Region:Africa

Author(s):Dev

Product Code:KRAA0448

Pages:86

Published On:August 2025

By Waste Type:The waste management market can be segmented into various types of waste, including Municipal Solid Waste, Hazardous Waste, Industrial Waste, Construction and Demolition Waste, E-Waste, Plastic Waste, Bio-medical Waste, Organic Waste, and Others. Among these, Municipal Solid Waste is the most significant segment, driven by the increasing urban population and the resultant rise in household waste generation. The growing emphasis on recycling and waste-to-energy initiatives is also contributing to the expansion of this segment .

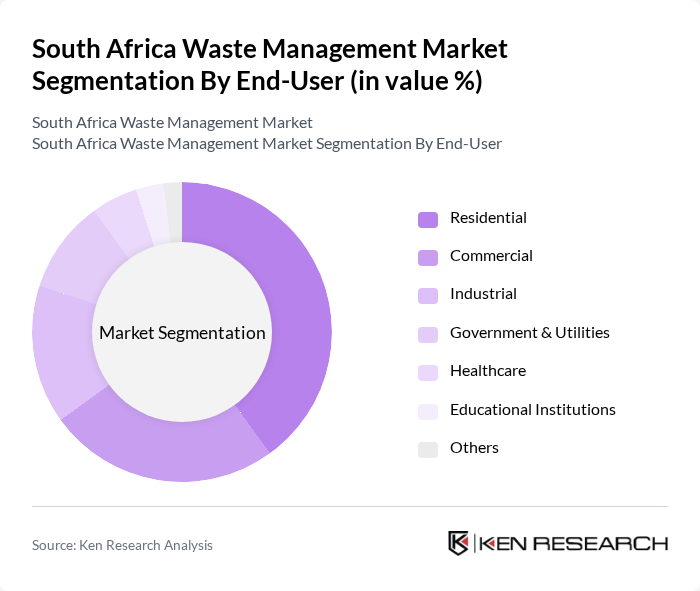

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, Healthcare, Educational Institutions, and Others. The Residential segment is the largest contributor to the market, driven by the increasing population and urbanization. The growing awareness of environmental issues has led to a rise in demand for efficient waste management solutions in residential areas, further propelling this segment's growth .

The South Africa Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as WastePlan, Interwaste, EnviroServ, Pikitup, Remade Recycling, Averda South Africa, Veolia Services Southern Africa, Mpact Recycling, GreenCape, Waste Management South Africa, EcoWaste, Clean City SA, WasteTech, Biowaste Technologies, WasteNot contribute to innovation, geographic expansion, and service delivery in this space.

The South African waste management market is poised for significant transformation driven by technological advancements and increased public engagement. As urbanization continues, innovative waste management solutions, such as smart waste collection systems, are expected to gain traction. Additionally, the government's commitment to recycling and sustainability will likely foster partnerships between public and private sectors, enhancing operational efficiency. The focus on circular economy models will further encourage investment in waste-to-energy projects, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Waste Type | Municipal Solid Waste Hazardous Waste Industrial Waste Construction and Demolition Waste E-Waste Plastic Waste Bio-medical Waste Organic Waste Others |

| By End-User | Residential Commercial Industrial Government & Utilities Healthcare Educational Institutions Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Free State Limpopo Others |

| By Collection Method | Curbside Collection Drop-off Centers Collection from Businesses Community Clean-up Initiatives Others |

| By Treatment Method | Recycling Composting Incineration Landfilling Anaerobic Digestion Dismantling Others |

| By Waste Management Technology | Mechanical Sorting Biological Treatment Thermal Treatment Chemical Treatment Others |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 60 | City Managers, Waste Collection Supervisors |

| Industrial Waste Processing | 40 | Operations Managers, Environmental Compliance Officers |

| Recycling Initiatives | 40 | Recycling Plant Managers, Sustainability Coordinators |

| Hazardous Waste Management | 40 | Health and Safety Officers, Waste Treatment Facility Managers |

| Community Engagement in Waste Reduction | 40 | Community Leaders, Environmental Activists |

The South Africa Waste Management Market is valued at approximately USD 17 million, reflecting a significant growth trend driven by urbanization, environmental regulations, and increased awareness of sustainable waste management practices.