Region:Middle East

Author(s):Dev

Product Code:KRAB3065

Pages:90

Published On:October 2025

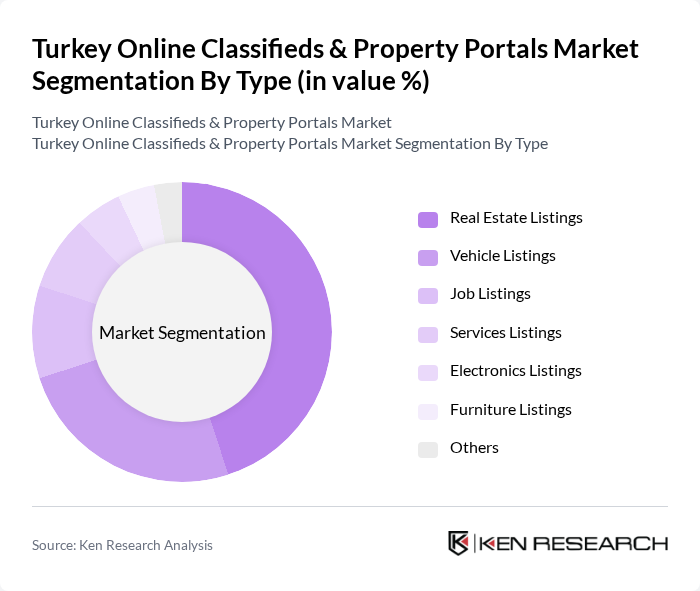

By Type:The market is segmented into various types, including Real Estate Listings, Vehicle Listings, Job Listings, Services Listings, Electronics Listings, Furniture Listings, and Others. Among these, Real Estate Listings dominate the market due to the high demand for housing and commercial properties, driven by urbanization and population growth. Vehicle Listings also hold a significant share, reflecting the increasing consumer interest in buying and selling vehicles online.

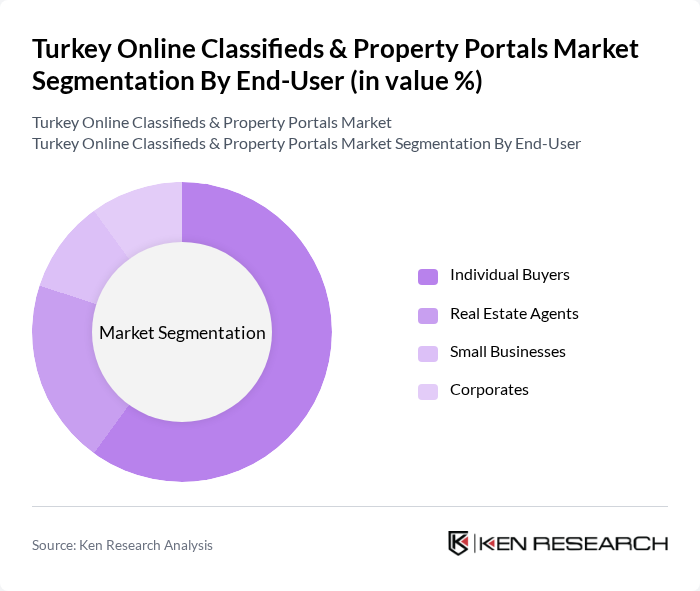

By End-User:The market is segmented by end-users, including Individual Buyers, Real Estate Agents, Small Businesses, and Corporates. Individual Buyers represent the largest segment, driven by the increasing number of consumers seeking to buy or rent properties and vehicles online. Real Estate Agents also play a crucial role, leveraging online platforms to reach a broader audience and facilitate transactions.

The Turkey Online Classifieds & Property Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sahibinden.com, Hürriyet Emlak, Zingat.com, Emlakjet.com, Armut.com, Letgo, Facebook Marketplace, Hepsiemlak, N11.com, Trendyol, Vitrinova, Toptan.com, Emlak.com.tr, Property Turkey, Turyap contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey online classifieds and property portals market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning will enhance user experiences, enabling personalized recommendations and streamlined transactions. Additionally, as urbanization continues, platforms will increasingly focus on sustainability, promoting eco-friendly properties and practices. These trends will likely reshape the competitive landscape, encouraging innovation and collaboration among industry players to meet emerging consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Listings Vehicle Listings Job Listings Services Listings Electronics Listings Furniture Listings Others |

| By End-User | Individual Buyers Real Estate Agents Small Businesses Corporates |

| By Sales Channel | Online Platforms Mobile Applications Social Media |

| By Price Range | Low-End Listings Mid-Range Listings High-End Listings |

| By Geographic Focus | Major Cities Suburban Areas Rural Areas |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Listing Duration | Short-Term Listings Long-Term Listings Permanent Listings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Listings | 150 | Real Estate Agents, Property Managers |

| Commercial Property Transactions | 100 | Commercial Brokers, Business Owners |

| Online User Experience | 80 | Property Buyers, Renters |

| Market Trends Analysis | 70 | Market Analysts, Economists |

| Digital Marketing Strategies | 60 | Marketing Managers, Digital Strategists |

The Turkey Online Classifieds & Property Portals Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a rising preference for online transactions among consumers.