Region:North America

Author(s):Shubham

Product Code:KRAB6234

Pages:95

Published On:October 2025

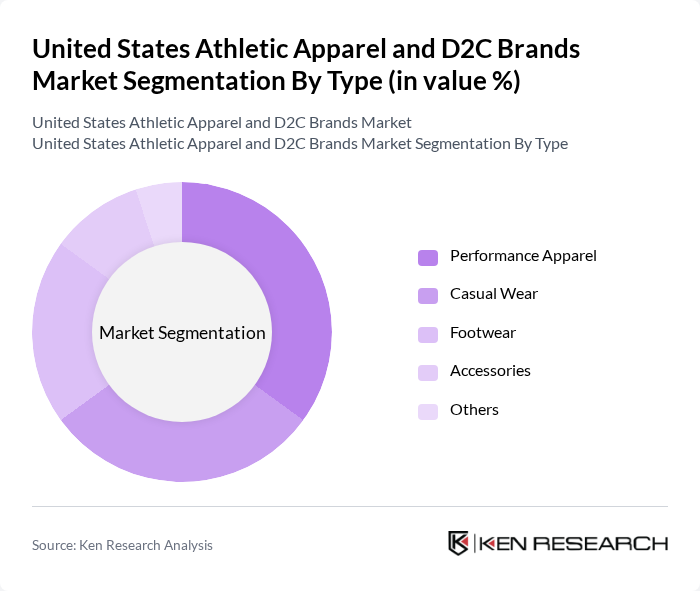

By Type:The market is segmented into various types, including Performance Apparel, Casual Wear, Footwear, Accessories, and Others. Performance Apparel is gaining traction due to the increasing participation in sports and fitness activities, while Casual Wear is popular for its versatility and comfort. Footwear remains a significant segment, driven by both athletic and lifestyle choices. Accessories and Others also contribute to the market, catering to specific consumer needs.

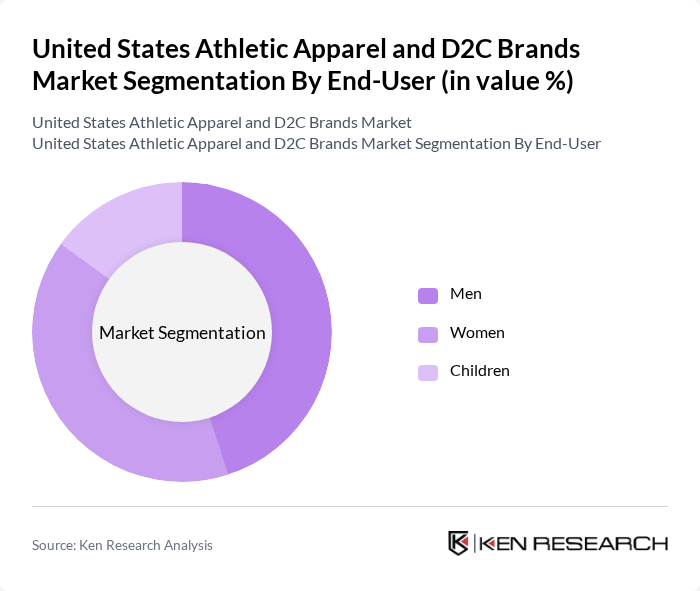

By End-User:The market is categorized into Men, Women, and Children. The Men's segment is the largest, driven by a growing interest in fitness and sports. Women’s athletic apparel is also on the rise, fueled by the increasing participation of women in sports and fitness activities. The Children’s segment is expanding as parents invest in quality athletic wear for their kids, reflecting a broader trend towards health and fitness from a young age.

The United States Athletic Apparel and D2C Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, New Balance Athletics, Inc., Columbia Sportswear Company, ASICS Corporation, Reebok International Ltd., Gymshark Ltd., Fabletics, Inc., Athleta, Inc., Champion Athleticwear, Outdoor Voices, Inc., Sweaty Betty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States athletic apparel market appears promising, driven by ongoing trends in health and wellness, as well as technological advancements in fabric and design. As consumers increasingly seek sustainable options, brands that prioritize eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of smart technology into apparel is expected to enhance user experience, further driving demand. The market is poised for continued growth as these trends evolve and consumer preferences shift.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Wear Footwear Accessories Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Nylon Blends |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Direct-to-Consumer Brand Insights | 150 | Brand Managers, Marketing Executives |

| Consumer Preferences in Athletic Apparel | 200 | Fitness Enthusiasts, Casual Consumers |

| Market Trends in E-commerce Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

| Influencer Impact on Brand Perception | 80 | Fitness Influencers, Social Media Managers |

| Retailer Feedback on Athletic Apparel | 120 | Retail Buyers, Store Managers |

The United States Athletic Apparel and D2C Brands Market is valued at approximately USD 90 billion, reflecting significant growth driven by health consciousness, athleisure trends, and the popularity of fitness activities among consumers.