Region:Europe

Author(s):Shubham

Product Code:KRAB3273

Pages:96

Published On:October 2025

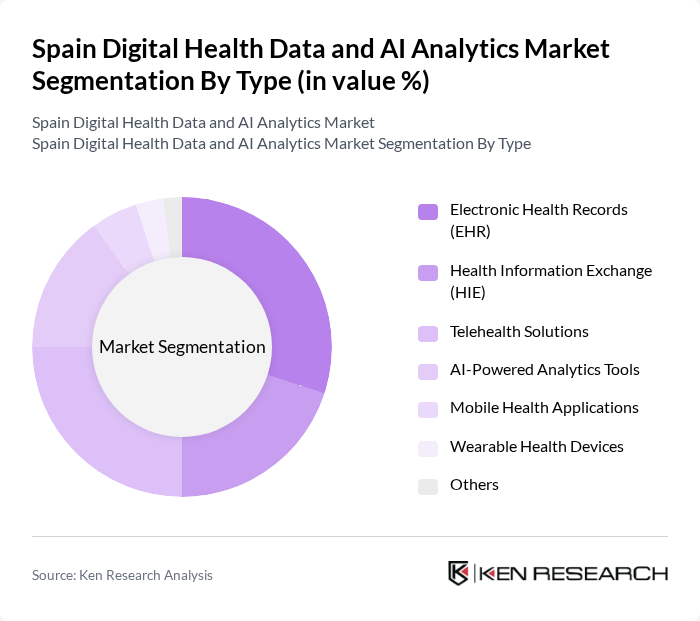

By Type:The market is segmented into various types, including Electronic Health Records (EHR), Health Information Exchange (HIE), Telehealth Solutions, AI-Powered Analytics Tools, Mobile Health Applications, Wearable Health Devices, and Others. Each of these segments plays a crucial role in enhancing healthcare delivery and patient management.

The Electronic Health Records (EHR) segment is currently dominating the market due to the increasing need for efficient patient data management and streamlined healthcare processes. EHR systems facilitate better communication among healthcare providers, enhance patient safety, and improve overall healthcare quality. The growing emphasis on data-driven decision-making in healthcare is further propelling the adoption of EHR solutions, making them a critical component of digital health strategies.

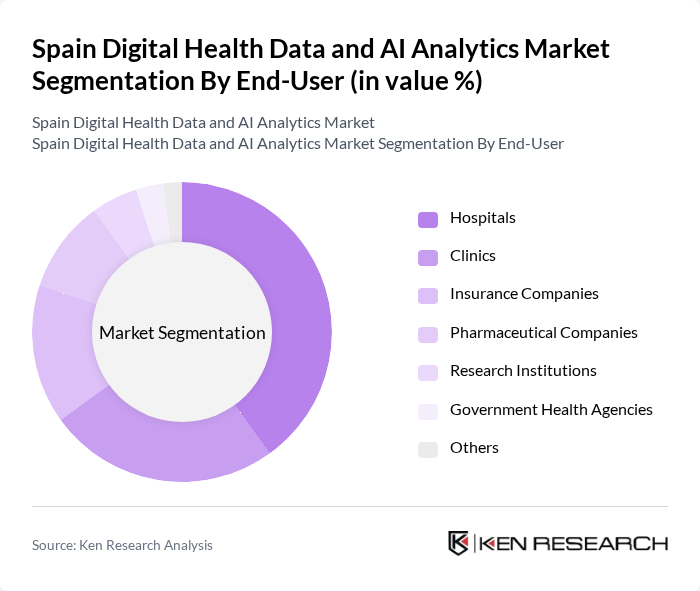

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Insurance Companies, Pharmaceutical Companies, Research Institutions, Government Health Agencies, and Others. Each end-user category has unique requirements and contributes differently to the overall market dynamics.

Hospitals are the leading end-user segment, driven by the need for comprehensive patient management systems and the integration of advanced technologies in clinical settings. The increasing patient volume and the demand for improved healthcare outcomes are pushing hospitals to adopt digital health solutions. This trend is further supported by government initiatives aimed at enhancing hospital infrastructure and promoting the use of digital tools in patient care.

The Spain Digital Health Data and AI Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, Cerner Corporation, IBM Watson Health, Allscripts Healthcare Solutions, Medtronic, GE Healthcare, Oracle Health Sciences, SAP Health, Epic Systems Corporation, Health Catalyst, McKesson Corporation, Nuance Communications, Verily Life Sciences, Zynx Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's digital health data and AI analytics market appears promising, driven by technological advancements and increasing healthcare demands. As telehealth services expand, more patients will access remote care, enhancing overall health outcomes. Additionally, the integration of AI in diagnostics and treatment personalization will likely revolutionize patient care. With ongoing government support and investment in digital health initiatives, the market is poised for significant growth, fostering innovation and improving healthcare delivery across Spain.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Health Records (EHR) Health Information Exchange (HIE) Telehealth Solutions AI-Powered Analytics Tools Mobile Health Applications Wearable Health Devices Others |

| By End-User | Hospitals Clinics Insurance Companies Pharmaceutical Companies Research Institutions Government Health Agencies Others |

| By Application | Chronic Disease Management Remote Patient Monitoring Predictive Analytics Population Health Management Clinical Decision Support Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Partnerships with Healthcare Providers Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain Others |

| By Customer Type | B2B (Business to Business) B2C (Business to Consumer) Government Contracts Non-Profit Organizations Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Digital Transformation | 150 | Chief Information Officers, IT Managers |

| AI Analytics in Outpatient Services | 100 | Clinical Directors, Data Analysts |

| Telehealth Implementation Strategies | 80 | Telehealth Coordinators, Healthcare Administrators |

| Patient Data Management Solutions | 70 | Data Protection Officers, IT Security Managers |

| Healthcare AI Adoption Challenges | 90 | Healthcare Policy Makers, Innovation Leads |

The Spain Digital Health Data and AI Analytics Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of digital health technologies and AI analytics integration in healthcare systems.