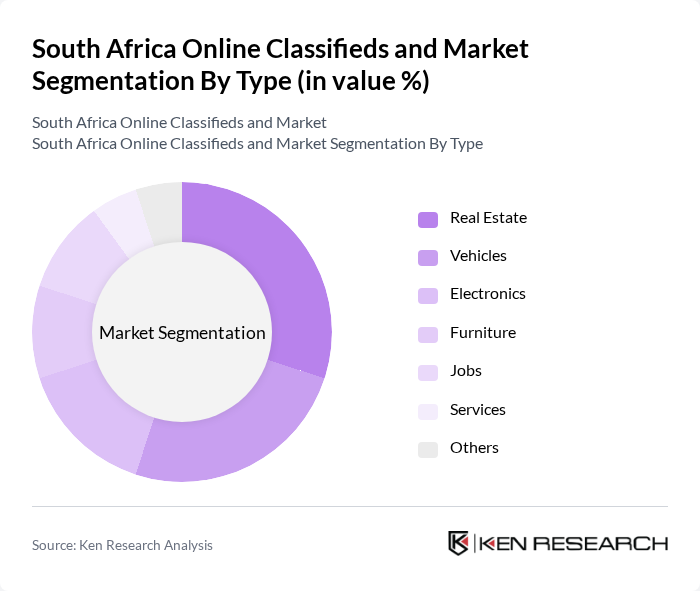

By Type:The market can be segmented into various types, including Real Estate, Vehicles, Electronics, Furniture, Jobs, Services, and Others. Each of these segments caters to different consumer needs and preferences, with some segments experiencing higher demand than others.

The Real Estate segment is currently dominating the market due to the increasing demand for housing and rental properties in urban areas. The rise in property prices and the growing trend of online property listings have made this segment particularly attractive to both buyers and sellers. Additionally, the convenience of browsing and comparing properties online has further fueled its growth, making it a preferred choice for consumers.

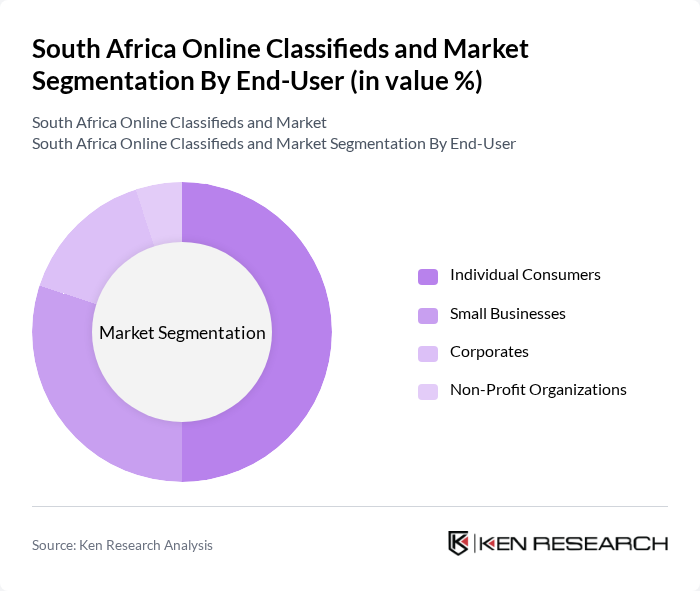

By End-User:The market can also be segmented by end-user categories, including Individual Consumers, Small Businesses, Corporates, and Non-Profit Organizations. Each of these segments has unique requirements and purchasing behaviors that influence their engagement with online classifieds.

Individual Consumers represent the largest segment in the market, driven by the increasing trend of online shopping and the convenience of accessing a wide range of products and services. The growing familiarity with digital platforms and the desire for cost-effective solutions have made this segment a key driver of market growth. Small businesses also play a significant role, utilizing online classifieds to reach a broader audience and promote their offerings.

The South Africa Online Classifieds and Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gumtree South Africa, OLX South Africa, Property24, Cars.co.za, Junk Mail, Bidorbuy, Facebook Marketplace, Takealot, Ananzi, Locanto, Classifieds.co.za, MyBroadband, AutoTrader South Africa, Free Classifieds, South Africa Classifieds contribute to innovation, geographic expansion, and service delivery in this space.

The South African online classifieds market is poised for continued evolution, driven by technological advancements and changing consumer behaviors. As internet penetration increases and mobile commerce expands, platforms will need to adapt to meet user expectations. Enhanced user experiences, including personalized recommendations and streamlined transactions, will be crucial. Additionally, the integration of advanced technologies like AI and machine learning will enable platforms to optimize operations and improve safety measures, fostering a more secure and engaging marketplace for users.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Vehicles Electronics Furniture Jobs Services Others |

| By End-User | Individual Consumers Small Businesses Corporates Non-Profit Organizations |

| By Sales Channel | Direct Sales Online Marketplaces Social Media Platforms Mobile Applications |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Product Condition | New Used Refurbished |

| By Payment Method | Credit/Debit Cards Mobile Payments Cash on Delivery |

| By Customer Demographics | Age Groups Income Levels Geographic Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General User Experience on Classifieds | 150 | Regular Users, Occasional Buyers |

| Seller Insights and Challenges | 100 | Small Business Owners, Individual Sellers |

| Market Trends and Future Outlook | 80 | Industry Analysts, Market Researchers |

| Impact of Mobile Platforms on Usage | 70 | Mobile App Users, Tech-Savvy Consumers |

| Advertising Effectiveness on Classifieds | 60 | Marketing Professionals, Advertisers |

The South Africa Online Classifieds and Marketplace market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration and a shift towards online shopping behaviors among consumers.