Region:Europe

Author(s):Dev

Product Code:KRAB6014

Pages:93

Published On:October 2025

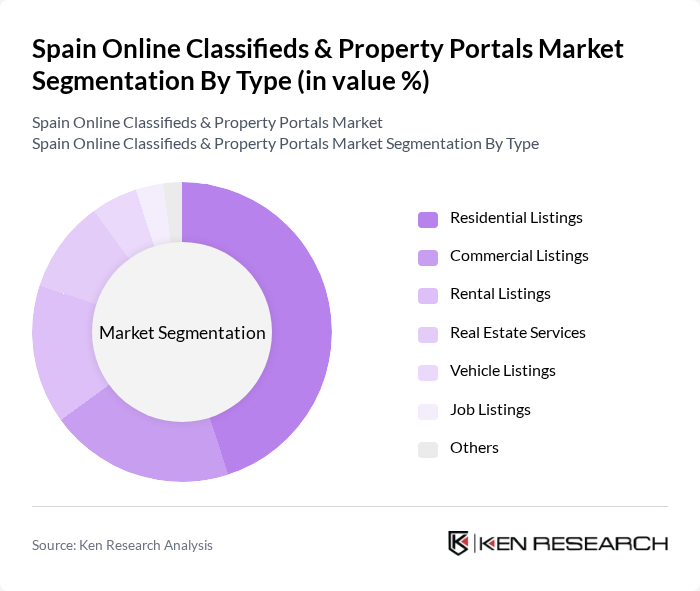

By Type:The market can be segmented into various types, including Residential Listings, Commercial Listings, Rental Listings, Real Estate Services, Vehicle Listings, Job Listings, and Others. Each of these subsegments caters to different consumer needs and preferences, with Residential Listings being the most prominent due to the high demand for housing in urban areas.

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Individual Buyers represent the largest segment, driven by the increasing number of first-time homebuyers and the growing trend of online property searches.

The Spain Online Classifieds & Property Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Idealista, Fotocasa, Habitaclia, Milanuncios, Wallapop, eBay Classifieds, Trovit, Badi, Anuncios, Segundamano, Locanto, Ocasión, Yaencontre, Piso Compartido, Rentberry contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain online classifieds and property portals market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI and machine learning is expected to enhance user experience by providing personalized recommendations and improving search functionalities. Additionally, the growing trend of virtual property tours is likely to reshape how consumers engage with listings, making the buying and renting process more interactive and efficient, thus attracting a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings Real Estate Services Vehicle Listings Job Listings Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Offline Channels |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Listing Type | For Sale For Rent Auctions |

| By User Demographics | Age Groups Income Levels Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Listings | 150 | Real Estate Agents, Property Owners |

| Commercial Property Transactions | 100 | Commercial Brokers, Investors |

| Rental Market Insights | 80 | Property Managers, Tenants |

| Online User Experience | 120 | End Users, Digital Marketing Specialists |

| Market Trends and Forecasts | 90 | Market Analysts, Economic Researchers |

The Spain Online Classifieds & Property Portals Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digitalization in real estate transactions and increasing consumer preference for online platforms.