Region:Asia

Author(s):Rebecca

Product Code:KRAB1721

Pages:82

Published On:October 2025

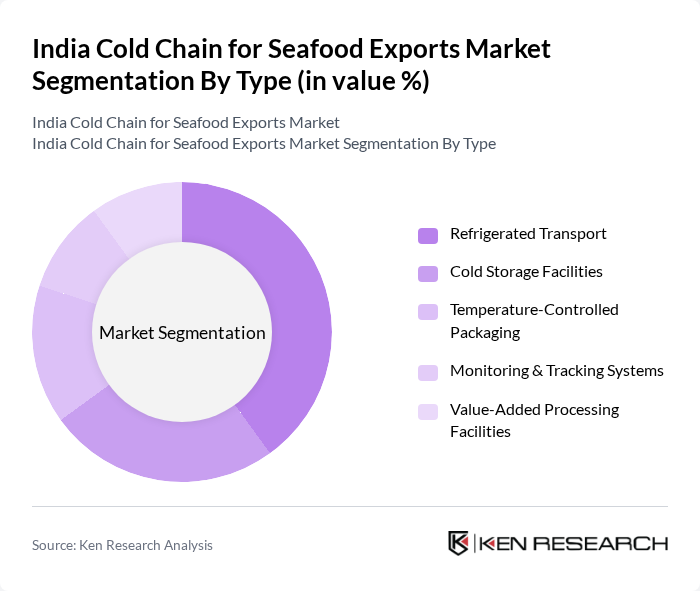

By Type:The cold chain for seafood exports can be segmented into several types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring & Tracking Systems, and Value-Added Processing Facilities. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for fresh seafood and the need for efficient logistics solutions. The rise in e-commerce and direct-to-consumer sales has also contributed to the growth of this segment, as timely delivery of perishable goods is critical. Additionally, the integration of IoT and real-time monitoring systems is enhancing traceability and quality assurance throughout the supply chain .

By End-User:The end-users of the cold chain for seafood exports include Seafood Exporters, Seafood Processors, Distributors & Logistics Providers, and Retailers & Foodservice Companies. Seafood Exporters dominate this segment as they require efficient cold chain solutions to maintain the quality of seafood during transportation to international markets. The increasing global demand for high-quality seafood products has led to a surge in exports, further driving the need for robust cold chain logistics. The adoption of advanced cold chain solutions by processors and distributors is also rising, driven by export compliance requirements and consumer expectations .

The India Cold Chain for Seafood Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marine Products Export Development Authority (MPEDA), Avanti Feeds Limited, Apex Frozen Foods Limited, Devi Seafoods Limited, Nekkanti Sea Foods Limited, Falcon Marine Exports Limited, Sandhya Marines Limited, Gadre Marine Export Pvt. Ltd., Forstar Frozen Foods Pvt. Ltd., Sagar Grandhi Exports Pvt. Ltd., Liberty Frozen Foods Pvt. Ltd., Suryamitra Exim Pvt. Ltd., Seagold Overseas Pvt. Ltd., Sree Venkateswara Marine Exporters, Uniroyal Marine Exports Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cold chain for seafood exports market appears promising, driven by increasing global demand and supportive government policies. As technological advancements continue to enhance operational efficiencies, the sector is likely to attract more investments. Additionally, the focus on sustainability and quality assurance will shape the market landscape, encouraging exporters to adopt innovative practices. In future, the integration of advanced technologies and infrastructure improvements will be crucial for maintaining competitiveness in the global seafood market.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring & Tracking Systems Value-Added Processing Facilities |

| By End-User | Seafood Exporters Seafood Processors Distributors & Logistics Providers Retailers & Foodservice Companies |

| By Region | East Coast (Andhra Pradesh, Odisha, West Bengal) West Coast (Gujarat, Maharashtra, Kerala) South India (Tamil Nadu, Karnataka) North & Central India (Delhi, Punjab, Others) |

| By Application | Fresh Seafood Frozen Seafood Dried & Processed Seafood Value-Added Seafood Products |

| By Distribution Channel | Direct Export Sales Third-Party Exporters Online B2B Platforms Wholesale Seafood Markets |

| By Temperature Range | Frozen (-18°C and below) Chilled (0°C to 4°C) |

| By Technology | Conventional Refrigeration Advanced Refrigerants (e.g., Ammonia, CO?) IoT & Remote Monitoring Solar-Powered Cold Storage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Exporters | 50 | Export Managers, Business Development Heads |

| Cold Chain Logistics Providers | 40 | Operations Managers, Logistics Coordinators |

| Fishermen Cooperatives | 60 | Cooperative Leaders, Fishermen Representatives |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Cold Storage Facility Operators | 70 | Facility Managers, Technical Supervisors |

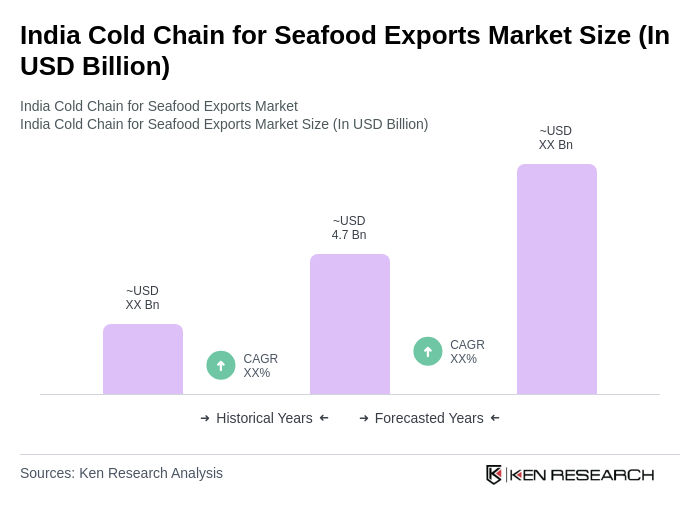

The India Cold Chain for Seafood Exports Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by increasing international demand for seafood and advancements in cold chain logistics and technology.