Region:Asia

Author(s):Dev

Product Code:KRAB6049

Pages:95

Published On:October 2025

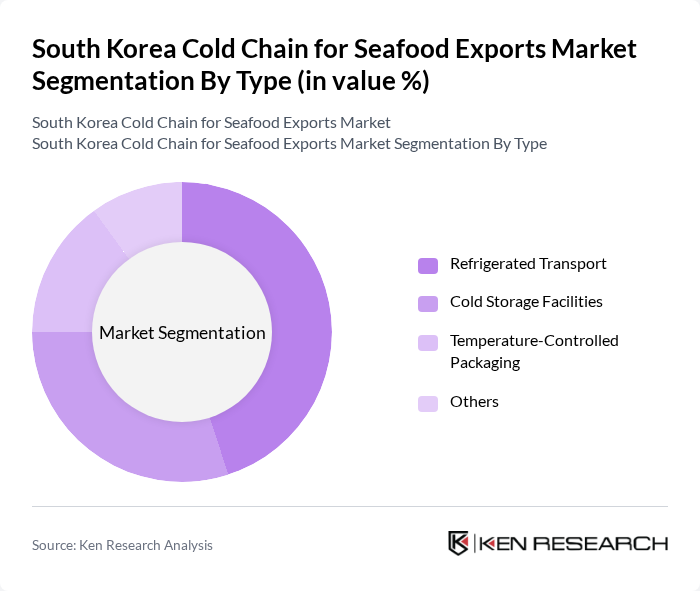

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for timely delivery of fresh seafood products. The growth in e-commerce and online food delivery services has further fueled the need for efficient refrigerated transport solutions, ensuring that seafood reaches consumers in optimal condition.

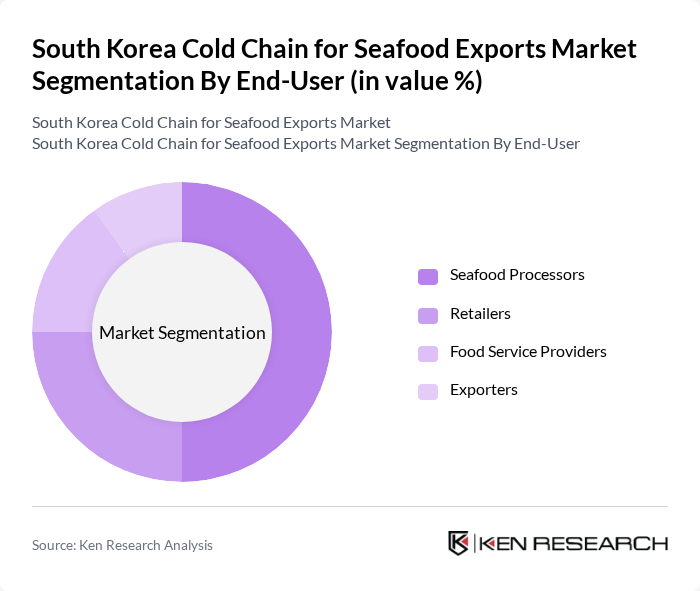

By End-User:The end-user segmentation includes Seafood Processors, Retailers, Food Service Providers, and Exporters. Seafood Processors dominate this segment, driven by the increasing need for efficient processing and packaging of seafood products. The rise in consumer demand for processed seafood, such as ready-to-eat meals and frozen products, has led processors to invest in advanced cold chain solutions to maintain product quality and safety.

The South Korea Cold Chain for Seafood Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dongwon Industries Co., Ltd., Sajo Industries Co., Ltd., Jeju Fisheries Co., Ltd., Hansung Seafood Co., Ltd., Daewoo Logistics Corp., CJ Logistics Corporation, Hyundai Glovis Co., Ltd., Lotte Global Logistics, Samho Shipping Co., Ltd., Hanjin Transportation Co., Ltd., KCTC Co., Ltd., Seajet Co., Ltd., Korea Cold Chain Association, Dongbu Express Co., Ltd., SK Networks Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea cold chain for seafood exports market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As automation and IoT technologies become more prevalent, operational efficiencies are expected to improve, reducing waste and enhancing product quality. Additionally, the increasing focus on sustainability will likely shape industry practices, encouraging investments in eco-friendly packaging and sustainable sourcing. These trends will create a more resilient and competitive market landscape, positioning South Korea as a leader in seafood exports.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Seafood Processors Retailers Food Service Providers Exporters |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Insulated Packaging Others |

| By Product Type | Fresh Seafood Frozen Seafood Processed Seafood Others |

| By Sales Channel | Online Sales Offline Sales Wholesale Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Export Logistics | 100 | Logistics Managers, Export Coordinators |

| Cold Chain Service Providers | 80 | Operations Managers, Business Development Executives |

| Seafood Processing Facilities | 70 | Quality Control Managers, Production Supervisors |

| Regulatory Compliance in Seafood Exports | 60 | Compliance Officers, Regulatory Affairs Managers |

| Market Trends in Seafood Consumption | 90 | Market Analysts, Seafood Buyers |

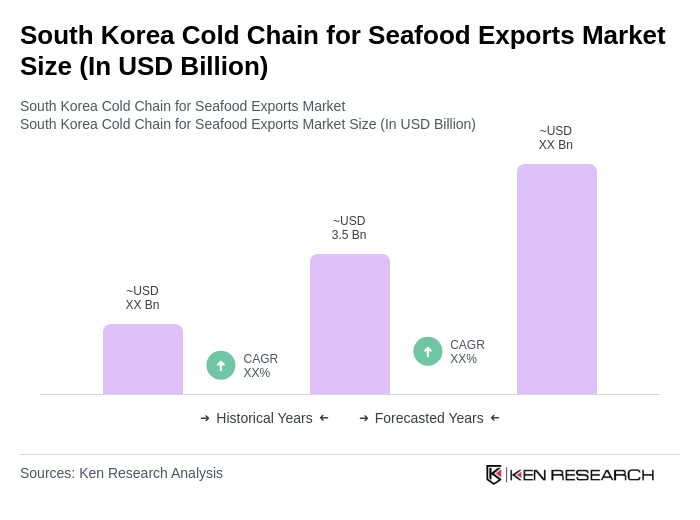

The South Korea Cold Chain for Seafood Exports Market is valued at approximately USD 3.5 billion, reflecting a significant growth driven by increasing demand for high-quality seafood products and the expansion of international trade agreements.