Region:Central and South America

Author(s):Dev

Product Code:KRAA3556

Pages:82

Published On:September 2025

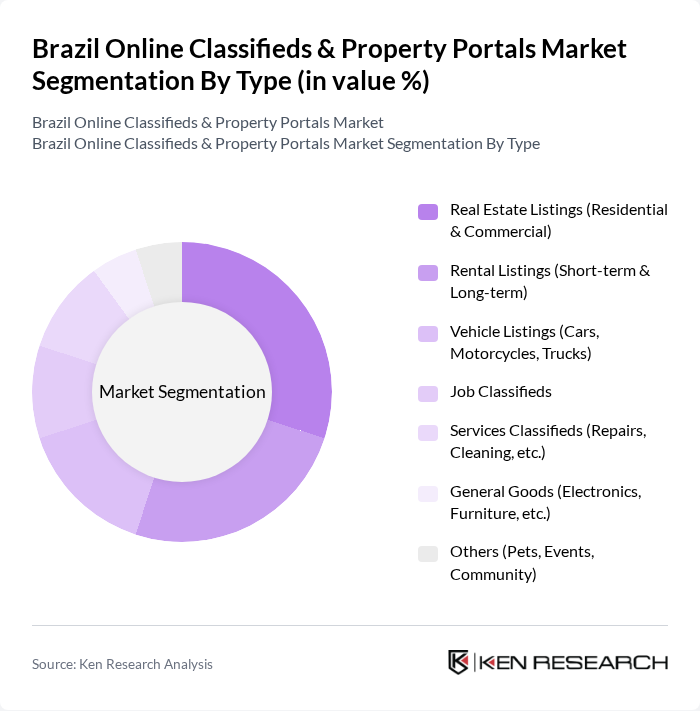

By Type:The market can be segmented into various types, including Real Estate Listings (Residential & Commercial), Rental Listings (Short-term & Long-term), Vehicle Listings (Cars, Motorcycles, Trucks), Job Classifieds, Services Classifieds (Repairs, Cleaning, etc.), General Goods (Electronics, Furniture, etc.), and Others (Pets, Events, Community). Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics. The Real Estate Listings segment leads due to the high demand for urban housing and commercial properties, with digital platforms offering convenience, transparency, and a wide selection for both buyers and sellers .

The Real Estate Listings segment, which includes both residential and commercial properties, dominates the market due to the high demand for housing and commercial spaces in urban areas. The growing trend of online property searches and the convenience of digital transactions have made this segment particularly appealing to consumers. Additionally, the increasing number of real estate agents and developers utilizing online platforms for listings has further solidified its leading position in the market .

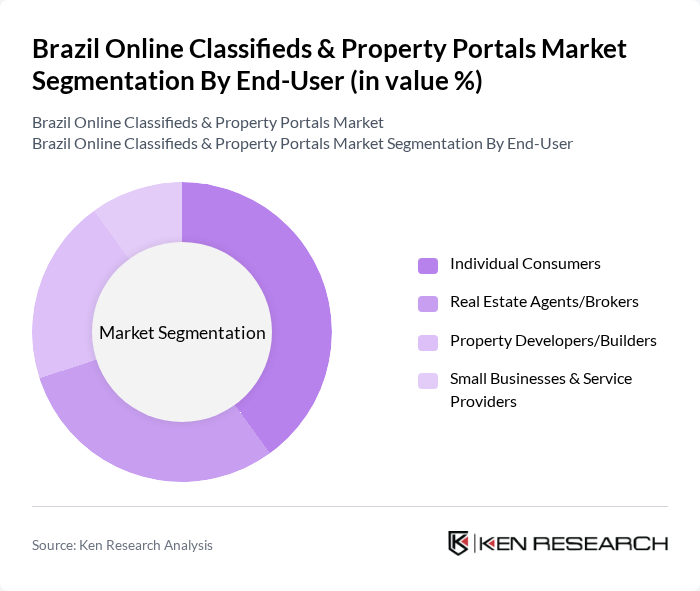

By End-User:The market can also be segmented by end-users, which include Individual Consumers, Real Estate Agents/Brokers, Property Developers/Builders, and Small Businesses & Service Providers. Each of these end-users plays a crucial role in the dynamics of the online classifieds and property portals market. Individual Consumers represent the largest segment, reflecting the growing trend of online shopping and digital engagement for property and service searches. Real estate professionals and small businesses increasingly leverage these platforms for broader market access and operational efficiency .

Individual Consumers represent the largest segment in the end-user category, driven by the increasing trend of online shopping and the convenience of accessing various services through digital platforms. The growing number of consumers seeking to buy or rent properties online has significantly contributed to this segment's dominance. Additionally, real estate agents and brokers are increasingly leveraging online platforms to reach a broader audience, further enhancing their market presence .

The Brazil Online Classifieds & Property Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, ZAP Imóveis, VivaReal, Imovelweb, Webmotors, Trovit Brasil, Mercado Livre, 123i, QuintoAndar, Properati Brasil, Bossa Nova Sotheby’s International Realty, Lopes Consultoria de Imóveis, Brasil Brokers, Grupo ZAP, Imovel Aki contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil online classifieds and property portals market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning will enhance user experiences, enabling personalized recommendations and streamlined transactions. Additionally, as urbanization continues, platforms will increasingly focus on sustainability, promoting eco-friendly listings. These trends will likely reshape the competitive landscape, encouraging innovation and collaboration among market players to meet evolving consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Listings (Residential & Commercial) Rental Listings (Short-term & Long-term) Vehicle Listings (Cars, Motorcycles, Trucks) Job Classifieds Services Classifieds (Repairs, Cleaning, etc.) General Goods (Electronics, Furniture, etc.) Others (Pets, Events, Community) |

| By End-User | Individual Consumers Real Estate Agents/Brokers Property Developers/Builders Small Businesses & Service Providers |

| By Sales Channel | Dedicated Online Portals Mobile Applications Social Media Platforms Aggregator Platforms |

| By Pricing Model | Free Listings Featured/Paid Listings Subscription-Based Listings |

| By Geographic Focus | Major Urban Centers (São Paulo, Rio de Janeiro, etc.) Secondary Cities Rural & Remote Areas |

| By Property Type | Apartments/Flats Houses/Villas Commercial Properties (Offices, Retail, Industrial) Land & Plots |

| By User Demographics | Age Groups Income Levels Family Size Education Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Listings | 120 | Real Estate Agents, Property Managers |

| Commercial Property Transactions | 80 | Commercial Brokers, Business Owners |

| Rental Market Insights | 60 | Landlords, Tenants |

| Consumer Preferences in Online Searches | 100 | Home Buyers, Renters |

| Market Trends and Digital Adoption | 70 | Industry Analysts, Digital Marketing Experts |

The Brazil Online Classifieds & Property Portals Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by increased internet penetration and mobile device usage among the population.