Region:Europe

Author(s):Geetanshi

Product Code:KRAA3253

Pages:95

Published On:September 2025

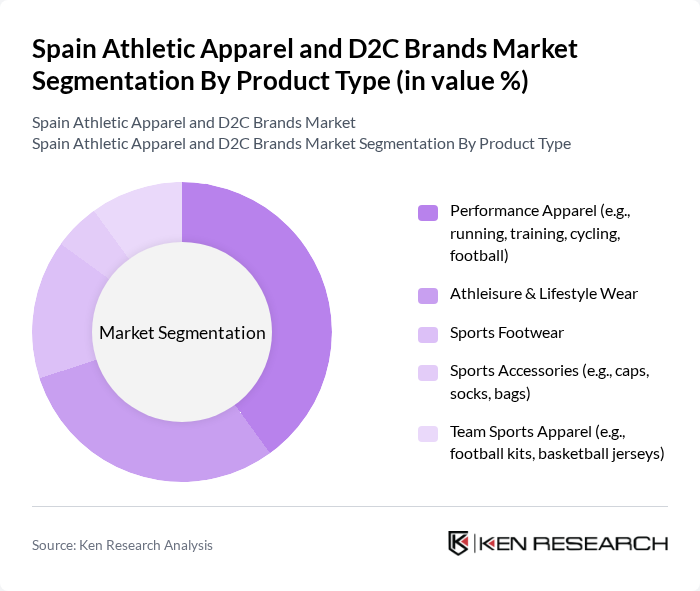

By Product Type:The product type segmentation includes various categories such as Performance Apparel, Athleisure & Lifestyle Wear, Sports Footwear, Sports Accessories, and Team Sports Apparel. Among these, Performance Apparel is currently the leading segment, driven by increasing participation in sports, fitness activities, and sports tourism. Athleisure has also gained significant traction as consumers seek comfortable yet stylish clothing for both workouts and casual wear.

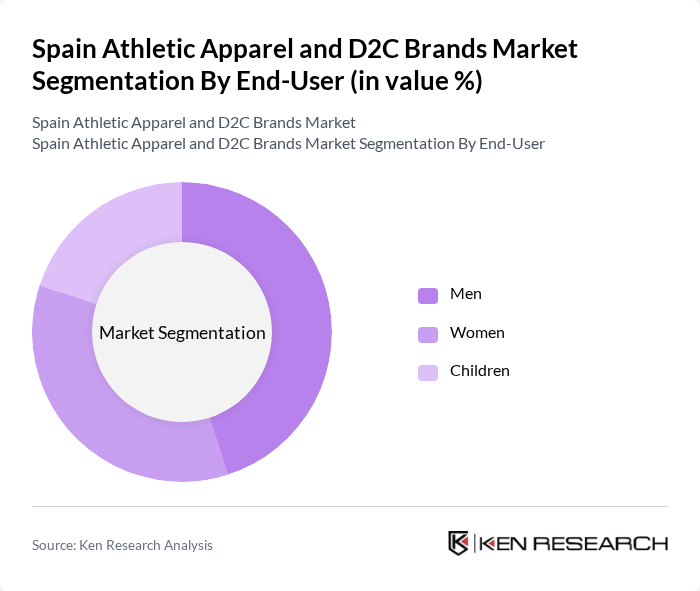

By End-User:The end-user segmentation encompasses Men, Women, and Children. The men's segment is currently the largest, driven by a growing interest in fitness and sports among male consumers. Women’s participation in sports and fitness activities has also increased, leading to a rise in demand for athletic apparel tailored to their needs. The children’s segment is growing steadily as parents invest in quality sportswear for their kids.

The Spain Athletic Apparel and D2C Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Decathlon S.A., ASICS Corporation, New Balance Athletics, Inc., Lululemon Athletica Inc., Reebok International Ltd., Fabletics, Inc., Gymshark Ltd., Oysho España S.A. (Inditex Group), Joma Sport, S.A., Sprinter Megacentros del Deporte S.L., El Corte Inglés S.A., Décimas (Grupo Sport Street S.L.), HOFF Brand S.L., Mango Sports (Punto Fa, S.L.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain athletic apparel market appears promising, driven by evolving consumer preferences and technological advancements. The integration of smart technology into apparel, such as fitness tracking features, is expected to enhance user experience and engagement. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly products, as consumers become more environmentally conscious. Brands that adapt to these trends will be well-positioned to capture market share and foster brand loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Performance Apparel (e.g., running, training, cycling, football) Athleisure & Lifestyle Wear Sports Footwear Sports Accessories (e.g., caps, socks, bags) Team Sports Apparel (e.g., football kits, basketball jerseys) |

| By End-User | Men Women Children |

| By Sales Channel | Online Direct-to-Consumer (D2C) Brands Multi-brand E-commerce Platforms Specialty Sports Retailers Department Stores & Hypermarkets |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Established Global Brands Local Spanish Brands Private Labels |

| By Fabric Type | Synthetic Fabrics (e.g., polyester, nylon) Natural Fabrics (e.g., cotton, bamboo) Blended Fabrics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athletic Apparel | 120 | Active Consumers, Fitness Enthusiasts |

| D2C Brand Awareness and Perception | 60 | Brand Managers, Marketing Executives |

| Market Trends in E-commerce for Apparel | 90 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Sustainability on Purchasing Decisions | 50 | Sustainability Advocates, Eco-conscious Consumers |

| Fitness Trends and Apparel Usage | 40 | Personal Trainers, Gym Owners |

The Spain Athletic Apparel and D2C Brands Market is valued at approximately USD 6.1 billion, reflecting a significant growth trend driven by increased health consciousness, fitness activities, and the popularity of athleisure wear among consumers.