South Korea Semiconductor Foundry & Fabless Market Overview

- The South Korea Semiconductor Foundry & Fabless Market is valued at approximatelyUSD 115 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for advanced semiconductor technologies in consumer electronics, automotive, and industrial applications. The rapid digital transformation, adoption of artificial intelligence, and the rise of 5G technology have further accelerated the need for high-performance chips, making South Korea a pivotal player in the global semiconductor landscape .

- Key players in this market are concentrated inSeoul, Gyeonggi Province, and Busan. Seoul is the heart of South Korea's technology sector, housing major semiconductor companies and research institutions. Gyeonggi Province, with its proximity to Seoul, benefits from a robust supply chain and skilled workforce, while Busan serves as a strategic port for international trade, facilitating the export of semiconductor products .

- In 2023, the South Korean government implemented theK-Semiconductor Strategy(Ministry of Trade, Industry and Energy, 2023), which aims to investUSD 450 billionby 2030 to enhance the country's semiconductor manufacturing capabilities. This initiative focuses on fostering innovation, increasing production capacity, and supporting research and development to maintain South Korea's competitive edge in the global semiconductor market. The strategy mandates the creation of a mega-cluster, expansion of R&D incentives, and support for workforce training .

South Korea Semiconductor Foundry & Fabless Market Segmentation

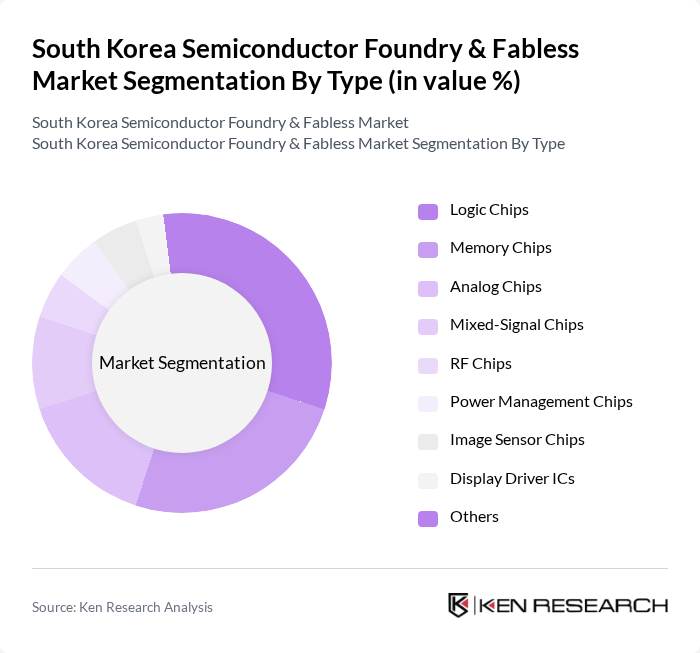

By Type:The market is segmented into various types of semiconductor chips, including Logic Chips, Memory Chips, Analog Chips, Mixed-Signal Chips, RF Chips, Power Management Chips, Image Sensor Chips, Display Driver ICs, and Others. Each of these sub-segments plays a crucial role in different applications, withMemory Chips and Logic Chipsbeing the most dominant due to their extensive use in consumer electronics, computing devices, and data centers. South Korea is a global leader in memory chips, accounting for over 60% of global DRAM and NAND production .

By End-User:The semiconductor market is further segmented by end-user applications, including Consumer Electronics, Automotive, Industrial Automation, Telecommunications, Healthcare, Aerospace & Defense, Data Centers & Cloud Computing, and Others. TheConsumer Electronicssegment is the largest, driven by the increasing demand for smartphones, tablets, and smart home devices. The automotive and industrial automation segments are also expanding rapidly, supported by the integration of AI chips, sensors, and connectivity solutions .

South Korea Semiconductor Foundry & Fabless Market Competitive Landscape

The South Korea Semiconductor Foundry & Fabless Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., SK hynix Inc., DB HiTek Co., Ltd., MagnaChip Semiconductor Corporation, Key Foundry Co., Ltd., Dongbu HiTek (now DB HiTek Co., Ltd.), Silicon Mitus Inc., Anapass Inc., Telechips Inc., Nextchip Co., Ltd., Alpha Holdings Inc., Chips&Media, Inc., LX Semicon Co., Ltd., Sapeon Korea Inc., ADTechnology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Semiconductor Foundry & Fabless Market Industry Analysis

Growth Drivers

- Increasing Demand for Advanced Semiconductor Technologies:The South Korean semiconductor market is projected to reach $100 billion in future, driven by the demand for advanced technologies. The global semiconductor market is expected to grow to $500 billion, with South Korea contributing significantly due to its robust manufacturing capabilities. The rise in consumer electronics, automotive applications, and smart devices is fueling this demand, with a projected increase of 10% in chip sales in future, according to the Semiconductor Industry Association.

- Expansion of 5G Infrastructure:South Korea is leading the 5G rollout, with over 30 million subscribers expected in future. The government has invested approximately $20 billion in 5G infrastructure, creating a substantial demand for semiconductors. This expansion is anticipated to drive the need for high-performance chips, with an estimated increase of 15% in semiconductor usage per 5G base station. The growth of 5G applications in IoT and smart cities further enhances this demand, positioning South Korea as a key player in the global market.

- Rise of AI and Machine Learning Applications:The AI semiconductor market in South Korea is projected to reach $10 billion in future, driven by the increasing adoption of machine learning technologies across various sectors. Major companies are investing heavily in AI chip development, with Samsung and SK Hynix allocating over $5 billion for R&D in AI-related technologies. This trend is expected to boost the demand for specialized chips, with a projected growth rate of 20% in AI chip sales, reflecting the broader global shift towards AI integration in consumer and industrial applications.

Market Challenges

- Supply Chain Disruptions:The semiconductor industry in South Korea faces significant supply chain challenges, exacerbated by global events such as the COVID-19 pandemic. In future, the industry is projected to experience a shortfall of approximately 1 million chips due to ongoing disruptions. This shortage is impacting production timelines and increasing costs, with estimates suggesting a 5% rise in manufacturing expenses. Companies are struggling to secure raw materials, which could hinder growth and innovation in the semiconductor sector.

- High Capital Expenditure Requirements:The semiconductor foundry sector requires substantial capital investment, with an average expenditure of $10 billion per fabrication plant. In future, the total capital expenditure for South Korean semiconductor companies is expected to exceed $20 billion. This high barrier to entry limits the ability of smaller firms to compete, consolidating market power among a few large players. Additionally, the rapid pace of technological advancement necessitates continuous investment, further straining financial resources and impacting profitability.

South Korea Semiconductor Foundry & Fabless Market Future Outlook

The South Korean semiconductor market is poised for significant growth, driven by advancements in technology and increasing global demand. The focus on AI, 5G, and IoT applications will continue to shape the landscape, with companies investing heavily in R&D and infrastructure. As the market evolves, strategic partnerships and collaborations will become essential for innovation. Additionally, the emphasis on sustainability and green manufacturing practices will likely influence production methods, aligning with global trends towards environmentally responsible technology development.

Market Opportunities

- Growth in Electric Vehicle Semiconductor Demand:The electric vehicle (EV) market in South Korea is projected to grow to 1 million units in future, significantly increasing the demand for specialized semiconductors. This surge is expected to create a market opportunity worth approximately $5 billion, as EVs require advanced chips for battery management and autonomous driving technologies, positioning semiconductor manufacturers to capitalize on this trend.

- Development of IoT Devices:The IoT market in South Korea is anticipated to reach $15 billion in future, driven by smart home and industrial applications. This growth presents a substantial opportunity for semiconductor companies to develop low-power, high-efficiency chips tailored for IoT devices. The increasing integration of IoT in everyday life will likely boost semiconductor demand, creating a favorable environment for innovation and market expansion.